Prevailing cookie-cutter strategies and monolithic business models limit banks in reaching their full potential. That’s why banks will embrace more diversified strategies that are tailored to meet the needs of specific customer segments.

The digital banking era requires banks to evolve their culture and business models

In order to win in the digital era, successful banks evolve their culture to empower both employees and customers.

Purpose-driven: Banks re-define their business purpose beyond creating shareholder profit. A holistic purpose that clarifies the role of the bank within societal, economical and ecological contexts resonates with customers and empowers employees to make a difference.

People-centric: Obsessing over customer needs is the baseline for effective innovation and delivering marvellous experiences. That’s why the prevailing product-driven and risk-averse culture will be complemented with a people-centric culture.

The cultural change enables banks to open up to new business and operating models that utilise financial products and technologies across the larger business ecosystem.

Embracing the open ecosystem: Opening up to collaboration is key in diversifying business models and becoming omnipresent. Banks build capabilities to expose their services to new external partners and even competitors. Product portfolios become more flexible to support business diversification.

Venturing beyond the bank: Financial services are now becoming integrated into the everyday activities of customers, and are more frequently distributed beyond the bank. End-users connect to them via ingredient brands or co-branded partner offerings. Distribution models evolve and diversify, ranging from B2B2X platforms to personalised direct-to-consumer service bundles.

The strategy playground in financial services is expanding radically

The decline of the interest based business model is the single greatest change in the business environment. It is further affected by regulatory changes, increasingly blurred industry categories, growing customer expectations and the rise of the conscious consumer.

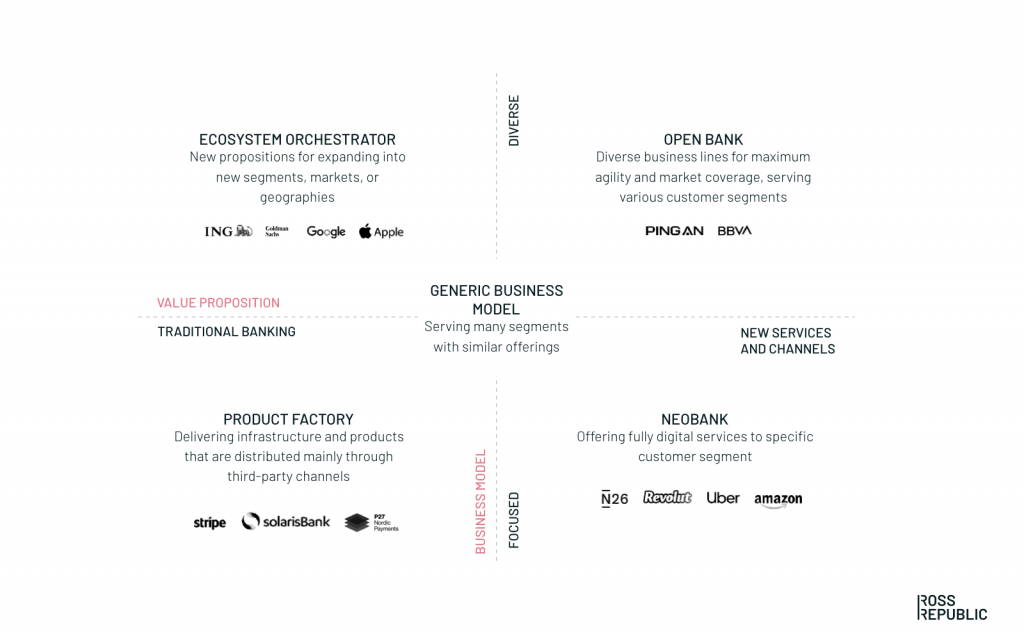

To respond to changes in the business environment, financial services companies embrace complementary business models. Strategy approaches diversify, as cookie-cutter product portfolios and distribution channels limit banks in reaching their full potential.

Banks now have the opportunity to develop tailored digital strategies that are based on customer-centric value propositions, unique core capabilities and digitally-enabled product portfolios. Each bank will therefore need to find its unique position and value-add within the larger financial services value chain, which is currently transforming from a closed to an open one.

In the following blog posts, we introduce four strategic archetypes that help banks to evolve their culture and digital business models:

Digital banking archetypes. Source: Ross Republic analysis

About the author