Ecosystem orchestrators launch new propositions to expand into new segments, markets, or geographies.

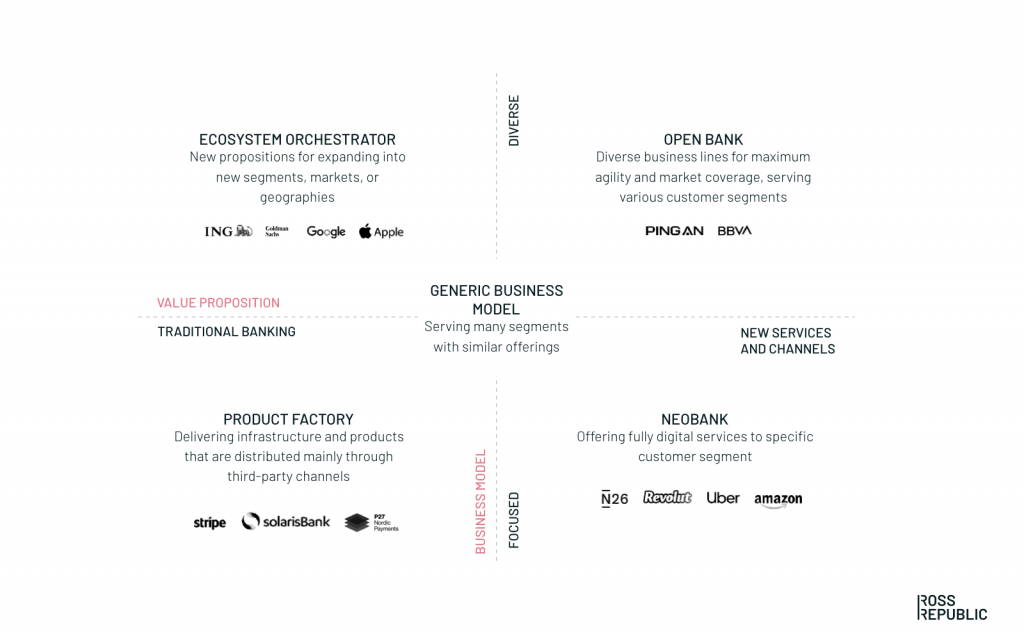

Prevailing cookie-cutter strategies and monolithic business models limit banks in reaching their full potential. That’s why banks will embrace more diversified strategies that are tailored to meet the needs of specific customer segments.

This series of blog posts introduces four strategic archetypes that help banks to win in the digital banking era. The first article of the blog series can be found here.

DIGITAL BANKING ARCHETYPES. SOURCE: ROSS REPUBLIC ANALYSIS

Ecosystem orchestrators offer best-in-class banking and collaboration

Ecosystem orchestrators diversify their business footprint by nurturing a focused portfolio of banking propositions. Such propositions range from new product lines to new ventures and often integrate several other third parties. They act as portfolio managers with the aim to build up a pipeline of new competitive digital offerings and to enter new markets and geographies. The core business of ecosystem orchestrators is still traditional banking services, which are increasingly powered by seamlessly integrated third party solutions. Such integrations with business and technology partners are crucial in order to increase speed to market and to save costs.

With over 6 000 banks operating in Europe, it’s highly unlikely that every bank will become the winner-takes-it-all ecosystem orchestrator. Consumer trust is the basic requirement for orchestrating best-in-class services for the bank’s customers. That’s why ecosystem orchestrators are mostly restricted to their geographical markets where consumers know and trust them already. However, they don’t necessarily need to be the orchestrating party only. It’s also feasible to act as an ecosystem builder or participant. The latter sells own banking products through third party distributors, often as co-branded offerings. The former additionally provides the functional infrastructure behind the ecosystem, which would be a product factory play.

Dutch banking group ING is successfully pursuing such an ecosystem strategy. After adapting agile ways of working, the bank cut time to market and costs of new propositions. It further introduced a modular IT infrastructure, micro-services and digitalised processes end-to-end. The bank expanded to new markets through Yolt, a personal finance management app that so far attracted over 500 000 users in the UK.

Another example is Marcus by Goldman Sachs, an online savings platform. Next to its core investment banking business, Goldman Sachs currently develops its own proprietary digital ecosystem of saving, borrowing and lending services. Last year, Marcus surpassed over $60 billion in deposits. Beyond that, Goldman Sachs launched a consumer credit card in partnership with Apple and MasterCard, which might have been the most successful credit card launch ever.

What does it take to become an ecosystem orchestrator?

People and culture: Developing a culture of cross-functional collaboration and agile ways of working. Instead of relying on in-house expertise, opening up to collaborating with third party product development, marketing, distribution, or technology partners is key to increase speed to market for new propositions.

Business model: Ecosystem orchestrators are rarely first movers. They often diversify the business footprint through digital banking services that have already proven to be successful on the market. Beyond that, cooperating with distribution and technology partners is key for creating an ecosystem that is able to fully serve key customer needs. Growth comes in complementary forms of strengthening the digital core business, expanding the product portfolio and by launching entire new ventures.

Technology: Modernising the technology stack of the core business to remain a competitive second mover. For example, backend-related parts of the technology stack can be outsources to best-in-class vendors. Beyond that, strong capabilities in data collection and analytics from various sources of the ecosystem enable the orchestrator to create customer-centric services.

About the author