After a golden growth period, companies now navigate macro headwinds and rapid technological changes. Succeeding in the current cycle requires business leaders to shift their growth playbooks towards radical organic growth.

In the current macroeconomic landscape, characterised by higher interest rates and economic headwinds, top-performing companies are adapting their growth strategies. The focus is now quickly shifting from heavy diversification and expansion to disciplined growth within the core business. This article explores why this transition is necessary and how to successfully navigate it.

Here’s a quick summary of the main points:

- Aggressive expansion and diversification strategies, prevalent during the zero-interest-rate policy (ZIRP) era, are not sustainable anymore due to the rapid rise in interest rates and macroeconomic headwinds

- This macro shift requires an adapted growth playbook that radically focuses on supercharging organic growth opportunities, prioritising the core business by leveraging existing capabilities and assets

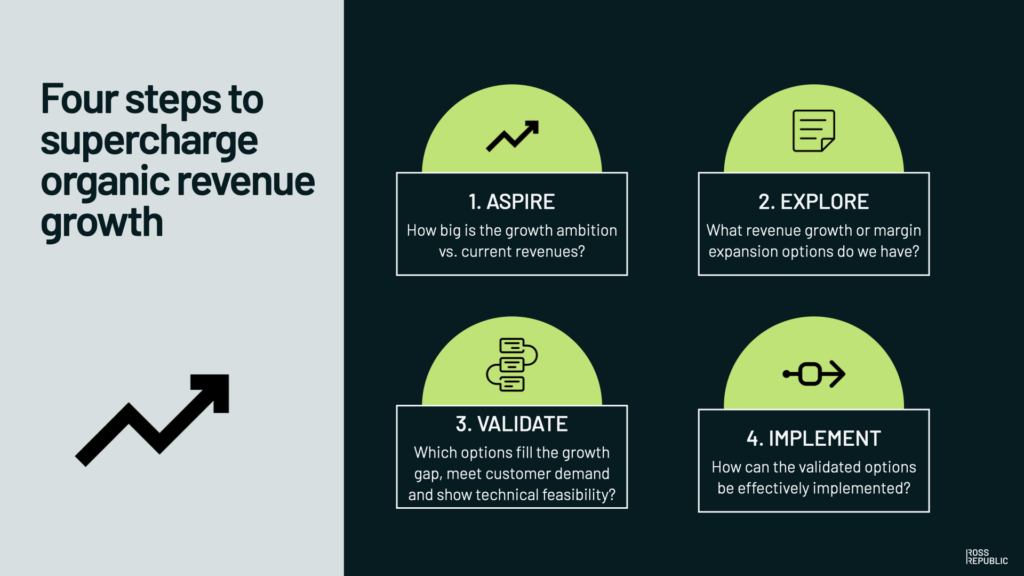

- We developed a four-step program to support commercial leaders in planning, exploring, validating and implementing revenue growth or margin expansion opportunities

Let’s dive into it.

A hard reset for expansionary growth strategies

In the aftermath of the 2008 global financial crisis, businesses operated in an exceptional growth environment. Global central banks kept interest rates near zero, significantly reducing borrowing costs for corporations that in turn benefitted from more flexible cash flow management. Low discount rates made riskier, longer-term projects more financially attractive, while inflated asset valuations created opportunities for leveraging and mergers and acquisitions (M&A). Fueled by further economic tailwinds like low inflation, reduced production costs and accelerated global market access, many businesses adopted a growth-at-all-costs mindset and followed expansionary growth strategies.

Fast forward, last decade’s innovation and growth strategies have become material for ZIRP memes (zero-interest-rate phenomena):

- Sinking significant budgets into innovation labs, venture building units or incubators in the hopes of building a new moonshot opportunity, while employees within the core business kept their heads down and paid the bills

- Heavy diversification into non-core segments and later grappling with post merger integration or missing critical capabilities for scaling

- Management teams, driven by FOMO, following short-sighted hypes such as becoming a certified human-centred™ design thinking company or re-organising around tribes and squads like Spotify

- Virtue signalling through pet projects in the areas of AI, new work, agile transformation, DEI or ESG

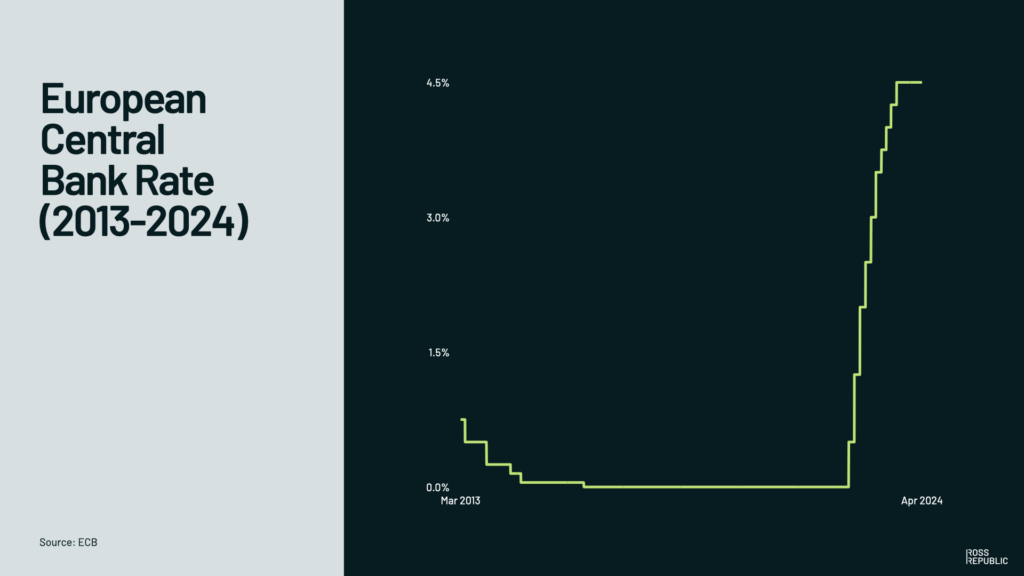

These approaches can be effective in the right context and with the appropriate strategic objectives. When borrowing costs are low and businesses operate in a low-yield environment, making risky bets is often a necessary move to drive growth. However, this strategy becomes unsustainable when confronted with the most aggressive interest rate hikes in monetary policy history:

RAPID rate hikes by the ecb

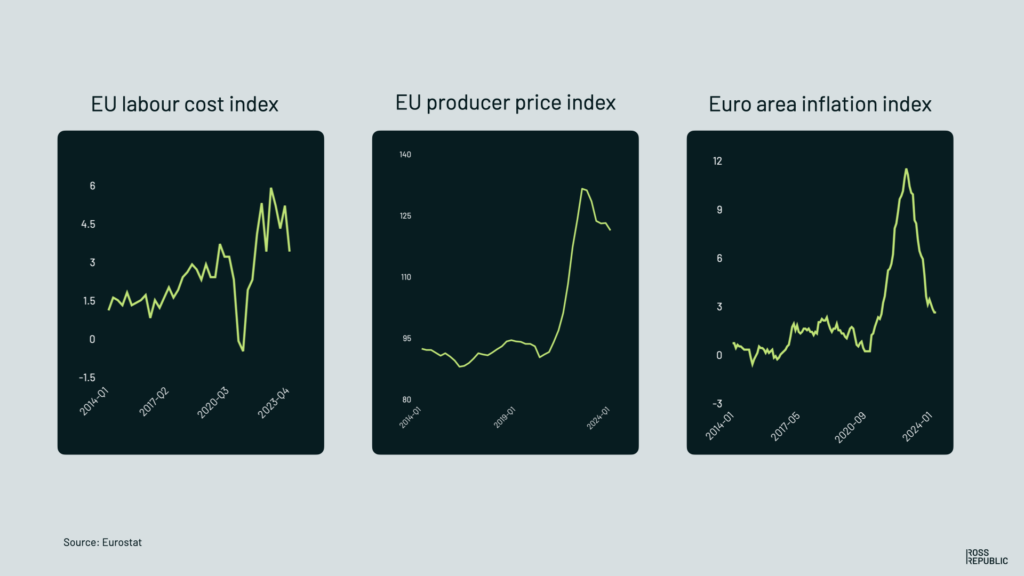

Rapidly rising interest rates signal that businesses have entered a fundamentally different market environment – the post-ZIRP era. This shift is evident in several related indicators, such as increased inflation, higher producer prices and rising labour costs:

Macro-headwinds posed by the post-ZIRP era

The tectonic macro shift reminds of the iconic “Peacetime CEO/Wartime CEO” piece by Ben Horowitz, co-founder of $42 billion AUM VC firm Andresen Horowitz:

“In peacetime, leaders must maximise and broaden the current opportunity. As a result, peacetime leaders employ techniques to encourage broad-based creativity and contribution across a diverse set of possible objectives. In wartime, by contrast, the company typically has a single bullet in the chamber and must, at all costs, hit the target. The company’s survival in wartime depends upon strict adherence and alignment to the mission.”

Looking at the end of the x-axis of the indexes above, it’s clear that businesses have just entered wartime mode. The post-ZIRP era will be defined by fighting against headwinds:

- Slower economic growth

- Margin compression

- Higher cost of capital

- Shrinking labour forces

- Higher inflation

- Reshoring and deglobalization

This results in several downstream consequences on how to create and capture value in the post-ZIRP era.

Why top-performers are now supercharging organic growth

First, rising discount rates make ZIRP-era assets that promised profits far into the future far less attractive. During the ZIRP-era, moonshot projects and corporate venture building aiming to build new verticals outside the core business domains have been all the rage. However, such projects are no longer viable under higher discount rates. As a result, board and executive team members shifted their focus from beyond core expansion and speculative bets to more disciplined forms of capital allocation over the last 18 months. This shift involves cost-cutting in the form of layoffs and slashing business units or projects not central to the core profit-centres of a company.

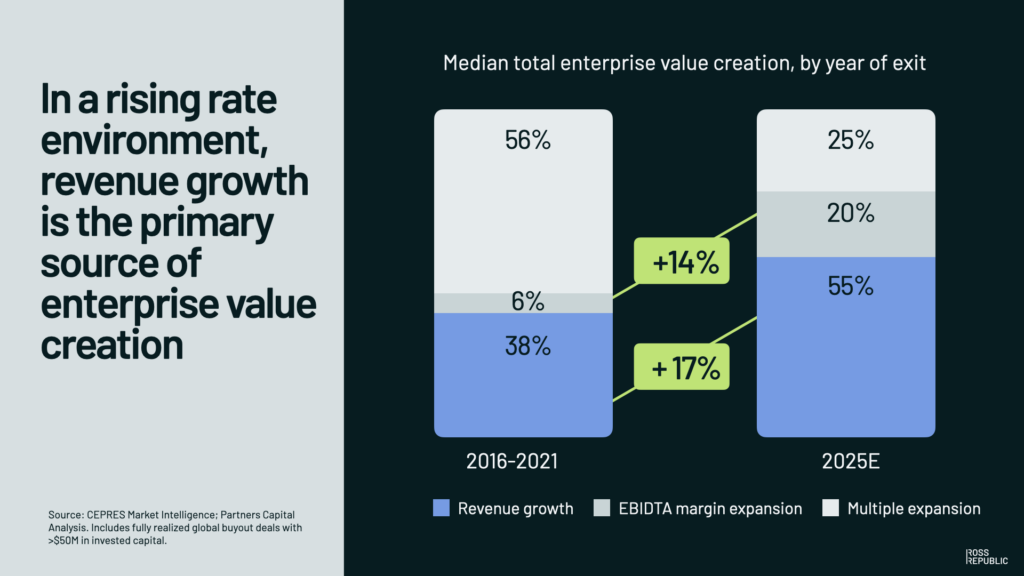

Second, corporate development teams shift their playbooks from expansion to future-proofing the core business. In a high-rate environment, multiple expansion and financial engineering become far less feasible due to higher capital costs. That’s why the primary driver of value creation will be operational improvements, focusing on revenue growth and margin expansion within the core business. In fact, leading research on private equity-owned firm performance indicates that organic revenue growth is set to become the main driver of value creation, potentially contributing up to 55 percent by 2025.

Rising importance of organic growth

Transitioning from an expansionary to a disciplined organic growth playbook requires a few changes and comes with its own challenges. One of our recent engagements with a large global bank is a case in point. The bank won an award for the best innovation lab globally, just to shut it down a week later. Within a few months, anyone that valued his or her career progression would very carefully avoid mentioning the term ‘innovation’ anywhere near a management board member. Instead, initiatives that could improve near-term profits and market share metrics moved up the priority list. Projects with positive ROI were favoured, focusing on the ones with an immediate path to market by finding solutions around the complex operational and technical debt within the core business. Budgeting and governance activities were also streamlined, moving from separate steering boards to direct supervision by business unit leaders.

Based on engagements like these, we’ve developed our key guiding principles to succeed in the post-ZIRP era:

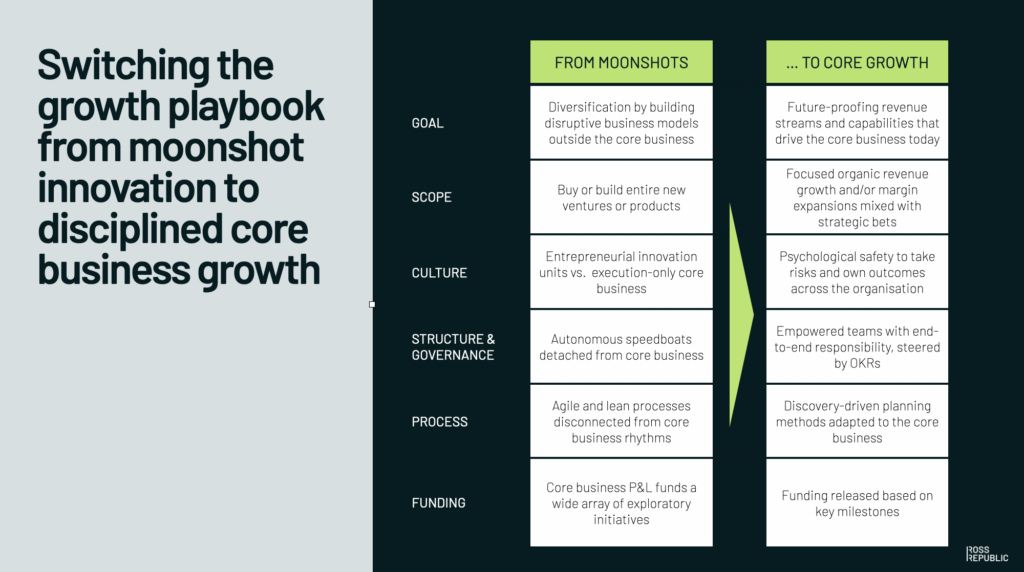

Shifting to the core growth playbook

Goal

Due to higher capital costs, diversification through disruptive business models outside the core business becomes less viable, making it more prudent to focus on future-proofing existing business lines.

Scope

Instead of acquiring or building new verticals from scratch, the scope shifts towards near-term organic revenue growth and margin expansion. The most important success factor for organic growth is to radically focus on leveraging existing capabilities and assets, such as products, channels, supply chains, data or brand equity, in new ways.

Organic growth opportunities typically fall in these categories:

- Fixing broken business models

- Supercharging growth in healthy, but slower-growing, businesses

- Gaining market share in existing areas through better products, services or customer experiences

- Expanding into adjacent markets by launching new products, entering new geographies, and targeting new client segments

Margin expansion is often a by-product of business model or product iterations and involves cutting costs, e.g. through an operating model overhaul or process automation.

Structure & governance

Autonomous speedboats detached from the core business become less sustainable as they require extensive funding and inevitably need to grapple with spin-in vs. spin-out challenges later. Instead, embedding an operational improvement stream right within the core business and co-steering it with the business unit leaders ensures better alignment with strategic goals and operational efficiencies, fostering a growth culture where employees can simultaneously explore new ideas and exploit existing resources effectively.

Business development process

Agile and lean startup approaches rarely fit into the risk, budgeting and policy frameworks of larger organisations, hence adopting its principles around rapid iterations and customer-centricity within existing rhythms of the core business ensures coherence and smoother integration. This can involve setting up fast-track versions of approval and review processes or new risk policies that dynamically adapt to the scope of new initiatives.

Funding

Instead of extracting budgets from the core business P&L for exploratory initiatives; we advocate for a risk-adjusted and disciplined approach of releasing funds upon hitting milestones. Integrating such funding mechanisms into quarterly backlog and budget reviews ensures improved capital allocation and risk management.

In summary, the core growth playbook brings the best of corporate development and innovation practices right into the core organisation with the goal to future-proof the core business, instead of diversifying away from it.

How to kickstart the core growth playbook

Given the headwinds posed by the post-ZIRP era and the following shift towards core business growth playbooks, we’ve developed four hands-on, systematic and data-driven programs to support commercial leaders in accelerating operational improvement initiatives, i.e. organic revenue growth and margin expansion.

Shifting to the core growth playbook

1. Aspire

The first step, Aspire, focuses on identifying your growth gap. It’s simply the delta between current vs. aspired future revenue within your business lines. This phase is essential for setting a clear and quantifiable revenue growth goal, which serves as the foundation for subsequent actions.

In order to quantify the growth gap, we analyse your current revenue vs. aspired future revenue as well as the industry macro growth rates. Future projections based on market trends, competitive analysis and internal capabilities provide further context. The result is a quantifiable delta between the current state and future projections.

Based on your corporate strategy we then set the frame for exploring revenue growth and margin improvement opportunities, e.g. by narrowing down market or product segments with existing rights to play and capabilities to win.

Output: A quantified revenue delta, future revenue pockets and strategic growth models, providing a clear operational improvement goal.

2. Explore

In the Explore phase, the objective is to uncover new revenue growth or margin expansion opportunities. In order to uncover new ideas we follow a two-step combination of outside-in and inside-out analysis: First, the outside-in analysis involves creating a market and customer deep dive and gathering competitive intelligence. Market deep dives can focus on competitive analysis, the impact of new regulatory developments or large scale trends like digitalisation, ESG, AI or re-shoring, as well as qualitative and quantitative customer research. The deep dives feed into an inside-out analysis, consisting of bottom-up ideation with your employees across relevant functions and stakeholders as well as internal data analysis and process mining.

A final crucial step is to rank the identified opportunities based on their estimated implementation effort vs. return potential.

Output: Clustered growth and margin expansion ideas, ranked based on their ROI potential and implementation effort.

3. Validate

The Validate phase aims to de-risk the final selected ideas before assigning serious budgets and resources. Depending on the case, we test for three specific types of risk:

- Market risk: Do end-users, whether internal or external, find the proposition valuable?

- Financial risk: Is the expected cost saving or revenue potential large enough to meet the required hurdle rate?

- Technical and operational risk: Can blockers related to existing technical and operational capabilities, system integration and data availability be removed?

As a general principle, the focus is on staying lean and hands-on by validating only the most critical risks.

Output: A final selection of validated revenue growth or cost saving ideas, ready for presentation to the management team for final go/no-go decision-making.

4. Implement

The final phase, Implement, focuses on putting the chosen ideas into action. We act as interim program or product managers during this stage, help with RFPs if necessary and ensure successful implementation.

No free lunch

In reality, the most obvious, known-knowns operational improvements are usually already on the backlog or in implementation. They are often based on best-practices, industry-standard cost-cutting exercises or the bulk of digitisation projects that automate processes.

Effective organic revenue growth doesn’t just happen accidentally. First, the right ideas need to be generated and shaped into opportunities that fit your growth ambition; then pushed into an implementation process that adapts to the realities of the core business. High-potential opportunities often lie hidden between the intersection of creative market foresight, crossovers of adjacent segments (for example, e-commerce and finance), ideas from the work floor and internal data. The combination of corporate strategy, analytical rigour and creative opportunity generation is where RR has built a strong track record over the last years.

A few references below:

Leveraging data to create a competitive edge in SME financial services

Client: Software leader ($14.3bn revenue in ‘23)

The already commoditised local accounting software market was on the verge of becoming a heavy red ocean due to new regulations and customer’s low willingness-to-pay. Together with the client we conducted a deep dive into an adjacent market, SME financial services, and mapped out all available products as well as the underlying revenue opportunity. We always preach heavy utilisation of existing assets and in this case could demonstrate how the existing real-time banking and accounting data can be leveraged to create vastly improved financial products and user experiences. As a result, we achieved a clear prioritisation of new product features that leverage existing data to gain a competitive edge.

Transforming logistics and ERP systems into new client-retaining services

Client: Chemical company ($15.5bn revenue in ‘23):

Our client’s management team aimed to retain clients by augmenting the product offering with value-added services. In this case, one of the management team members already had an early stage idea about utilising an existing asset, i.e. warehouses and logistics infrastructure as well as ERP and ordering systems, to create a new service. Through a series of iterations we facilitated the value proposition development around a new outsourcing model for wholesale partners and validated the new offering by engaging potential clients. As a result, we enabled the management team to make an informed go-no-go decision.

Developing a differentiated loan product to penetrate new markets

Client: Banking institution (€22.6bn revenue in ‘23)

Aiming to grow market share in a strategically important target segment, we ideated, validated and developed a new loan product from scratch. This is another case where we could utilise existing assets, predominantly internal data, capital and brand equity, to develop a differentiated offering. As part of the engagement we uncovered key customer pain points and new tech-driven product opportunities, leveraged data analytics to develop a new risk model and aligned over 80 stakeholders across divisions during the development phase.

Get in touch and boost your core business growth

The post-ZIRP era demands a return to core business growth strategies. By focusing on operational improvements, leveraging existing assets, and adopting disciplined funding approaches, companies can ensure sustainable growth and long-term competitiveness in a challenging economic environment.

At RR, we support commercial leaders in accelerating organic growth by uncovering, validating and implementing new opportunities. If you’re working in corporate development, innovation, portfolio management, or lead a specific business line, get in touch. We’re keen to hear how you’re mastering the post-ZIRP transition and to help you kickstart your organic growth journey.

About the author