The infrastructure of the financial services value chain is increasingly outsourced to specialised product factories.

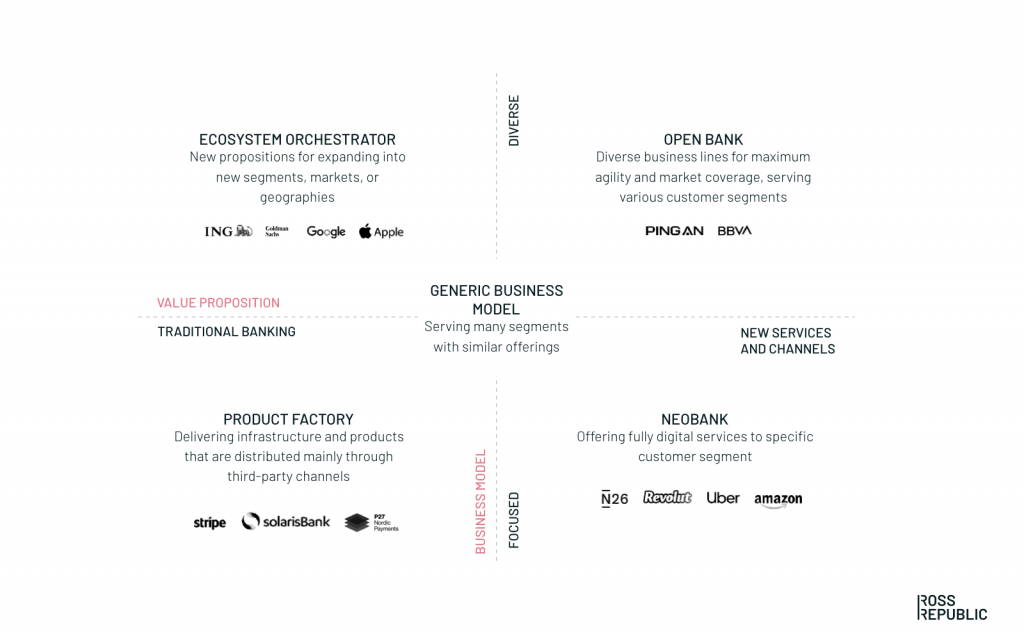

Prevailing cookie-cutter strategies and monolithic business models limit banks in reaching their full potential. That’s why banks will embrace more diversified strategies that are tailored to meet the needs of specific customer segments.

This series of blog posts introduces four strategic archetypes that help banks to win in the digital banking era. The first article of the blog series can be found here.

DIGITAL BANKING ARCHETYPES. SOURCE: ROSS REPUBLIC ANALYSIS

Product factories provide superior industry knowhow and technical capabilities

Product factories are the bedrock of banking, providing the infrastructure, balance sheet or regulatory expertise as integrable services. Their main customers are other financial services companies, which increasingly integrate best-in-class third party technologies, such as credit scoring, digital KYC solutions or cloud-based core banking. Beyond that, non-financial services companies are realising the business opportunity to branch out into banking-like services in order to extract more revenue from their existing user base. Thus, product factories become the back-end partner of choice for other innovators and deliver their services through B2B2X models.

Berlin-based solarisBank is a successful product factory benchmark. The technology company offers a fully licensed banking platform, which allows third parties to connect to current accounts, fixed-term deposits or lending products over its APIs. Thus, solarisBank’s customers can easily offer financial products to their own end-customers without maintaining the underlying infrastructure or regulatory requirements. Fintech startups, such as Penta, as well as e-commerce players and traditional banks are among its customers.

Klarna is one of Europe’s largest banks and provides payment solutions for 85 million consumers across 17 countries. Klarna’s product factory play is a complete checkout solution for online merchants. It allows to streamline the checkout experience, accept many payment forms and to identify returning customers.

Product factories benefit from recent developments in open banking, one of BBVA’s key strategic bets. After upgrading to a real-time core banking platform, the bank now provides API-driven banking and payments for third parties across a wide spectrum of industries. Javier Rodríguez Soler of BBVA explains the open bank rationale:

“BBVA Open Platform is always on the lookout for use cases that are not purely fintech, thereby creating myriad opportunities in verticals outside of banking and financial services.”

Other very successful product factories are UK-based lender OakNorth, which provides credit scoring technology for SME clients, as well as Stripe, which offers developer-friendly technical infrastructure for internet commerce businesses.

What does it take to become a product factory?

People and culture: The majority of employees at a product factory are working in technology, which is the underlying success factor: understanding developer needs and providing a developer-first product experience. Product factories focus on a few core areas of expertise and pioneer new ways of enabling third parties to utilise financial infrastructure. They excel in understanding emerging consumer needs and trends, such as fast online payment experiences, and in making it easy and secure for their customers to leverage these trends.

Business model: In a B2B2X model, it’s all about reaching sufficient scale and efficiency, while utilising expert talent and technology to reduce overhead. Due to the heavy regulatory nature of the banking industry, many product factory providers are mostly focusing on serving the local market. Typically, they apply API-based revenue mechanisms, such as pay-per-use, subscription fees, tiered pay-as-you-go, or revenue-sharing models.

Technology: Product factories focus on developing modern RESTful API technologies, which allow their customers to use white-label banking services on a modular basis. For instance, such modules enable third parties to integrate online payments, mobile bank accounts, cards, loans and digital identification services (KYC). Furthermore, providing a secure and dedicated infrastructure is key for guaranteeing maximum security and reduced latency.

Read next: Open banks go beyond banking

About the author