Open banks branch out into adjacent sectors with the aim to acquire more users and to cross-sell financial products.

Prevailing cookie-cutter strategies and monolithic business models limit banks in reaching their full potential. That’s why banks will embrace more diversified strategies that are tailored to meet the needs of specific customer segments.

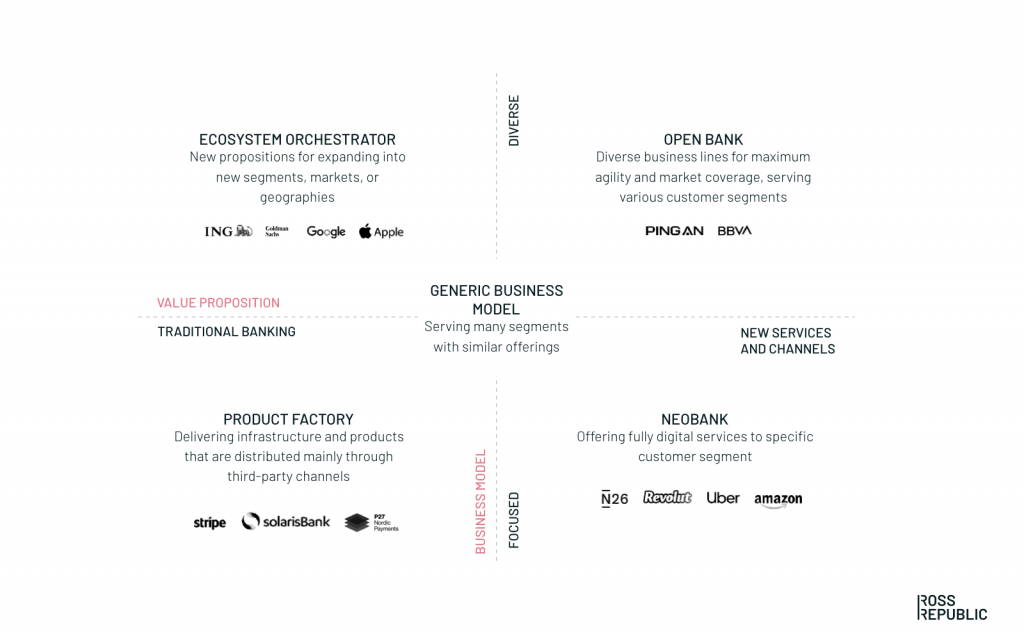

This series of blog posts introduces four strategic archetypes that help banks to win in the digital banking era. The first article of the blog series can be found here.

DIGITAL BANKING ARCHETYPES. SOURCE: ROSS REPUBLIC ANALYSIS

Open banks build on maximum agility and technological expertise

Open banks become omnipresent, running on diverse business and distribution models. They create unique user acquisition platforms by expanding and connecting various business segments, such as healthcare, energy and mobility. Open banks utilise their technological expertise, cutting-edge data analytics and open API’s to enable seamlessly integrated customer journeys and highly personalised banking services.

Particularly in China, the quick expansion of Alibaba and Tencent resulted in extensive open ecosystems, spanning e-commerce, finance and logistics. For instance, Chinese financial conglomerate Ping An pursues a highly successful open bank strategy that drives its growth beyond the boundaries of the traditional financial services sector. The company built a direct distribution model around automobile, housing and healthcare service platforms. These platforms attract large amounts of users at scale. Later on, Ping An cross- and up-sells tailored financial products based on online behavioural data.

A Western benchmark that comes close to the Chinese open bank model yet has to emerge. European data protection and competition laws, geographic fragmentation and consumer privacy concerns are actively preventing large-scale open banks.

Some banks, however, are actively exploring opportunities that are very similar to the open bank archetype. In particular, Dutch lender ING is mentioning open platforms as a key strategic priority:

“To remain relevant and continue delivering a differentiating experience for customers, ING has to be where they are: on the digital platforms where they are shopping, socialising and doing business. We have to find ways to empower people and businesses on their preferred platforms with a clear and easy experience – or become a platform business ourselves.”

What does it take to become an open bank?

People and culture: Transforming towards radical user-centricity by focusing on new segments where financial services can unlock customer value. Open, agile ways of working and a culture of rapid experimentation are the norm. For example, the open bank benchmark Ping An famously introduced zero-based-budgeting in order to evaluate yearly targets based on market potential instead of legacy business performance.

Business model: Open banks nurture a portfolio of adjacent businesses and design distribution strategies around them to support data-based, personalised cross-selling. Online platforms serve as top-of-funnel customer acquisition channels.

Technology: Open banks rely on cutting-edge technological platforms that enable personalised propositions across business lines. Beyond that, data mining and analysis capabilities form the baseline for embedding financial services into other online platforms.

Read next: Banks diversify by becoming ecosystem orchestrators

About the author