Fintech has become one of the most sought-after sectors for investors and venture capitalists. Fueled by cheap capital, most consumer-focused fintech startups prioritise expansion and user acquisition over profitability. However, will they ever turn their large customer base into a sustainable business?

Fintech companies prioritise customer growth over profitability

Nobel-prize winning psychologist Daniel Kahneman speaks of System 1 thinking when explaining human biases. System 1 thinking is fast, emotional and instinctive and subconsciously influences most decision making. In business, nothing influences System 1 more than incentive systems. Teams and individuals optimise around success metrics, both official and unofficial, that determine their progress inside the company. For most fintechs, the key success metric is the scale and pace of customer acquisition.

Markets Insider quoted the CFO of N26 three years ago:

“N26 is ‘not focused on short-term profits,’ he says. For now, it’s all growth, growth, growth.

Since then, the growth mantra didn’t change (€).

N26 recently celebrated crossing the 5 million customer mark. Source: N26.

Fintech companies will unlikely continue to follow the VC goldrush and start evolving customer activation activities.

After raising money from the private markets, consumer fintechs are trapped in the 10X treadmill: sell a big vision, infuse cheap capital, spend it on acquisition, expand into new markets, and wash, rinse, repeat.

Goodhart’s Law states that after a measure becomes the target, it ceases to be a good measure. Customer acquisition might be an indicator that intensive top-of-the-funnel marketing works and that there’s consumer interest in digital banking services. But is customer base a meaningful success metric for fintechs without any consumer-technology-like scalability advantages?

In contrast to the big consumer technology platforms who thrive on scale, the regulatory nature of the banking sector makes it very difficult for fintechs to create lock-in, viral or network effects.

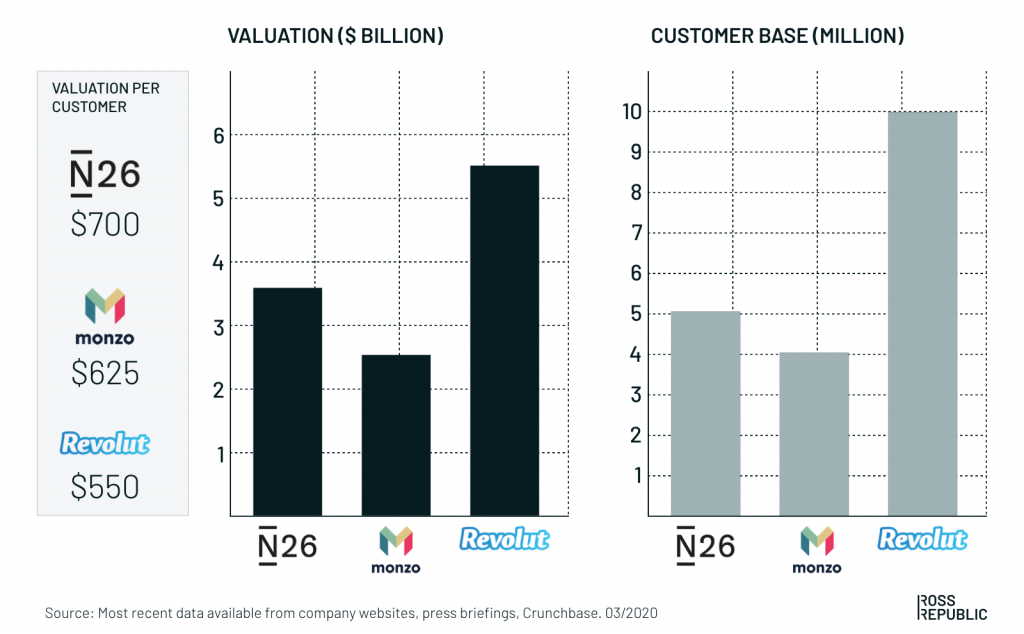

If the relentless focus on growth ever leads to a sustainable business is therefore still an open question. A single user acquired by a fintech company today is worth around $500 to $700 based on valuation per customer. With annual per-customer contribution margins ranging from six to sixty dollars, fintech companies will unlikely continue to follow the VC goldrush and evolve their customer activation activities.

Current valuation per customer of selected challenger banks. Source: Ross Republic analysis

The next evolutionary step for fintech companies is customer activation

Fintech companies have proven that millions of users are willing to try out new, convenient digital banking propositions. Acquiring as well as serving these users is less expensive for fintechs when compared to the incumbent banks, who struggle with legacy organisational and technological debt.

For fintech companies it is nevertheless crucial to increase contribution margins, as marketing and international expansion are huge cost factors. That’s why in 2020 and beyond the next threshold will be user activation and monetisation: Increasing active primary customers, boosting unit economics and launching customer-centric services with high willingness-to-pay would shift the focus from acquiring customers to delighting customers.

Part of the evolution will be to adapt the widely used land-and-expand pricing strategies. Offering free basic current accounts and a few lifestyle-focused tiers on top might not work out well over the long-term. The free tier is often lacking true differentiating factors and simply expanding the product portfolio and anticipating that users will move along is risky. Thus, figuring out the willingness-to-pay for specific features of the higher tiers is key.

These features will likely go beyond banking, such as intelligent personal money management or automated subscription or loan contract management. Alternatively, most fintechs haven’t actively explored the other side of the balance sheet yet, i.e. innovating around lending and credit services, which is another promising area to increase profitability.

2020 will be all about fortifying the positioning as a trusted banking entity beyond a mere lifestyle app with sleek budgeting features.

About the author