A significant shift is on the horizon of the banking industry, and it is not borne out of technological or data-based advances; it is instead human and mindset-driven change for the world of ecosystems. The new era of ecosystem banking starts with senior leaders’ new mindset and updated banks’ culture to connect digital banking assets to the outside world where life, business and work happens – outside banks.

Synopsis

During the past ten years, the financial services industry has gone through a massive digital transformation that could be described as an era of technology-enabled, customer-centric, and operationally efficient, all within the confines of a bank. The challenge banks face in their journey towards greater relevance and profitability is that the ongoing transformation is designed for digitalising the core business, a market that will face further competitive pressures. It is also designed for closed-loop banking, that has become commoditised with differentiation almost impossible, an era that is about to end.

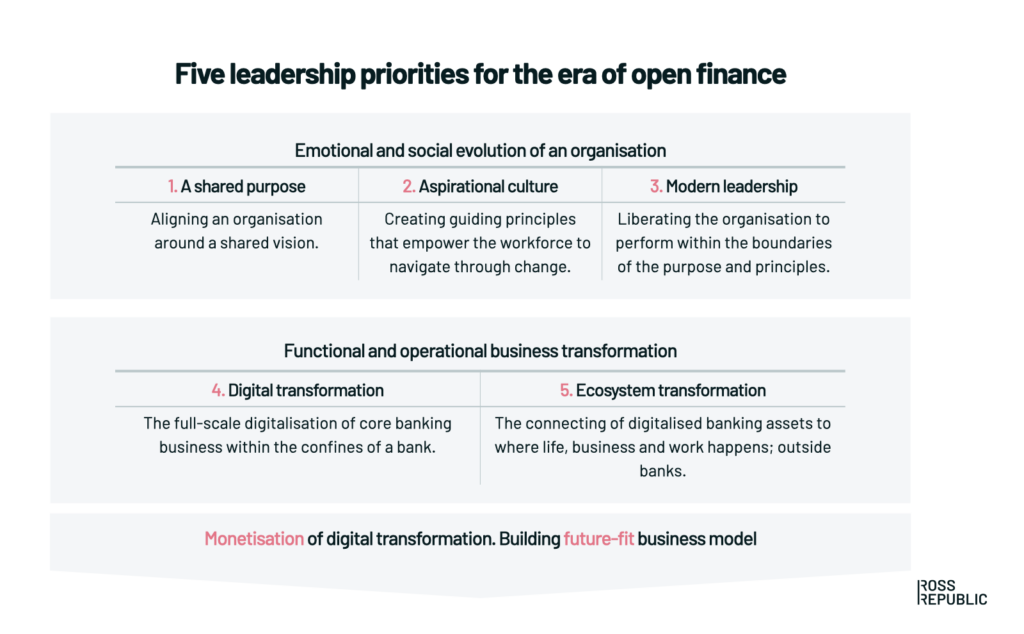

Leaders paying attention to soft skills and the more emotional and social side of leadership positively impact the outcome of the transformation.

The rise of open finance, a market that lives outside the banks’ physical walls and digital services, marks the start of another transformative period with new challenges and opportunities. We call it a period of ecosystem-enabled innovation and business model transformation to connect banks to the outside world. Traditional banks must adapt their business and operations to monetise digital transformation and build a future-fit business model for the digital and open world.

What may surprise corporate boards and senior management teams is that by paying attention to soft skills and the more emotional and social side of leadership, a shared purpose and aspirational culture can be cultivated, which positively impacts the outcome of the transformation.

A short history of the disruption in the financial services industry

Looking back to early 2010, the customer-centricity and digital and data maturity in the financial services industry were low, creating an opportunity for disruption with a handful of fintech companies and venture capitalists capitalising on this and challenging the status quo. Today, Europe and the UK have a vibrant fintech scene with countless tech and data-enabled, purpose-driven, customer-obsessed financial technology businesses. Their vision for what banking should be, together with ever-changing customer needs, and a requirement to ensure competitiveness and robustness in the European banking sector, finally pushed the traditional banks to adapt their strategies and activities for the digital age. Fast forward to late 2021, and the financial services landscape and market dynamics have changed dramatically.

Banking customers are the undisputed winners

As a result, the life of a banking customer across all customer segments has changed for the better. Banking today is more customer-centric, inclusive, smooth, affordable, and engaging. Customers have a variety of options to choose from across product categories.

Imagine for a moment that customers already enjoy a seamless banking experience. We would expect then, that this positive experience will continue to soar in the face of the rise of open finance which we use in this article as an umbrella term for PSD2; the banking customer having the power over who has access to their real-time banking data, the regulatory changes and new technologies enabling non-banks to complement their service ecosystems with embedded banking products, and for EU’s open finance plans to further open the market for competition.

Indeed, open finance is the magic bullet for ever-more inclusive, straight-forward, and personalised financial products and services that will be consumed even more often where life, work, and business happen – outside banks. Open finance will revolutionise where and how certain high- and mid-frequency financial services are used. It integrates finance into life and business; a value proposition that should be attractive for younger TikTok users as well as for businesses looking for the most effective way to manage money-in and money-out flows. It also releases individuals and businesses to build a portfolio of best products and services from various partners, enabling them to manage these in a hassle-free way. As ING states in its purpose description, “People do not need banks, they need banking.”

The European fintech sector is disrupting banking in multiple sectors

According to Crunchbase data from 2021, close to a third of private company unicorns headquartered in Europe are in the financial services sector, with 2021 set to be a record year for European fintech investments. The European fintech sector is becoming the most funded area in European tech. The rise in the number of highly valued and heavily funded fintech start-ups in Europe shows how the continent is taking the lead in disrupting multiple sectors from lending to payments, payroll, trading, capital markets and e-commerce, to banking, insurance, and crypto, among others.

The most dynamic and profitable genre of fintech companies are the niche players focused on individual aspects of banking.

Indeed, neobanks now feel almost outdated yet there are still new neobanks, mainly SME neobanks, being founded and funded. Some of the so-called older neobanks have finally reached a status of a trusted mainstream bank and become profitable. However, the most dynamic and profitable genre of fintech companies are the niche players focused on individual aspects of banking.

If neobanks feel like yesterday’s news, non-banks that are the latest banking market entrants that build their financial services offerings with banking-as-a-software providers, don’t. Andreessen Horowitz goes as far as claiming that every non-bank will be a fintech company and sees embedded finance as the most attractive phenomenon in the disruption of the financial services industry.

Embedded finance is changing the game

In the US, where the embedded finance trend is years ahead of Europe, payment fintech companies like Stripe and Square, e-commerce platform companies like Shopify, and accounting software companies like Intuit have introduced SME banking concepts that target underserved SME segments and comprise of a full range of banking products with a unique twist. The non-banks challenge the notion that in banking one cannot differentiate with product features. The way they do it is by re-imagining banking in relation to those products that made them successful in the first place. They systematically build an intelligent and interoperable ecosystem around their hero products. Being digital and data natives and having real time access to their customers money-in and money-out flows, they have created their own credit scoring models. But what about their monetisation models? Affordable and simple pricing plays a major role in their aggressive growth strategies. They also position their financial service business units differently, as “growth partners with a focus on cash flow management” rather than “better digital banks” – the original proposition of neobanks.

European businesses, non-banks, are actively looking into opportunities to strengthen their service ecosystems with banking products.

Following in the footsteps of the US-based non-banks, European businesses, non-banks, with large B2C and B2B customer bases and effective sales engines are actively looking into opportunities to strengthen their service ecosystems with banking products. Our recent engagements with both B2C and B2B businesses tell us that they are planning to enter the financial space with vigour and determination.

The last interesting group of fintech companies worth mentioning in this short overview are the data science and analytics experts ranging from TPPs with their open banking platforms, to companies like Moody’s Analytics. The insights and profiles these companies can create in a blink of an eye – based on PSD2 data combined with other data points – are often more accurate and valuable than the insights traditional banks have of their customers after serving them for years. Aptly, one banking executive recently stated that one of the biggest challenges for the traditional banks is them still being “stupid and not commercial enough”, and the lack of data-enabled culture needed to build and run modern data analytics units that focus on growing the business while managing risk. All in all, it seems like the best fintech start-ups and companies are the other winners in the disruption of the financial services industry.

Traditional banks must change gear to adapt to the open finance landscape

For traditional banks, the picture is more mixed. Positive news is the remarkable digital progress, including the giant leaps made due to COVID-19, with banks becoming fully digitised and creating modern foundations on which to build their futures. The journey, which for most banks is far from over, covers aspects like:

- Recruiting specialist talent to bring technology to the heart of banking

- Updating core banking systems and having a modern technology stack with cloud-based services, microservice architecture, and open APIs

- Digitising end-to-end business processes across all functions

- Excelling in end-to-end customer experiences

- Adopting agile methodology to drive customer experience and power time to market

- Building data-enabled capabilities and culture to digitally understand customers’ financial lives

- Managing customer relationships with a single view of the customer to provide top-of-the-line experiences with relevant and personalised interactions

- Introducing AI-powered intelligence to boost digital sales with hyper-personalised products and services

- Empowering customer-facing workforce – from advisors to private bankers – with digital tools to offer sophisticated digital experiences combined with the human touch where needed

- Senior leaders, including the CEO, creating a strong digital culture to achieve breakthrough performance.

In addition to the massive investments in digital transformation, banks have steered strategic cost transformation programs to reduce their cost base and free up capital to invest in future growth. Most major banks are now also purpose-driven – or at least they have a perfunctory purpose statement – and some have repositioned their brands for effective differentiation and greater relevancy. The ongoing branch closures and physical banking demise have made the customer experience less tangible and further increased the need for new technologies to build loyalty and customer advocacy. In late 2021, many banks are very different animals to their appearance in early 2010.

Despite all these efforts, the profitability of European and UK universal banks has remained lacklustre. Before the COVID-19 crisis broke, significant banks’ return on equity was on average less than 6%, falling short of their cost of capital. While COVID-19 hit bank valuations hard in the initial crisis phase, market sentiment has now improved. ECB expects banks’ return on equity to recover back to 6% by 2022. However, some banks – across geographical spread from purely local to pan-European market strategies – have consistently outperformed their peers and even delivered the best H1 results in 2021 due to their transformation efforts that were boosted by the positive impact of COVID-19 in areas like mortgage interest revenue and investment fees.

Increased competition across customer segments and product categories has negatively impacted both margins and market share. The massive digital investments have increased costs without immediate returns on investments as digital transformations tend to eat profits for years before the investments pay back. It is one thing to build a modern foundation, but quite another to understand and accrue all the potential business benefits from it.

Uncovering the future-fit business requires banks to embrace ecosystems

The challenge the banks face in moving towards greater relevance and profitability is that the ongoing digital transformation is designed for digitalising the core business, the market that will face further competitive pressures. It is also designed for closed-loop banking, which we know is at the end of its shelf life. It is not designed for success in the new open financial services market, which lives outside the banks’ physical walls. Nor does it support digital services or innovative business model transformation to connect banks to the outside world.

The ongoing digital transformation is designed for closed-loop banking and digitalising the core business, the market that will face further competitive pressures.

The result is that the monetisation of digital transformation and uncovering the future-fit business in the retail and smaller business segments will require banks to embark on wholesale development and deployment of a robust ecosystem strategy to connect their core assets to the real world. As a by-product, banks may need to sharpen up their business focus as the ecosystems will further stark contrasts between retail, SME, and corporate banking business models.

The new requirements for branding, partnerships and risk management

To succeed in the digital and open world, banks must adopt the following three capabilities as an absolute minimum:

- They need to become a life and business partner to their customers, enabling a better quality of life and more successful business with their deep financial services expertise. The target market shifts from financial services to life and business. Culture change and the role of leadership to nurture customer-centric mindsets becomes critical.

- They must excel in partnerships, fintech, and non-bank to determine the most efficient ways of operating as a regulated entity.

- Their risk management practices must be adjusted to the open finance landscape. Banks will have to learn that directives and compliance initiatives are not just about doing the bare minimum to maintain trust, but that having a modern mindset can improve competitiveness and eventually impact the bottom-line too. As an example, how many banks offer their clients a lite bank account with basic functionality, allowing their clients to decide for themselves when to give their full KYC disclosure to enjoy the full features and benefits?

The forerunners are already building the new open finance market

Digitally mature and forward-looking banks are already busy working with ecosystems to find new ways to scale and monetise their core assets, including:

- Expanding to new distribution channels. Examples include OP, the largest Finnish retail bank, now offering a fully integrated invoice financing product on the accounting platform of Netvisor, while ING Germany offers loans to Amazon’s eligible sellers through their seller portal. Furthermore, Citi are creating an account product for Google’s customers, and BBVA’s banking app is being pre-installed in all mobile phones sold by its strategic partner, Xiaomi

- Extending into new attractive value spaces by marrying their core assets with modern and easy-to-integrate software of fintechs. For example, a premium bank with a strong footprint in asset management building a more inclusive hybrid wealth management concept to target new customer segments with a new business model – a theme that keeps our team busy

- Launching new inclusive financial service offerings by partnering up with competitors such as Lloyds Banking Group and Schroders, creating a joint venture for the new wealth management concept called Schroders Personal Wealth – a project our team members were an integral part of

- Building an open platform on which third parties can add and offer their products such as Starling Bank’s Business Marketplace, which aggregates beyond banking business solutions, or Citi’s Bridge built by CitiSM, a bank-led, digital meeting place that connects businesses looking for loans up to $10 million with regional, local and community banks

- Partnering up with fintech brands and offering their solutions for banks’ customers to help them run their business operations with state-of the-art solutions, such as BNP Paribas helping their business customers find the best fintech cash management solution

- Looking for new ways to leverage up and downstream ecosystem players to re-configure the bank for growth, as well as optimize its operations to serve customers in the most effective and efficient way – a project we are currently working on

- Opening the core banking infrastructure to third parties and entering the banking-as-a-software market, similar to Goldman Sachs and Starling Bank.

The list above is by no means a complete overview of what kind of opportunities open finance gives banks. Instead, it serves as an example of how diverse a topic open finance is and communicates three important things. First, in open finance, there are no one-size-fits-all solutions. What works for a large global bank most definitely does not work for a smaller local bank and vice versa. Actively monitoring the market developments in open finance helps, but each bank must find their unique and profitable way of engaging with the ecosystem.

The talent needed for the digital transformation is not necessarily the right talent to master and monetise the ecosystem game.

Secondly, the talent needed for the digital transformation is not necessarily the right talent to master and monetise the ecosystem game. Nor is the digital culture the banks have built necessarily optimal to motivate and guide the workforce from leaders to new ecosystem talent enabling open finance market operations safely.

Thirdly, open finance is still a great unknown, and we believe that it is still too early to predict its final impact on the lives of banking customers and the industry. However, we believe that a waiting game is not the right strategy. Management teams should now focus on creating an environment that motivates and guides the workforce to navigate both digital and ecosystem transformation to result in both open finance success and retaining traditional banking core assets.

A focus on emotional and social leadership to build sustainable competitive advantage

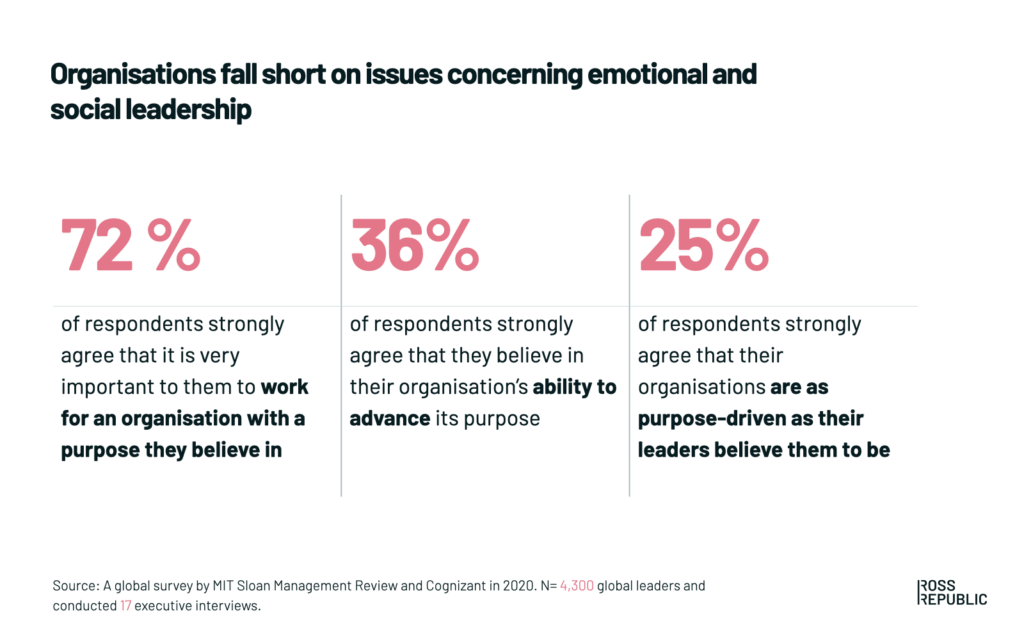

Against this backdrop, banks must win the hearts and minds of their employees to remain competitive, externally relevant, and internally efficient. To transform and win in the new market dynamics, banks need the right talent who care and have a strong emotional link with the organisation. The standard view is that management succeeds in employee engagement if it excels in four aspects of business transformation: functional, operational, emotional, and social. Another common truth is that the more dynamic the business environment, the more important the emotional and social factors are in navigating the change and inspiring the extraordinary effort and sustained commitment required to deliver consistently superior performance. The third is that many businesses still suffer from gaps between the emotional and social expectations of the workforce and the delivery of the senior leaders on these areas of leadership, putting companies’ long-term competitiveness at risk.

It may come as a surprise that encompassing a softer approach to employee relations and understanding people as humans give a shared purpose in the workplace, with transformational and authentic leaders having a significant impact on the success of the business. Indeed, if senior leaders adopt a common purpose and positive culture as top priorities, these potentially act as a source of sustainable, competitive advantage still available to them in the digital age. Today when a digital-savvy competitor can copy a unique product feature and exceptional customer journeys at velocity, the key to any company’s long-term success is in its unique heart and soul that cannot be replicated beyond those organisational boundaries. Banks make no exception.

Managing risks with emotional and social leadership tools

A wealth of research indicates that CEOs and senior leadership teams that connect with their workforce emotionally with a shared purpose, and socially through building an aspirational culture are more likely to successfully transform their businesses. Correspondingly, C-suite personnel and their management teams who run an organisation without purpose and view the organisation as a purely economic entity, and who engage the workforce intellectually using rational examples of transformation such as greater efficiency, are more likely to face unforeseen risks and unanticipated costs. The same applies if they manage their business with a purpose gap. The absence of a purpose statement or, conversely, the presence of one that does not sit at the root of their ‘why’, will hinder the clarity and guidance around basic principles that should be evident from strategy to operational level.

The first risk is a talent risk. Rational economic entities do not attract the talent needed for success in today’s dynamic financial services landscape, nor do they motivate them to give their effort and energy. The second risk is a reputational risk. Purpose statements draw scrutiny. Empty purpose statements, statements that are not properly operationalised and commercialised, become internal fuel for cynicism as well as external fuel for negative press and disloyal customers.

Conclusion

To monetise digital transformation, traditional banks must become more agile and active in ecosystem-enabled innovation and business model transformation to connect their digital assets to the outside world. Digital and ecosystem transformations will enable banks to expose a modern, fit-for-purpose business model in the digital and open era. Managers must incorporate the emotional and social aspects of leadership for competitive advantage, and to truly thrive in a VUCA, volatile, uncertain, complex, and ambiguous environment.

Key takeaways

- Complement your digital transformation with ecosystem transformation to cohesively bring ecosystem capabilities to the heart of what you do, enabling you to develop new and innovative ways to commercialise core assets and enter new markets with lower cost and risk.

- Bring a wider, shared purpose to the core of your strategy by operationalising and commercialising it. The benefits will go beyond accelerating digital and ecosystem transformations. Being a truly purpose-led bank communicates to external shareholders the shift from shareholder to stakeholder capitalism, and the management’s intention to bring sustainability in from the side-lines to the overall business strategy, which is vital in risk and reputation management.

- Build an aspirational culture that combines your heritage as a trusted bank and models the desired new thinking and behaviours to win in the open finance landscape. How could your bank compete or collaborate with fintech companies and non-banks if you do not adjust your culture and leadership methods to new market dynamics and align them to support your new open finance discoveries and endeavours?

- Manage the transformation by managing the drivers of purpose and culture. Encourage the leadership team to “walk the talk;” clarify roles and accountabilities for key jobs; replace people where necessary; add performance metrics or incentives; and change the performance management or recruiting processes.

Our next article will be about the shared purpose and how to operationalise and commercialise it. After that, we will analyse what kind of culture is an aspirational culture that guides and supports the strategies required to navigate the open finance landscape.

Acknowledgements

- Maro Arai, Ross Republic, Partner, Ecosystem Banking and super apps

- Terry Tyrrell, Ross Republic, Senior advisor, Brand transformation

Sources

- LEADERSHIP’S DIGITAL TRANSFORMATION: Leading Purposefully in an Era of Context Collapse

- HBR: From Purpose to impact

- HBR: Building a Game-Changing Talent Strategy

- HBR: The Leader’s Guide to Corporate Culture

- HBR: How to Shape Your Culture

- HBR: Leadership is conversation

- ESG and Corporate Purpose in a Disrupted World

- Purpose-driven Leadership

- ECB: Euro area banks in the recovery

- ECB: The euro area financial sector: opportunities and challenges

About the author