As banking increasingly becomes a technology play, the usage of internal and external application programming interfaces (APIs) is surging. That’s why API management platforms are crucial for financial services providers to reach true digital leadership.

Legacy business models and operations of incumbent financial services providers are increasingly maladapted to fundamental shifts in the market environment. One specific trend is the ongoing transfer from a linear, industrial financial services value chain towards open platforms and embedded financial services. It will inevitably result in a far-reaching market shift that disintermediates the manufacturers and distributors of financial products. Consequently, the strategic moves of traditional financial institutions have increased exponentially. This opens up an unprecedented opportunity to re-design financial services for maximum scalability, efficiency and resilience.

The biggest bottlenecks to unleash true digital transformation in banking

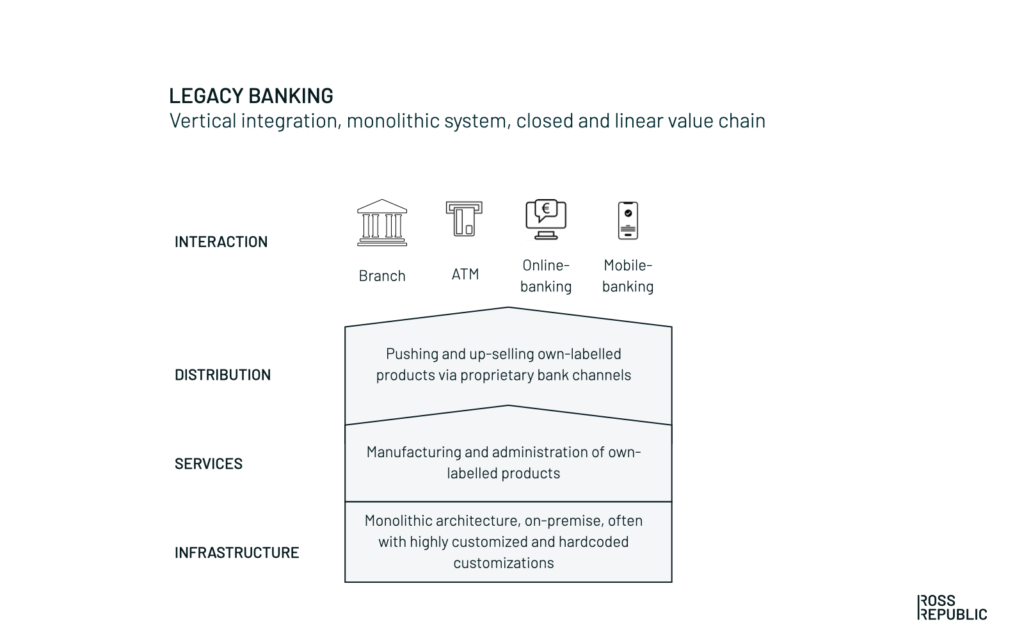

In the first phase of digital transformation, most financial services providers created digital twins of their prevailing business models, products and channels. These digital twins often run on top of legacy IT infrastructures, legacy business models, legacy cultures and legacy operations. Like other incumbent firms of digitally disrupted industries, this approach results in several challenges:

High cost-to-serve

The low-interest rate environment coupled with loan losses due to the Covid-19 crisis makes cost management ever more important for traditional financial institutions. Yet, legacy IT continues to be a huge cost factor and absorbs most digitalisation budgets. Highly customised, monolithic, siloed, on-premise banking infrastructure becomes a serious competitive disadvantage that prevents the whole organisation from innovating. Digital twins that mimic modern fintech front-ends, but still run on top of the cost base of a legacy backend, will never enable incumbents to seriously compete against truly digital-first competitors.

Slow time to market

Digital banking is effectively a red ocean. New entrants from within and beyond the industry have set high customer experience benchmarks. Once unique features become market standard within months, such as Apple Pay, instant loans or expense tracking. However, established financial services providers can only innovate as fast as their technology stack and operational agility allows them to. Monolithic core banking infrastructures, product silos, fragmented IT landscapes, vendor lock-ins and hard-coded integrations significantly limit the speed of innovation of established providers and leaves them trapped in an endless cycle of playing catch-up.

Limited scalability

The cash cow products at most banks, such as loans, mortgages or savings products, have become even more commoditized as product discovery and distribution moved online. Commodity banking products need to be manufactured at the lowest cost and distributed at maximum scale, while at the same time banks need to find opportunities for differentiation through personalisation. The current technology and data models in production neither allow horizontal scalability across platforms nor the ability to create unique customer experiences.

Traditional linear value chain in banking

Technology debt and fragmentation are still one of the biggest bottlenecks to boost innovation, agility and growth. It doesn’t have to be that way, as new technologies and cutting-edge fintech providers offer valid alternatives to the current infrastructure challenges.

Embracing technology as a key competitive advantage

Over the last years, upgrading core architecture platforms has been a key priority at incumbent banks. The end-goal of such migrations is to cut operating costs and to increase agility. In order to manage these massive transformations, banks usually follow one of three options:

- One-off core migration events

- Hollowing-out components over time and rebuilding them as microservices

- Greenfield build

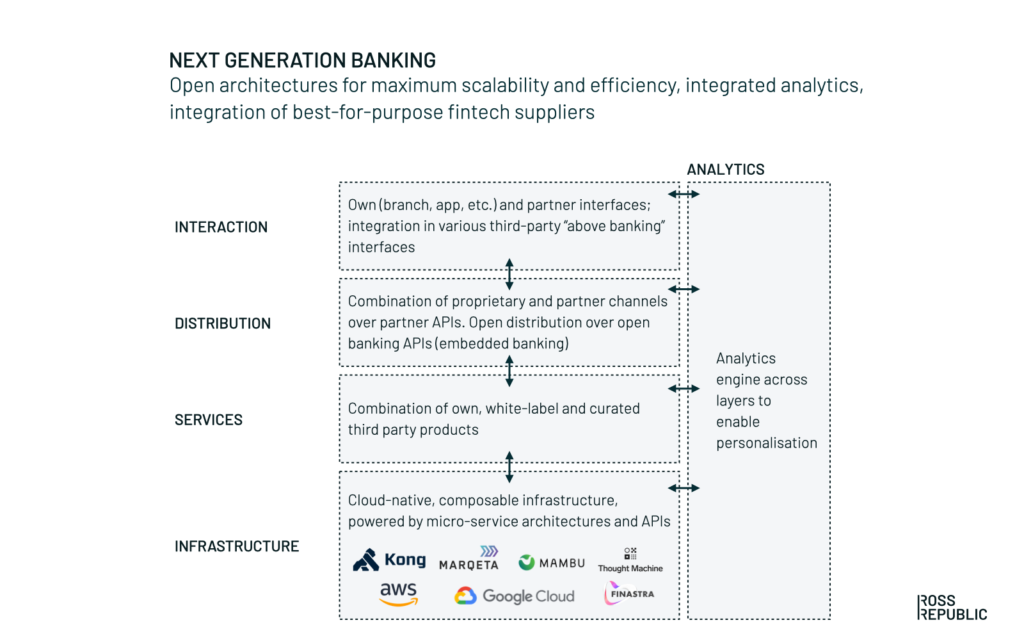

The adoption of cloud-native, composable architectures, independently deployable microservices and third-party integrations has replaced proprietary vertically integrated technology architectures with platform-based stacks:

Next generation open value chain in banking

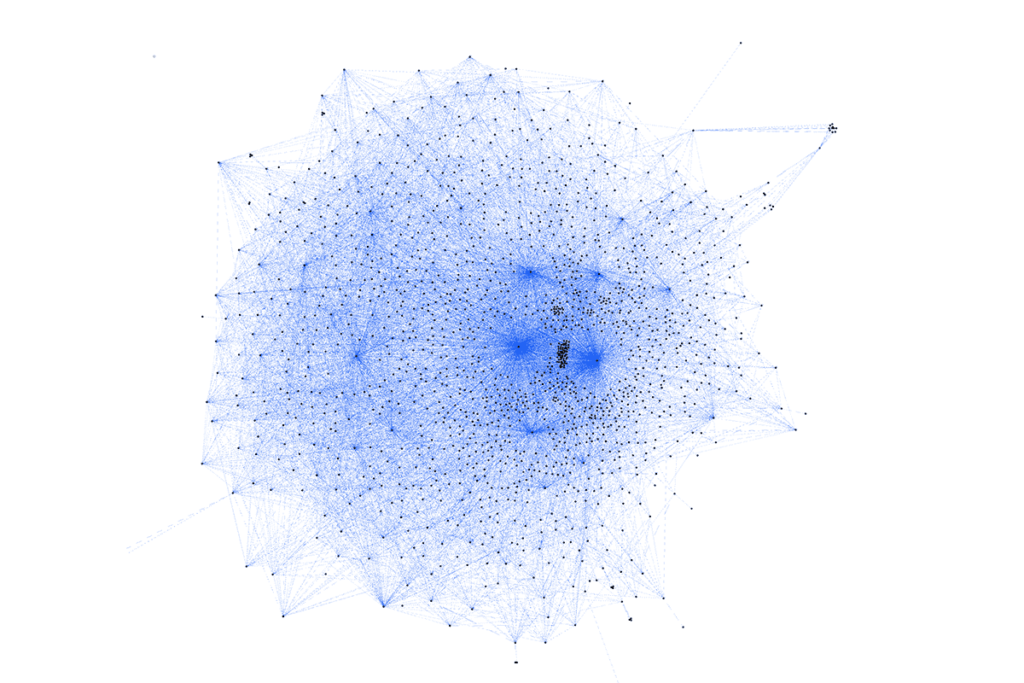

Next generation banking platforms are built on a composable system design, i.e. a combination of independent, best-in-class systems that are deployed to fulfill a specific function. This design allows them to operate on much lower cost structures and become more agile and responsive to market dynamics and customer expectations. Moreover, next generation composable banking platforms allow maximum freedom to integrate best-of-breed fintech solutions.

Visualisation of Monzo’s internal microservices architecture (source)

API-first approaches in banking

Next to the internal APIs, who mostly enable the infrastructure and services level, new digital distribution possibilities make banking capabilities ever more accessible and embedded across an ecosystem of financial and non-financial third parties. The Second Payment Services Directive in Europe (PSD2) set the groundwork for opening up account and transaction data for third parties. This is only the beginning of a larger open finance trend, which will ultimately separate the manufacturers and distributors of financial services.

That’s why next to the APIs required by regulations (such as PSD2), forward-looking banks are now figuring out their API strategies and are exposing partner or premium APIs to third parties in order to become the preferred manufacturer of choice. Simultaneously, they are integrating third party services into their own apps to curate new services for their customers.

The shift towards cloud-based, composable banking and open finance has unleashed enormous demand in data integration and governance. With the explosion of data and API connectivity, the management, monitoring and optimisation of APIs has become an essential success factor for digitally-enabled banks.

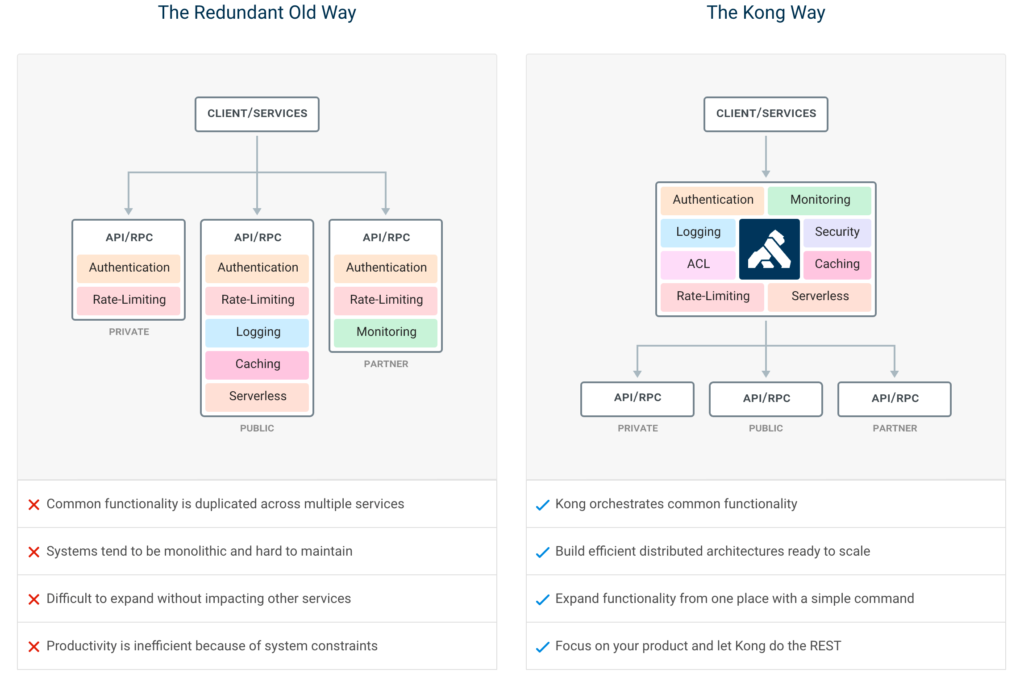

One of the leading providers in this space is Kong, the next-generation API platform for multi-cloud and hybrid organizations. Kong allows financial services providers to connect all microservices and APIs natively within and across clouds, Kubernetes, data-centers and more. Such API platforms and gateways provide the necessary control and governance layer that ensures a steady and secure data transmission, even at massive scale.

When working with financial services providers, Kong usually deploys its Service Control Platform, which consists of core modules supporting the client in

- ensuring a successful journey towards decentralization

- enabling end-to-end security and governance on APIs and services

- allowing publishers as well as subscribers of APIs to come together on a platform to get visibility and consume services

Next to that Kong offers a service mesh (Kuma, www.kuma.io) that allows service-to-service communication, which is essential for any financial institution deploying microservices architectures.

Kong’s next-generation API platform (Source)

Ewgeni Hersonski, responsible for the DACH region, explains:

“Traditional API management has been around much longer than most people think. Most of the time, monolithic applications in relatively static banking infrastructures were connected via traditional communication approaches. Over these predominantly on-premise installations, a very heavyweight, centralized API gateway was typically added.

In today’s world, we are experiencing a paradigm shift in the digital customer experience through key topics such as decentralization, decoupling, more heterogeneous communication channels and highly complex access patterns to services. Thus, a rapidly growing number of teams in banks is emerging from several monoliths to take care of the explosive growth of small services in the DevOps manner (microservices). In order to do justice to this new approach and not lose touch with the digital customer relationship, it is necessary to rethink service control and visibility in particular.”

A bank operating in the EMEA region leveraged Kong’s platform and decreased the timespan to offer a loan quote from 6 weeks to 15 minutes.

API management quickly becomes mission-critical for financial institutions to accelerate their digital transformation, i.e. ensuring internal efficiency and scalability, while growing the digital sales interface. Leveraging best-of-breed technology providers is often the most efficient way forward for most financial institutions: A bank operating in the EMEA region leveraged Kong’s platform to digitise one of their loan products, which decreased the timespan to get a loan quote down from 6 weeks to 15 minutes. The bank highlighted: “This is really making a difference. Especially in these times, where companies need quick loans to survive. We can automate the process and quickly help out.”

Getting started

The market-leading financial services providers of tomorrow leverage technology as a key competitive advantage and enabler, rather than a cost centre. Digital transformation is about re-defining the end-customer experience, enabled, not defined, by technology. It is about pioneering new products and business models, as new technologies create new possibilities across the entire infrastructure stack. It all starts with a coherent digital business strategy, evolved capabilities and cultures as well as new technology use cases in high-impact/low-risk business areas.

Strategy

In order to truly seize the emerging opportunities of API-driven banking, it all starts with a clear vision and strategy. The strategy phase should clarify key questions, such as:

- What’s the core value proposition of our API offering? Are we acting as a provider, marketplace, aggregator or platform?

- What kind of capabilities and data will be provided?

- Who are the different types of consumers and end-users for our offerings, beyond developers? What are their needs and what do we enable them to do?

- What business model and monetisation plan is the right one to start with?

- What governance, risk and compliance aspects should be considered?

The open banking canvas offers a simple framework to organise initial ideas about such considerations.

Culture and capabilities

Once the strategic direction is clear, it is critical to evaluate whether the prevailing internal capabilities and cultures are ready for API-driven banking. While new technologies offer the infrastructure to increase efficiencies, internal teams usually need to evolve cross-disciplinary ways of working and mind-sets in order to be able to truly leverage new business opportunities. This begins with bringing tech and business stakeholders together and to be open to explore new digital business models.

Technology

Digital banking would be impossible without APIs. Internally, they enable faster integration and an efficient utilisation of capabilities. Externally, an API is way more than just a data gateway. While financial institutions have been implementing API offerings mostly internally or to comply with open banking regulations, they increasingly leverage APIs as a product and business asset. That’s why upgrading to modern technology infrastructure and integrating best-of-breed fintech solutions is mission critical for making financial services providers future-proof. Instead of upgrading systems wholesale in overly complex migration events, it’s standard practice today to quickly deploy new technologies on a modular basis.

Kong x Ross Republic

In order to truly leverage the business opportunities of open finance, financial services providers rely on developing unique strategies for utilising APIs as business assets. At Ross Republic, we have supported the transformation of top-tier banks and enabled fintech challengers to develop new markets. As finance is a highly regulated industry, it’s critical to think forward about governing data access, controlling APIs and managing services properly, which is why we team up with Kong who offers leading technology solutions in this space. The combination of modern strategy consulting and technology delivery is a unique combination that helps financial services providers to accelerate digital transformation.

Ewgeni of Kong continues:

“Kong is working with the most sophisticated and demanding financial services and insurance companies globally by providing state of the art technology for service and cloud connectivity, while relying on strategy consulting and service integration partners either for the consulting of a cutting-edge digital business strategy or a modern approach towards a technical implementation.”

About Kong

Kong makes connecting APIs and microservices across today’s hybrid, multi-cloud environments easier and faster than ever. We power trillions of API transactions for leading organizations globally through our end-to-end API platform.

Our growing team of engineers and tech professionals work passionately to drive the future of API innovation and service control platforms to help our community and our customers stay at the forefront of technology and innovation.

About the author