The SME banking segment is ripe for disruption. After a first wave of digital UX focused fintechs, there are now plenty of product and service innovation opportunities to create truly customer-centric SME banking propositions.

After evaluating the SME market opportunity and analysing the market for innovative account-focused SME banking fintechs, it became evident that digital business banking is a coveted and crowded segment – a red ocean. What are emerging strategies that allow to create a competitive advantage in SME banking? What product plays can banks and fintechs apply to build truly impactful financial services for SME clients? In order to answer these questions, we developed four future innovation scenarios for the next-generation of business banking services. This post provides you free access to the first scenario: Vertical SaaS tools with integrated financial services.

Are you a fintech, bank or software provider looking to expand into the SME segment? Contact us for more information about the latest trends in SME banking and our related research and consulting services.

SME banking is all about enabling smart workflows

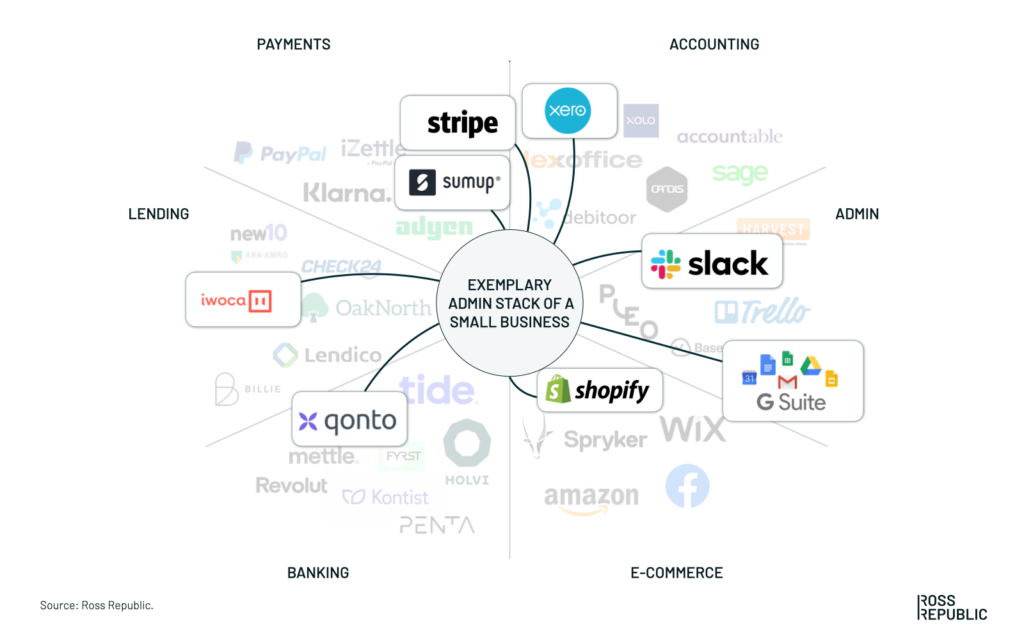

The bank account of the future needs to seamlessly weave into an ecosystem of digital tools. At minimum, the service stack of a business that sells products online consists of an e-commerce provider, an acquirer, a merchant account and accounting software. Depending on the specific nature of the industry, SMEs additionally rely on a variety of digital systems to manage their business efficiently, from advertising to payroll:

- Google, Facebook and Amazon provide dedicated programs for small businesses to boost their online presence and client acquisition

- Accounting incumbents like Xero, Sage, Quickbooks, Debitoor or lexware are already the de-facto primary financial interface for SMEs, which brings together bank accounts, transactions as well as accounts payable and receivable

- Real-time online project management and collaboration tools, such as Asana, Trello, Harvest, Basecamp, Miro and communication tools like Slack, Zoom or Microsoft Teams

- Shopify or Wix allow to create a responsive online shop with a few clicks, while Stripe or Mollie take care of online payment processing. iZettle or Sumup enable SMEs to get paid in-store, online and on-the-go

- Specialised tools that are the analytics layer on top of the stack, i.e. the systems of intelligence. For instance, xentral provides a lean ERP cloud software that bundles all business processes centrally in one place (from e-commerce, warehouse, production, fulfilment, accounting); LiveFlow, part of the Y Combinator W21 cohort, aggregates accounting platforms, banks, revenue platforms and more into one real-time spreadsheet.

SMEs use various tools on a daily basis – innovating around workflows is key

In this context, it’s evident that digital disruptors are the current market shapers. They are targeting SMEs with tools that offer sophisticated digital user experiences, work out-of-the-box and enable seamless workflows via API-driven, interoperable software.

The next-generation of business banking applications will be as intuitive and plug-and-play as their consumerised B2B software counterparts: consumer-grade usability, business-grade compliance and reliability.

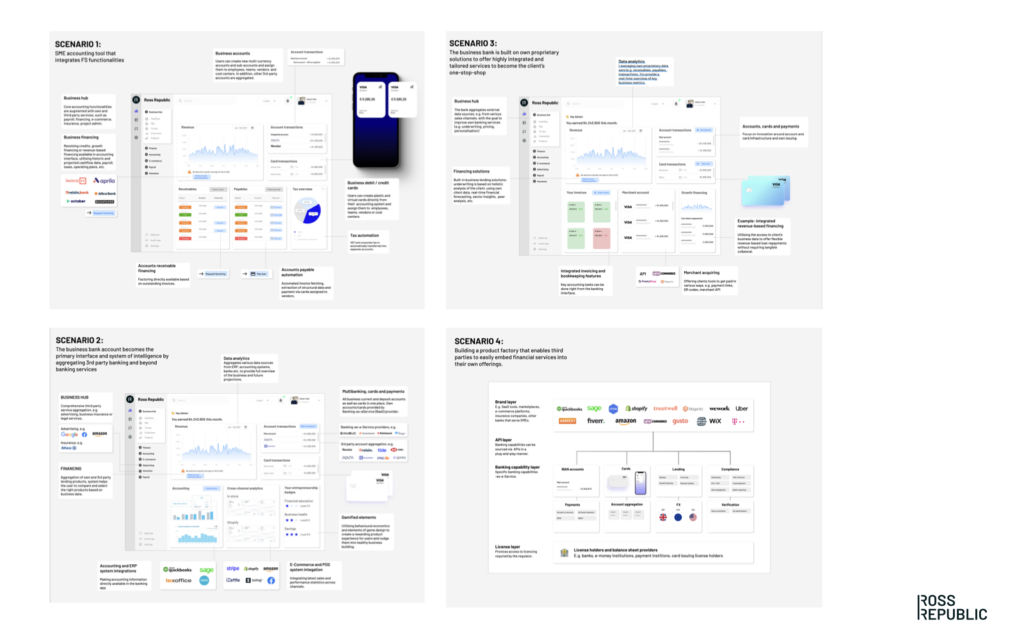

There are plenty of contextual jobs-to-be-done to be solved for professionals working at SMEs, who need to manage a range of operational and financial tasks without being a professional COO or CFO. Frequently switching mental contexts and applications is a pain point for them. Consequently, being able to bundle and orchestrate services becomes highly important: The next-generation of business banking applications will be as intuitive and plug-and-play as their consumerised B2B software counterparts. Based on these insights, we developed four viable innovation scenarios for the next-generation of business banking:

- Vertical SaaS tools with integrated financial services

- Business banking as aggregator

- Business banking as orchestrator

- Business banking as product factory

The next section of this post covers the first innovation scenario. Contact us to get a free copy of our full whitepaper, including all four SME banking innovation scenarios.

Digital disruptors move into SME financial services

A key theme in the current fintech ecosystem is that the barrier to entry into offering financial services is continuously reduced: Any company can become a fintech company by integrating banking functionalities on top of its own core service offering (“embedded finance”). In this scenario, non-financial SME software providers either get their own licensing and tailored fintech vendor setup in place or partner up with a Banking-as-a-Service provider that offers fintech functionalities and licensing out-of-the-box.

Many of the aforementioned SaaS tools are already adding adjacent financial services as part of their offering:

- Accounting software provides, such as Xero, aggregate accounts via open banking, match invoices to transactions and initiate payments directly from their applications

- Amazon partners with banks to provide lending to SMEs that sell over its platform, leveraging its proprietary dataset

- Shopify provides merchants access to financial services to launch, manage, and grow their business, including a Shopify Balance Account, Shopify Balance Card, as well as Shopify Loans, which leverage Shopify’s proprietary client data to improve underwriting

- Apple is moving into the softPOS space with its recent acquisition of Mobeewave, which turns iPhones into mobile payment terminals

Nimble digital disruptors that already excel in their core software offering have significant competitive advantages, such as proprietary datasets, high user engagement, opportunities to contextually tailor services, leading UX design and built-in real-time, digital workflows. They can offer financial services at lower margins, as their customer acquisition cost might be lower or their underwriting much better compared to traditional banks; alternatively they can offer financial services as a loss leader to boost the core product. Digital disruptors will likely continue to add financial services as a native feature of both their technology and business model stack, as it allows to capture additional revenue streams and makes their services more sticky. By utilising financial services as an integrated value driver, they become a major threat to traditional banks or fintechs who run financial services as their primary business model.

Innovation scenario 1: Vertical SaaS tools with integrated financial services

The specific financial services that will be integrated into software will vary greatly, depending on the industry, specific client needs and current service landscape. However, a few innovation opportunities stand out, as shown in our hypothetical scenario below:

What happens if an accounting tool for SMEs becomes the primary financial interface?

An accounting tool as primary financial interface

Improved user value

Accounts payable and receivable data is often already connected in such systems, thus offering own integrated bank accounts, cards and payment options opens up new product innovation opportunities: users can request factoring directly in the accounting interface with a few clicks or get access to better loan products that reflect the actual state of the business, based on real business data. Integrated cards can be assigned to specific vendors or employees, and receipts are automatically matched. This is also a major opportunity to streamline accounts receivable and payable workflows, with specific value-, user- or vendor-level permissions and payment triggers.

New monetisation opportunities

According to VC a16z, SaaS businesses that embed banking features can increase their revenue per user 2-5x, compared to a software subscription model. Hence, beyond improved user value integrated banking functionalities can unlock new revenue streams for SaaS providers. For instance, offering business debit cards allows to capture interchange fees, which range from 0.68% to 1.88% in Germany.

Get an in-depth analysis of the embedded banking opportunity

Want to know more about how embedded finance works? Check out our latest podcast episodes with Hubuc and Weavr, two innovative fintech pioneers that offer infrastructure for integrating financial services into third-party environments:

- The next generation of financial infrastructure (with Ignacio Javierre from Hubuc)

- Embedded finance (with Lars Markull from Weavr)

In response, banks and fintechs that have financial services as their core value proposition need to expand their competitive arena and ask: What if the next business banking innovation comes from a vertical SaaS player?

Traditional banks and fintechs: where to play and how to win?

Fintech companies that focused on business banking have been successful due to efficient online customer acquisition, fast online signups and a considerably upgraded UX. Their initial success has led to similar corporate innovation efforts from incumbents, albeit with mixed success rates:

- Fyrst by Deutsche Bank

- Mettle by RBS

- Kinetic by HSBC

- Azlo by BBVA (which recently closed down)

In the embedded finance era, just offering an improved mobile UX won’t be enough to win in the SME banking market. The business bank accounts by most European SME fintechs just offer a list of historic transactions that often require users to tag single transactions and add receipts manually. Some fintechs allow to send invoices, which are matched with the corresponding transactions automatically. However, it often does not make sense from a user’s point of view to do these tasks inside their business banking app, as they mainly need the data in their accounting tools that already offer similar features. A digitally-improved business banking account therefore provides very little utility at this point. There is no real differentiation in the SME digital banking market except for UX plays. Simultaneously, new SME fintechs are collectively driving up customer acquisition costs, mainly on performance marketing channels. Subsequently, the digital business account segment has become a red ocean.

Future SME banking innovation strategies

Where do banks and fintechs now sit in this competitive landscape? What are viable business model and product strategies, given the fact that most basic business banking services, i.e. accounts, cards and payments, are reduced to an integrated micro-feature provided by non-financial digital innovators?

Given the current competitive dynamics, SME banking providers will have to make a strategic decision. Do they want to:

- own the client interface, i.e. become an aggregator or orchestrator

- be the underlying enabler, i.e. become a product factory?

This is all about moving up or down the stack. Contact us to get a free copy of our full whitepaper, including all four SME banking innovation scenarios.

SME banking innovation scenarios

About the author