Thank you for joining the Ross Republic podcast. In our seventeenth episode, your host Adrian Klee is joined by Til Klein, the founder and CEO of Berlin-based fintech company Vantik, to discuss the importance of modern pension planning solutions.

RR Podcast #17

Due to the far-reaching economic shocks triggered by the Covid-19 crisis, one in three Germans fears that private pension provision will lose value due to falling prices and lower returns. Among households with a net income of between 1.500€ and 2.500€, the proportion is as high as 49% (source / Finanzen.net). In 2019, the at-risk-of-poverty rate in Germany was at 15.9% percent (source / Statista, Mikrozensus). Despite these issues, the pension savings market is significantly underserved and a ticking time bomb across segments, specifically among self-employed persons. The combination of younger generations not contributing to private pension strategies, people living longer and insufficient state pensions all contribute to a growing need for smart wealth management services that supplement state provisions.

Traditionally, incumbents have sold off-the-shelf, “buy-and-forget” private pension products. Emerging fintech start-ups are now entering the private pension planning market with more engaging services that merge cutting-edge investment products with user-centric digital apps that nudge users to take care of their pension savings throughout everyday life.

One of these fintech companies is Vantik, which provides a retirement fund that invests in sustainable exchange-traded funds (ETFs) and offers a debit card that connects to a customer’s existing bank account. Every time a customer makes a purchase with the debit card, he or she receives one percent of the value back as cashback, which is subsequently invested in Vantik’s retirement fund. On top of the cashback-based savings, customers can pay into the fund at any time.

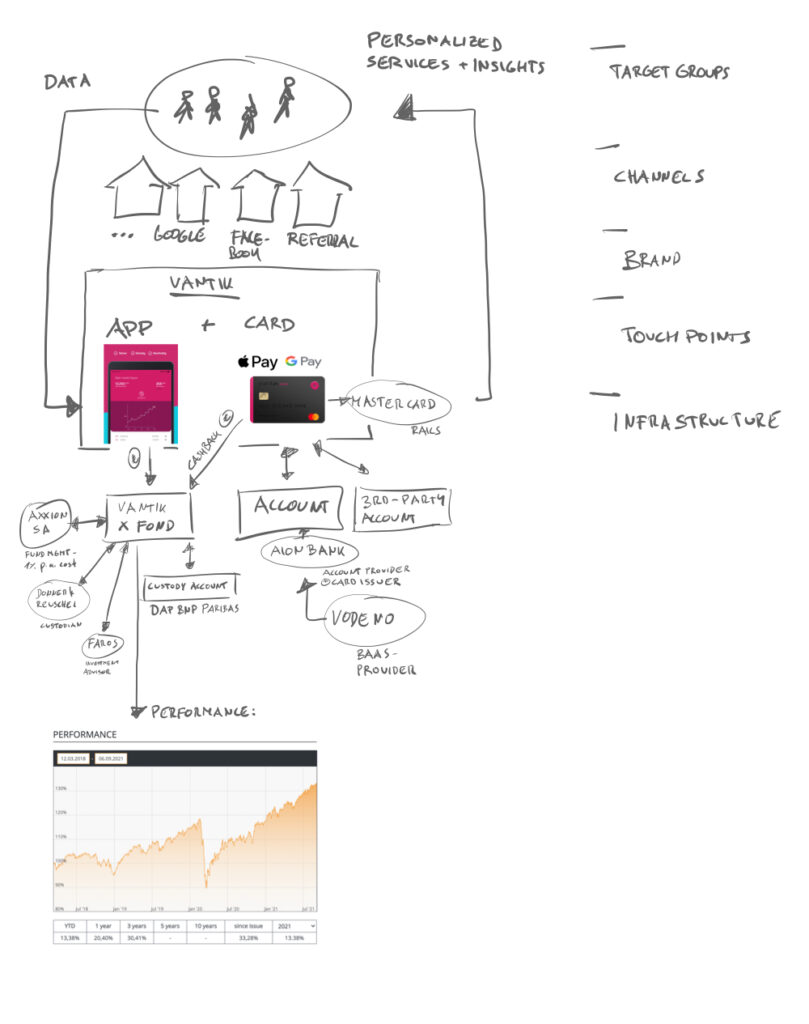

Together with Til, the Founder and CEO of Vantik, we discussed the macro-factors that influence today’s pension savings market and dissect Vantik’s business model from front to back (disclaimer: the infographic and text below, unless direct quotes, are based on the analysis of the author):

Analysis of Vantik’s business model

Target groups

When planning a new financial offering, target group segmentation is key. How does Vantik define its target group and are they targeting specific user verticals as a first entry point? Til mentioned: “You have to focus at the beginning. The key to creating a great product is to understand your customer, and to tailor your product and message.” According to Til, Vantik’s early adopters are the “credit card optimisers”, i.e. people looking for credit cards that provide added value. The next step will be target users looking for an easy start into saving up money, i.e. people who don’t want to become a financial expert or invest a lot of time into dealing with financial matters. Hence, Vantik targets a complementary target group compared to brokerage apps, such as fast-growing Trade Republic, by building a service for users that seek a convenient pension solution without making active trading their hobby.

In this section, we also covered how Vantik ensures to stay close to the customer and how it makes the topics of pension planning and wealth building accessible to (younger) target groups.

Distribution

A common challenge for fintech D2C companies is missing brand awareness, strong competition, entrenched existing consumer habits and low willingness-to-switch, resulting in very high customer acquisition costs. How did Vantik solve the cold start problem? When starting out, Vantik focused on offering its investment fund that allowed customers to invest in directly. “Customer acquisition cost is a big challenge”, Til mentioned, “particularly when you address the mass market.” The team at Vantik found out that while customers loved the simple pension fund solution, they struggled to access the product, get started and build a habit around it. Hence, Vantik needed to solve the hurdle to get started with a pension product. After testing and iterating many solutions, ultimately a payment card was chosen as the most effective entry tool for Vantik’s customers, allowing to build on established habits. Beyond that, the card can functions as an artifact that users can show to peers in order to explain the service more tangibly. Ultimately, the card allowed Vantik to reduce its customer acquisition cost. At the time of the podcast recording, the waitlist for the Vantikcard reached more than 30.000 users.

Embedded banking, i.e. delivering contextual banking products in non-banking environments via APIs, is currently a hyped topic in the fintech scene. Hypothetically, pension planning products can be delivered over other channels as well, such as Gusto Wallet (HR software). For now, Vantik remains fully focused on its direct-to-consumer model, though.

Brand

Compared to the cold and rational brands of incumbents (Allianz, Deutsche Bank, etc.), Vantik has created a modern and approachable consumer brand that reminds very much of the likes of Revolut, Klarna or N26. Brand plays an important role in order to build a direct relationship with the client and building brand equity might be a very important success factor to make the D2C model defensible. As banking products are mostly commodities, Til sees the key differentiators either in cost leadership due to technological advantages and/or in a better branding. The fact that Vantik provides banking from people for people is an important differentiating factor – in contrast to incumbents, who often reduce clients to a number.

Product and touchpoints

The Vantikcard is a free debit credit card that offers 1% cash back on every purchase. The sum earned is in turn automatically deposited monthly into a retirement savings account with a Vantik ETF savings plan managed via smartphone. If desired, users pay additional money in, either flexibly, once or regularly. When they retire, they receive the invested money as a payout. A new checking account is not necessary for this, because the card is linked to an existing account.

Presumably, Vantik’s biggest asset lies in controlling the upper part of the value chain: access to users, the Vantik brand, the front-end (app and card), as well as the payments data flow, which opens up more user data and insights than a traditional asset manager would normally receive.

Vantik’s revenue stream is built on “commissions, fees and other monetary payments as well as benefits of monetary value (collectively “benefits”) from investment companies, securities issuing houses or other third parties for investment brokerage, customer support and the provision of the Vantikcard App Platform. These benefits are not to be paid by the customer directly, but are paid to Vantik by the respective partners from their fees. Since these benefits are paid from fees already charged to the customer, no further costs are incurred by the customer.” (Source / Vantik T&Cs). Since Vantik is not owning the underlying infrastructure, the overall revenue potential hence scales with growing customer numbers.

Infrastructure: partner vs. build

All non-differentiating parts of the Vantik value chain are outsourced to third-parties. Looking at Vantik’s infrastructure stack it’s evident that building a presumably simple product, such as a card offering, cashback feature and ETF fund, requires handling several product and infrastructure partners:

- Axxion – fund management

- Donner & Reuschel – custodian bank

- Faros – investments

- BNP Paribas – custody account

- Mastercard – payment rails

- Aion Bank – account provider and card issuer

- Vodeno – Banking-as-a-Service provider

As a general rule, Vantik focuses on the parts of the value chain where it can make a difference and can build a competitive advantage, i.e. the customer relationship and experience built on deep customer insights, a tailored product that is based on customer needs as well as the unique Vantik brand.