In the digital era, successful banks design their brand portfolios around meeting contextual customer needs.

This is the second of two posts on building financial services brands, co-authored with Ross Republic’s brand transformation lead Terry Tyrrell. Read part one here.

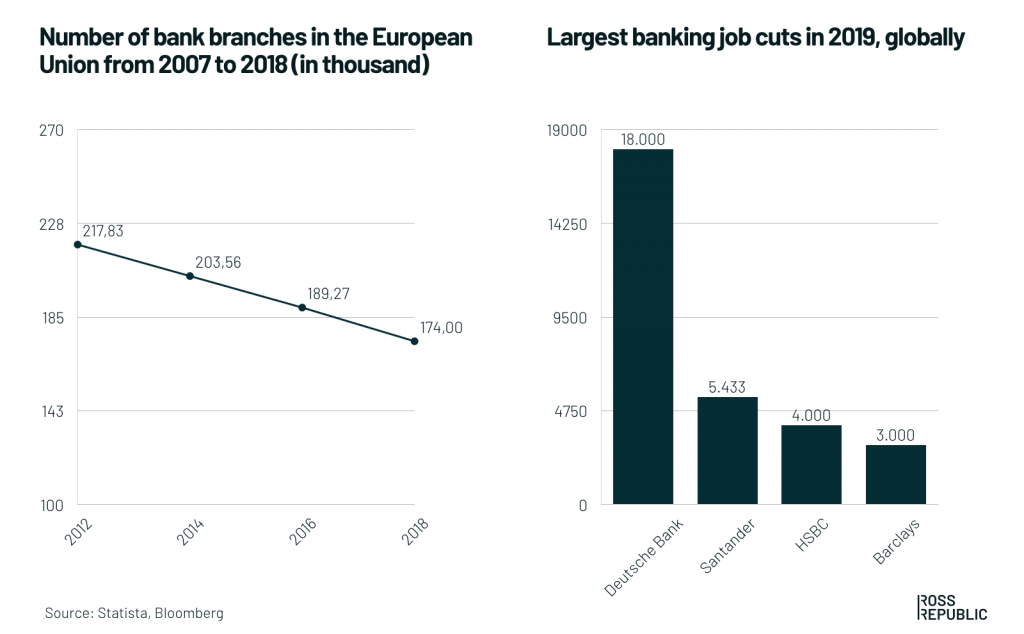

In a move to reflect the new business reality presented in our preceding post, incumbent banks re-allocate their capital from real estate and headcount into:

- backend cloud infrastructure, scalability and process automation

- frontend product innovation, discovery and digital distribution

Decline of reale estate and headcount as a strategic asset in banking. Source: Statista, Bloomberg, Ross Republic analysis

Banking is becoming a technology play. Source: Celent, Ross Republic analysis

Digital accessibility and sales performance replaced real estate and headcount as business success factors. In the digital era, the commoditization of financial products increases. In order to differentiate in the market, financial services providers need new approaches to manage their brands. Specifically, brand portfolios now need to reflect the new market realities.

Managing a financial services brand portfolio in the digital era

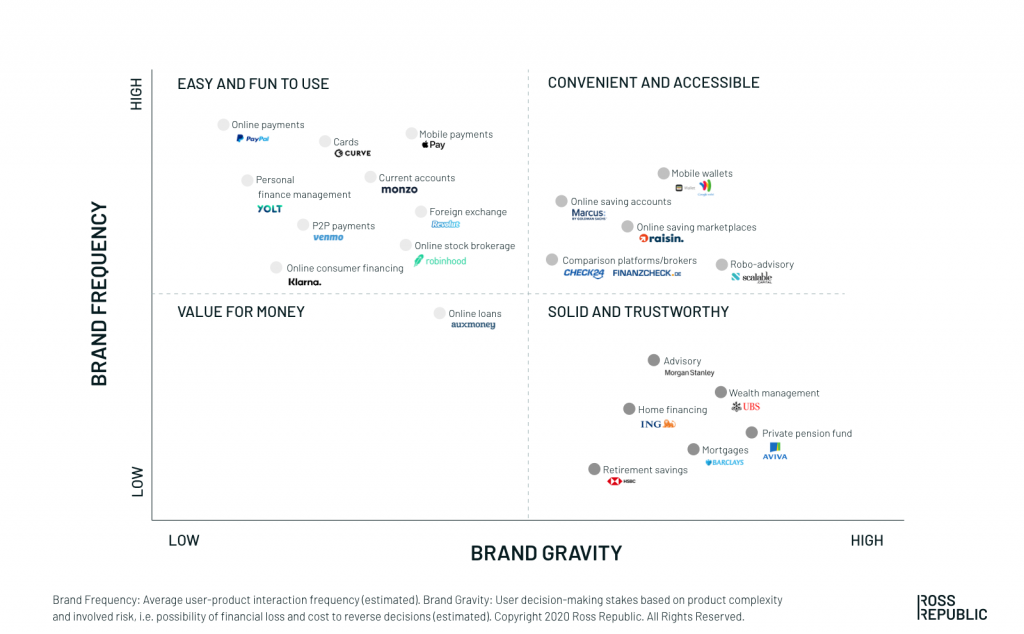

In order to update brand portfolio management to the highly dynamic digital banking era, we mapped out financial services product categories by the frequency of product-user interaction (brand frequency) and the stakes a user takes with the product (brand gravity). Afterwards, we attached the brands of leading financial services providers for each product category.

The resulting infographic visualises low vs. high frequency brands and low vs. high gravity brands. Four main brand territories emerged:

- solid and trustworthy

- value for money

- easy and fun to use

- convenient and accessible

Financial services brands divided by user-product interaction and product stakes. Source: Ross Republic analysis

Brand frequency describes how often a customer interacts with the product. Brand gravity describes the perceived stakes based on product complexity and risk, i.e. the possibility of financial loss and the cost to reverse decisions.

Each brand territory builds on specific requirements for brand success and market segmentation. The incumbent bank brands win in the solid and trustworthy territory exactly for the reasons why they’re losing in the easy and fun to use territory: their brand is built on the foundation of a trusted, risk-averse institution that keeps people’s money safe, which is a key success factor for providing high-stakes products. However, when it comes to winning over the fast-paced easy and fun to use territory, the static and slow incumbent bank brands lack the necessary digital agility and down-to-earth, playful customer experience.

Brand building is a long-term effort that is compounding through consistency. That’s why once a brand has established itself within a brand territory, it’s naturally incentivised to operate within its boundaries. This effect is known as brand permission: As described above, not all customers are willing to give incumbent banks the brand permission for providing lifestyle banking products, such as everyday debit cards. Vice versa, not all new digital challenger bank brands get the brand permission to provide mortgage advisory.

Traditional bank brands offering solid and trustworthy services

The landscape of traditional financial services corporate brands. Typical products are long-term savings accounts or mortgages, i.e. once in a lifetime decisions with high stakes. Such services require customer trust, expert advisory, risk management, a history of excellence and a direct customer relationship. Thus, for high-gravity, low-frequency products, many users still default to the incumbent bank brands.

As trust is a key brand asset in this territory, the established financial institutions are at an advantage. They are highly regulated entities and build on decades of business experience. New challenger fintechs might not have earned customer trust for these product categories yet. However, as their core capability is building user-centric applications and streamlining the usually cumbersome processes of established providers, it’s only a matter of time.

Brand attributes:

- Positioning around trust, psychological safety and service excellence

- Incremental and stable brand evolution, rather than disruption and experimentation

- Culture of risk-aversion, diligence and careful planning

Challenger brands making financial services easy and fun to use

For low-stakes, high-frequency everyday financial products, consumers can psychologically afford to try out newly established, digital-first challenger brands. For instance, there’s little penalty to switch travel debit card providers if something doesn’t work out.

Typical use cases are online or peer-to-peer payments, debit cards and online current accounts. The services launched by successful challenger brands don’t resemble anything like traditional banking products. Rather, they remind of consumer apps like AirBnB or Spotify: superior digital onboarding and customer experience, a clean design and intelligent features that help customers to manage their finances better. Customers prefer legacy-free services that offer easy sign-ups, a slick digital app and a brand that doesn’t speak through a compliance-filtered voice.

Brand attributes:

- Similar to direct-to-consumer brands: bold, fast, transparent, convenient

- Emotional, down-to-earth and human tone-of-voice

- Tailored value proposition focused on a specific user segment

- Culture of fast experimentation and agile development

Digital brands combining convenience and accessibility

The few financial services brands that operate in the high-frequency, but also high-gravity brand segment, merge digital convenience and accessibility with a more mature and reliable brand image. For example, users trust Apple Wallet with storing and processing their credit card information conveniently on their phone. Marcus by Goldman Sachs offers competitive savings accounts online, while leveraging the brand trust of the parent organisation.

Intermediaries are additional brands in this territory: third party online platforms and brokers, such as Check24. These online brands are acting increasingly as gatekeepers for the solid and trustworthy incumbent brands, e.g. by comparing suitable mortgage providers and streamlining the application process.

Brand attributes:

- Building reliability through transparent and seamless digital processes

- Digital convenience

- Often co-branded or endorsed brands that build on existing brand equity

Commodity financial products where value for money is key

Short-term online loans are an example of low-gravity, low-frequency products. These services are sought out for specific use cases, such as a holiday or wedding, and competitive rates as well as a fast transaction is the key differentiator. In a commodity market, the lowest price wins, which is why brand building is limited in this segment.

Banks can increase market coverage with contextual brands

In the digital era, successful financial services providers tailor their brands to the target market segment and the nature of their product portfolio. The frequency-gravity framework shows that offering the full palette of generic financial products for all customer segments is a suboptimal strategy: one-size-fits-all brands will dilute their brand image over time, so they need to define and stick to their territory, build brand equity there and earn the brand permission to innovate within the comfort zone of the brand.

Launching a greenfield proposition or acquiring an existing brand is the right way forward for incumbents that want to play in the high frequency, low gravity brand territory. For instance, ING has launched Yolt, a personal finance management app, which attracted over 500 000 users in the UK. BBVA has launched the new digital brands Azlo for business banking and BBVA Open Platform for banking-as-a-service offerings.

When it comes to the convenient and accessible territory, endorsed brands help to kickstart new offerings in two ways: first, they get instant reach through the known master brand endorsement. Second, they still have enough room to build our their own value proposition that is different enough from the master brand to tap into new segments or markets. When Goldman Sachs launched Marcus by Goldman Sachs as a direct-to-consumer online savings proposition, consumers trusted the offering right away, resulting in $60 billion of customer deposits at the end of 2019.

Assess the status-quo and accelerate your brand transformation

By using the frequency-gravity brand framework, banks can start strategizing the optimal market coverage of their brands. If you would like to assess where your financial organization stands on the path to brand transformation, and where it can go next, connect with us here.

About the author