Thank you for joining the Ross Republic podcast. In our thirty-ninth episode, your host Adrian Klee is joined by Joost Diepenmaat, Co-founder & COO at Moneybird as well as Lars Markull, founder of Embedded Finance Review. In this episode, we discover the benefits of embedded finance for SaaS platforms.

RR Podcast #39

Listen now on Spotify / Apple Podcasts / Google Podcasts

Currently, it’s predominantly the provider-side of Banking-as-a-Service solutions that is pushing the embedded finance narrative. Our aim with this episode is to explore first-hand how leading operators in the European SaaS segment are experiencing the embedded finance trend and how they’re implementing embedded finance solutions. During the episode, Joost, Lars and Adrian explore how the direct integration of financial services by B2B SaaS providers can enhance the overall customer experience, improve automation and generate new revenue streams. Beyond that, critical challenges when integrating business bank accounts and card issuing capabilities are highlighted.

The evolution of banking APIs

To begin with, Joost laid out the journey of Moneybird. The company was founded already in 2008 and evolved from an invoicing tool to a full-stack, integrated accounting platform now serving over 300.000 users across the Netherlands and Belgium. When building Moneybird, Joost mentioned one of the key challenges was to anticipate the seamless integration of banking services within software, as pre-PSD2 it was almost impossible to get private API connections to traditional Dutch banks. After PSD2, many operators realised that the regulatory (PSD2) APIs are not meeting performance standards required by modern SaaS apps. From the start, their vision, as Joost mentioned, was to make banking and bookkeeping a unified digital experience. Ultimately, with the emergence of Banking-as-a-Service APIs, the time was finally right: instead of solely pulling external data, the direct integration of accounts, card issuing and payment features into the accounting platform unlocks completely new levels of user experiences and accounting automation. For instance, an integrated solution enables the seamless reconciliation of bank transactions and respective accounts receivable and payable data.

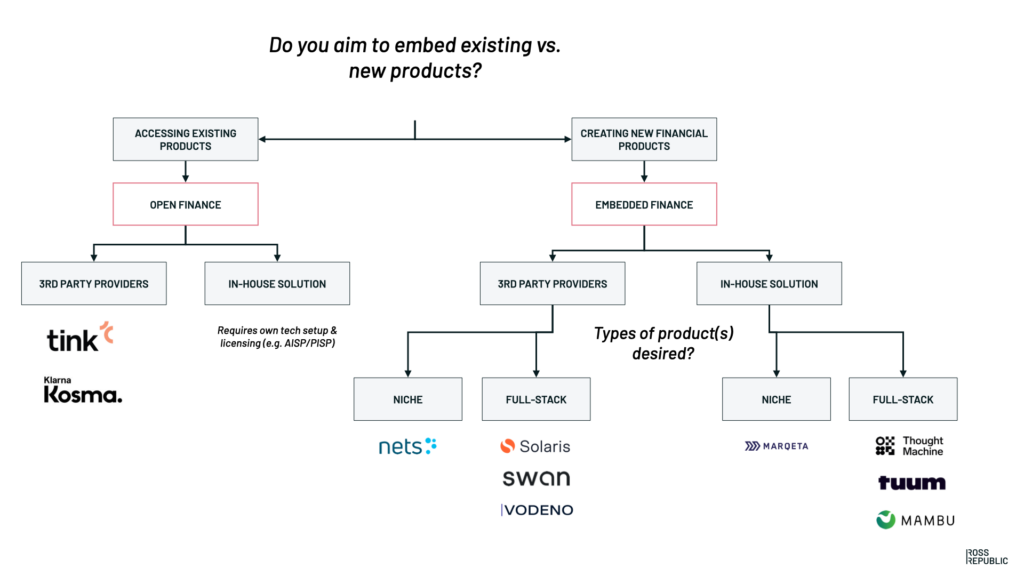

Schematic of embedded finance providers. Source: RR

Challenges when integrating banking APIs

Actualizing this vision was not without challenges. The process involved substantial elements of product design, API implementation, and regulatory compliance, such as handling KYC requirements. Joost stressed that integrating with a Banking-as-a-Service API was not a one-off task, but a continuous one due to constant updates and security measures. Hence, one key success factor that was highlighted is the importance of choosing a trustworthy and established Banking-as-a-Service provider, which continuously improves the underlying services and can offer a whole product suite beyond plain vanilla banking. For software companies contemplating integrating financial services, Joost recommended focusing on the value it adds to the customer experience. He emphasized the project’s complexity, suggesting it be treated as a principal focus endeavor, not a side project.

The power of context

Crucial to the discussion was the understanding that banks lack contextual information about transactions, which software companies often have at their disposal. In essence, banks know ‘what’ is done, but not ‘why.’ Hence, adding banking functionality to a software platform that already possesses transactional context, empowers entrepreneurs with deep financial insights originally unavailable with traditional banking models.

In conclusion, it was clear the merger of banking and accounting via embedded finance, despite initial hurdles, is well underway.