As there’s no commonly used definition of embedded finance, the concept oftentimes creates confusion even among industry professionals. In order to make the jump beyond early adopters and enable stakeholders outside the financial segment to participate, this article provides a holistic definition for the deployment of embedded finance strategies.

Say, you’re operating a large marketplace for used machinery. On the supply side, you’re aggregating manufacturers and vendors of various industrial machines, while on the consumer side you’re making it easy to find and buy the right machine. Your transaction volumes grow nicely over time and you’re wondering how you could further support buyers to afford equipment, while helping vendors to access working capital.

Enter the world of embedded finance. Where to start? Do you first focus on the seller or the buyer on your platform? What kind of products would be relevant to these segments? Even when you decided on the products to launch, do you invest in launching a solution inhouse or partner up with a provider that brings everything out-of-the-box? What about IT integration, customer support, compliance?

There are many entry points to embedded finance and a million aspects to consider in order to get it right. My last blog post – that I’ve updated in the meantime – has not been precise enough to fully portray this complexity. The amazing thing about posting in public is that you attract direct feedback to build on. On LinkedIn, I’ve got a lot of feedback, messages and open comments. Under one post, many users, rightfully, called out that some of the infographics are missing context:

Embedded finance comments. Source: LinkedIn

Mea culpa. However, based on Ross Republic’s learnings from working with leading brands that have successfully entered embedded finance, such as IKEA, Intuit QuickBooks or Candis.io, as well as players that enable embedded finance, such as ING bank, Marqeta, Codat or Tuum, this article dives deeper into the available deployment strategies for integrating financial services as part of a brand’s customer value proposition:

- Defining key terms to navigate embedded finance jargon

- Placing embedded finance providers into context

- Heuristics for choosing the right embedded finance deployment approach

Let’s get into it.

The fifty shades of embedded finance

Embedded finance is an umbrella term to describe the intelligent integration of financial services as an adjacent feature around non-financial propositions. There are many layers to this, so let’s peel the onion one by one. Across our projects at Ross Republic, we’ve been developing strategies that help providers to carve out a unique competitive advantage when integrating a financial service as part of their value proposition. This makes embedded finance part of business model innovation, comprised of finding new value-creating angles within distribution, product performance, process, monetization, brand or customer engagement. That’s why our definition of embedded finance deliberately highlights the importance of not just adding a financial product for the sake of it, but to use it as enabler of new strategic advantages:

Embedded finance is a (typically) non-financial brand seamlessly integrating a financial product as part of its broader customer proposition, leveraging proprietary assets, such as data, processes or channels, to create a radically improved end-customer experience.

What type of non-financial brands use embedded finance? This is an important question, as your available resources and strategic goals determine where to start. As a rule of thumb, established entities that already move large transaction volumes might want to invest in bringing financial services activities in-house to leverage economies of scale. Examples of this would be Zalando or Otto Group founding own licensed financial services units, such as Zalando Payments or Otto Payments respectively, or Intuit Quickbooks using its Intuit Financing Inc. entity to provide loans under QuickBooks Capital. IKEA Group even utilizes a fully licensed bank as part of its portfolio, Ikano Bank, to develop tailored financial products for its customers across markets. This only makes sense if you have a large scale, stable business that justifies investments needed to run an operate financial activities in-house, i.e. gaining additional margins by facilitating transactions or lending, making a financial service a key strategic pillar of your product portfolio or developing truly unique financial services. On the other end of the spectrum there are companies that recognise embedded finance as a mission critical, yet non-core activity. In this case, you might want to build integrated financial features into your products or processes via APIs. Seeking a plug and play, out of the box solution that doesn’t take much time and resources to set up is smart, as it enables to test the business and customer experience impact of integrated financial products to learn and iterate quickly.

The above starting points leave you with two options: Found your own regulated entity and create a tailor-made financial product for your clients, or collaborate with a provider that is specialized in the API-enabled whitelabeling of financial services. On both fronts there’s been a ton of innovation lately: the former ultimately requires a utilizing modern core banking system, while the latter requires teaming up with a Banking-as-a-Service (‘BaaS’) provider.

Modern core banking providers are essentially cloud- and API-first software platforms that financial services providers use for their day-to-day operations. It serves as the central operational nervous system for performing essential functions like processing transactions, managing customer accounts, handling financial data or keeping a ledger. In addition, core banking software also handles important functions such as risk management, compliance with regulatory requirements, and reporting. It ensures that you operate within legal and regulatory frameworks and maintain required data integrity and security. In summary, core banking software providers are the technical operating system of a financial provider that enables them to offer regulated financial products. They don’t come with the financial licensing, such as a credit institution, electronic money institution or payment provider license. It’s on the financial services provider to obtain such licenses separately.

Banking-as-a-Service (‘BaaS’) providers are tech-savvy financial institutions that specialize in whitelabel banking. It’s essentially a regulated financial institution, wrapped around a modern core banking platform that opens up financial services features – think of user onboarding, bank accounts, payments – via APIs to facilitate fast and compliant integrations for their typically non-licensed clients. For instance, BaaS provider Solaris uses for the most part an own-developed modern core banking solution, while SEB Embedded has opted to build on the ThoughtMachine core banking platform. Notably, BaaS providers leverage modern core banking platforms for their own operations. However, in contrast to the software layer that core banking platforms offer, BaaS providers hold the necessary licenses or offer pre-established partnerships with banks in the background to enable their clients to offer financial services in a compliant manner.

In this context it might be important to note that especially the ‘in a compliant manner’ aspect of BaaS recently got a lot of attention by regulators due to increased challenges around keeping the governance, risk and compliance functions robust under the BaaS model. For instance, Berlin-based Solaris has recently been ordered by the German regulator BaFin to require approval before onboarding any new business partners.

Further complicating the matter – have you ever heard of open finance? Open finance describes the concept of opening up access to existing financial products and related data, such as aggregating several existing bank account balances under one view or initiating a transaction from an existing account. Open finance is enabled by a regulatory push for increased competition in the banking sector and enforced by new regulations such as the Payments Service Directive in Europe or Open Banking in the U.K.

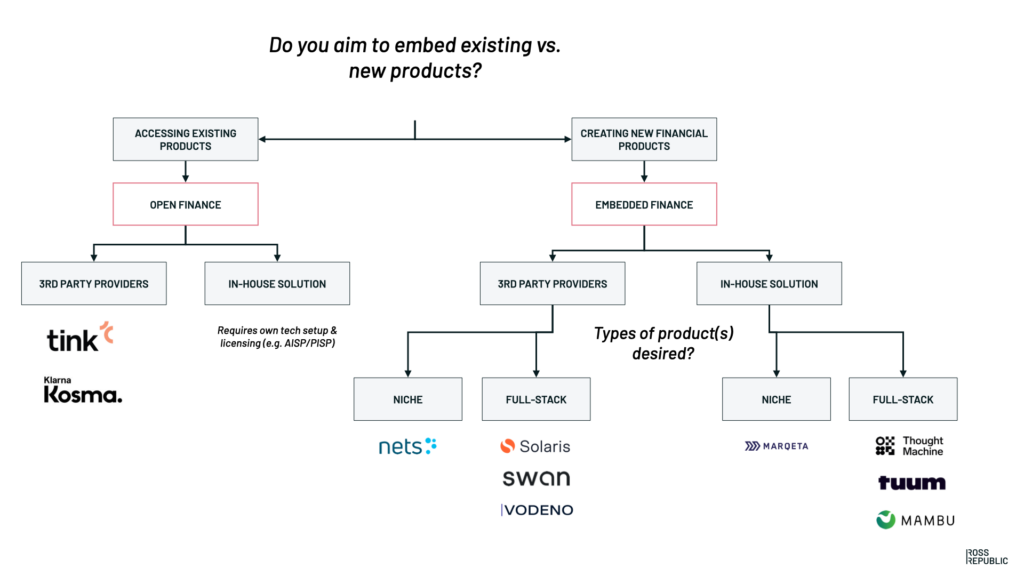

The options above leave you with the following approaches to launch embedded finance offerings:

High-level embedded finance deployment options

Please be aware that the infographic shows a very simplified and high-level decision tree, and therefore cannot replace a thorough analysis of most suitable options for launching an embedded finance solution. Especially the selection of 3rd party providers will depend on the specific products to be launched and the market in question, which would go beyond the possibilities of a simple infographic. The logos shown are non-exhaustive and for illustrative purposes only.

I’m curious to hear your thoughts on this topic. Get in touch with me via LinkedIn or through this form.

About the author