Embedded finance is rapidly gaining traction in the financial services industry. It will have a profound impact on the distribution of financial services, hence this article dives deeper into its benefits and applications.

One of my key hypotheses on the future of financial services is the split between manufacturing and distribution. The former is about the creation of financial products, typically entailing the regulatory foundation and balance sheet provisioning. The latter is about the integration of these products at the right place and time, which requires orchestration and integration capabilities in order to make the financial products contextually relevant for the target audience. Embedded finance is right at the centre of this natural trajectory, as the term typically describes the integration of financial services by brands outside the typical banking channels. However, there’s more to that, as we found while working with both end-consumers, brands as well as suppliers of embedded financial services. Hence, we came up with the following definition of embedded finance:

Embedded finance is a (typically) non-financial brand seamlessly integrating a financial product as part of its broader customer proposition, leveraging proprietary assets, such as data, processes or channels, to create a radically improved end-customer experience.

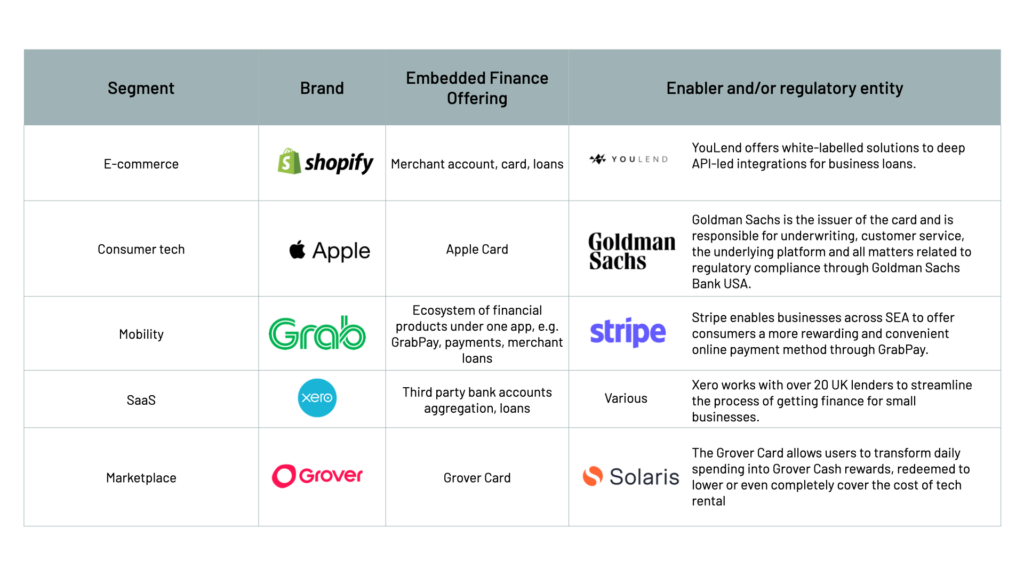

The important difference is that to truly classify as an embedded financial services, it should go beyond a simple referral partnership or integration between a financial service provider and distribution partner. Instead, it’s the intelligent use of alternative data to truly improve the whole service design, on both the customer-facing journeys as well as the backend provisioning of the service, such as improved onboarding or underwriting capabilities. Examples of embedded finance include current accounts, instant payments, lending, and investment products that are neatly integrated into the apps and services of everyday products:

Selected embedded finance benchmarks

Why Embedded Finance is a trend?

Embedded finance is a major trend in the financial services industry, as it allows for more seamless and user-friendly access to financial services.

On the consumer side, both business and retail users are busy engaging with a large variety of apps, platforms and digital service providers on a daily basis. For example, in a study conducted by Ross Republic, we found that the majority of SMEs active in the e-commerce segment actually prefers to get loans via the tools they use to run their business, such as e-commerce marketplaces or payment providers, in case they enable a more seamless customer journey and faster time-to-yes. Embedded finance allows them to access financial services directly through these channels, increasing convenience and efficiency when it comes to managing their finances.

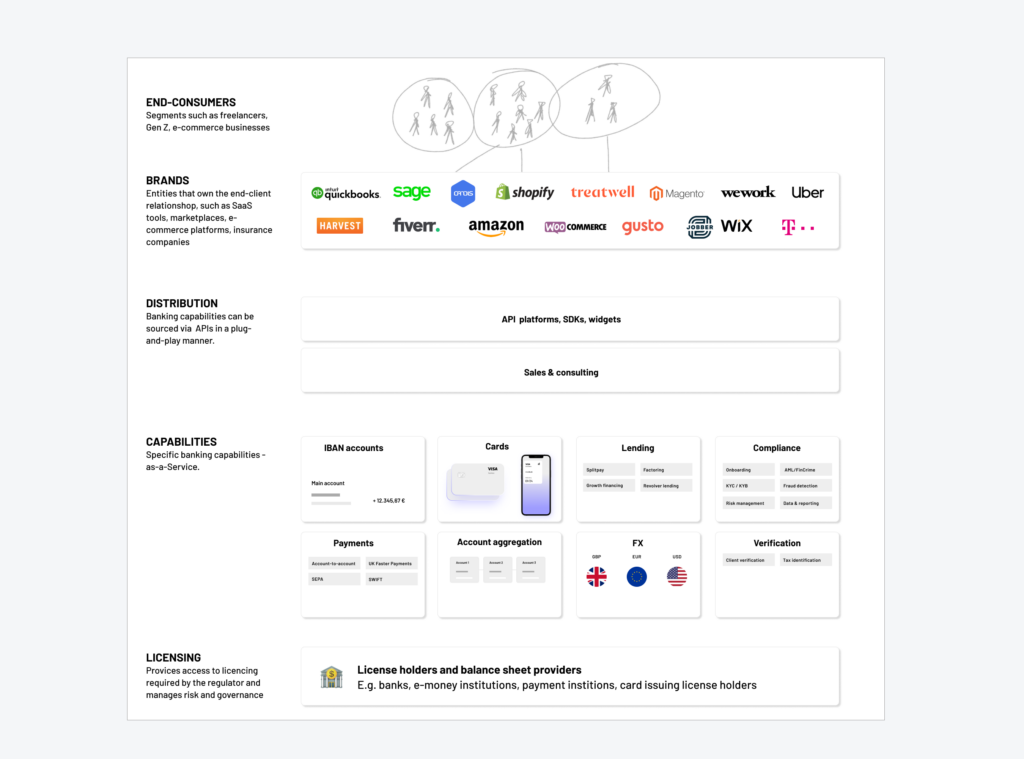

On the distribution side, embedded finance allows banks and financial services providers to both increase their sales interface and offer more personalised services to their customers. Once they have opened up specific financial products or capabilities for external parties, usually via application programming interfaces (APIs), they can allow any third party to integrate their service and often to tailor it to their use case, as they will likely have access to much more data about their customers than a bank could have on its own. This allows them to tailor their services to better meet the needs of their customers. As shown on the diagram below, typically embedded finance providers either focus on remaining in the background as a regulated entity or balance sheet, enabling other service providers or fintechs to compete in embedded finance, or also taking on the role of being the enabler itself by offering integrable services via API platforms and consultations.

Schematic of the embedded finance value chain

Due to the reasons stated above, embedded finance is growing rapidly and has the potential to revolutionise the financial services industry. It allows for more seamless and efficient access to financial services, more personalised user experiences, and the ability to offer a wider variety of financial services that is tailored to the needs of specific segments. Embedded finance could also lead to a more competitive marketplace, as more players will branch out into the financial services industry and be able to offer more competitive pricing and services to their customers by leveraging proprietary data or assets.

Embedded finance market size

The global embedded finance market size is valued differently depending on the source used, however it’s a rapidly growing market. According to our own estimates, around five percent of retail and business transactions can be attributed to embedded finance use cases. Within the next seven years, this number is likely to double or triple due to growing demand by retail and business users who expect seamless financial product experiences (payments, loans, accounts, etc.), increased demand from smaller businesses and retail clients due to economic volatility and the cost of living crisis respectively. At the same time, the elements to drive the distribution of embedded financial services are falling into place as well due to a growing amount of vertical software platforms and the growing scale of fintechs requiring them to branch out to new growth areas, as recently seen with Adyen moving into banking or Checkout.com moving into card issuing. Advancements on the infrastructure layer due to increased upgrades to API-driven and cloud-based core systems will drive the adoption of embedded finance use cases as well. Lastly, there’s an increased willingness of incumbents to collaborate with other platforms, as seen in the deal between Goldman Sachs and Apple.

What are the advantages of embedded finance?

Embedded finance can fuel growth, enhance customer experiences and loyalty and generate an additional revenue stream:

- Increased accessibility: Embedded finance provides users with frictionless access to financial services from within their existing applications, removing the need for customers to move between multiple applications. This makes financial services more accessible to a wider range of customers, including those who may have previously lacked access due to a lack of knowledge or convenience.

- Improved customer experience and loyalty: Embedded finance allows customers to access a broad range of financial services quickly and conveniently, without the need to switch between multiple applications. This can lead to a more seamless and enjoyable customer experience. Additionally, financial services are typically a very sticky product, e.g. due to lock-in effects of recurring loan repayments or cashback deals.

- Increased revenue: By integrating financial services into their existing applications, businesses can increase their revenue by receiving a revenue share from their embedded finance partner or a higher revenue per user due to direct monetisation. Benchmarks have shown that embedded finance can increase purchase sizes by fifty percent and increase purchase frequency by twenty percent. Such new revenue streams can also lead to more sustainable business models as income from financial services can cross-finance other, less profitable service lines.

- Improved security: By leveraging existing infrastructure and security protocols, businesses can reduce the risk of security breaches and protect user data.

- Cost savings: For some businesses, relying on fully outsourced financial services can become costly with increasing scale, as mentioned in our recent podcast with SEB Embedded. By removing the need for businesses to fully outsource financial services process and instead bring them closer in-house with the help of embedded finance partners, embedded finance can help reduce operational costs.

Embedded Banking

Embedded banking is usually referred as integrating current or savings accounts that are integrated into a third-party platform. This type of banking service allows users to store money inside these third-party providers and gain further access to a variety of financial services, such as deposits, payments, loans, investments, and money transfers, without the need to leave the platform. Embedded banking is especially useful for e-commerce platforms or telcos.

Embedded Lending

Embedded lending can be used in both B2B and B2C settings to facilitate an easy and convenient way to purchase goods at the point of sale or to increase access to working capital. In the context of POS lending, it typically involves a loan provided by a lender that is directly embedded within the purchase process, allowing customers to pay for their purchases over time rather than all at once. Typically, such lending products can increase conversion by seven percent for interest-free offerings and increase purchase frequency by over twenty percent. This type of splitpay or buy-now-pay-later financing is becoming increasingly popular as it allows merchants to offer customers a more attractive payment option, increasing both sales and customer satisfaction.

Embedded investments

Up to twenty percent of assets under management inflows could be generated by embedded investment channels, which makes them strategically relevant for asset managers or investment providers that wan to position themselves for the future. Embedded investments typically involve the integration of stock brokerage or ETF savings plans into services that have access to money inflows from retail clients, such as HR tools or payment providers. Such providers have access to data that in turn allows the embedded investment partner to improve customer risk assessments and improve overall customer experiences, e.g. by automating investment flows based on contextual triggers.

What is an embedded finance platform?

An embedded finance platform is provider that enables companies to offer financial services in an integrated manner, i.e. as a seamless part of their overall value proposition. This type of platform typically consists of a suite of application programming interfaces (APIs), software development kits (SDKs), and other tools like embeddable widgets that allow companies to easily integrate financial services into their existing product or service offerings. These financial services can include payments, money transfers, investments, and more.

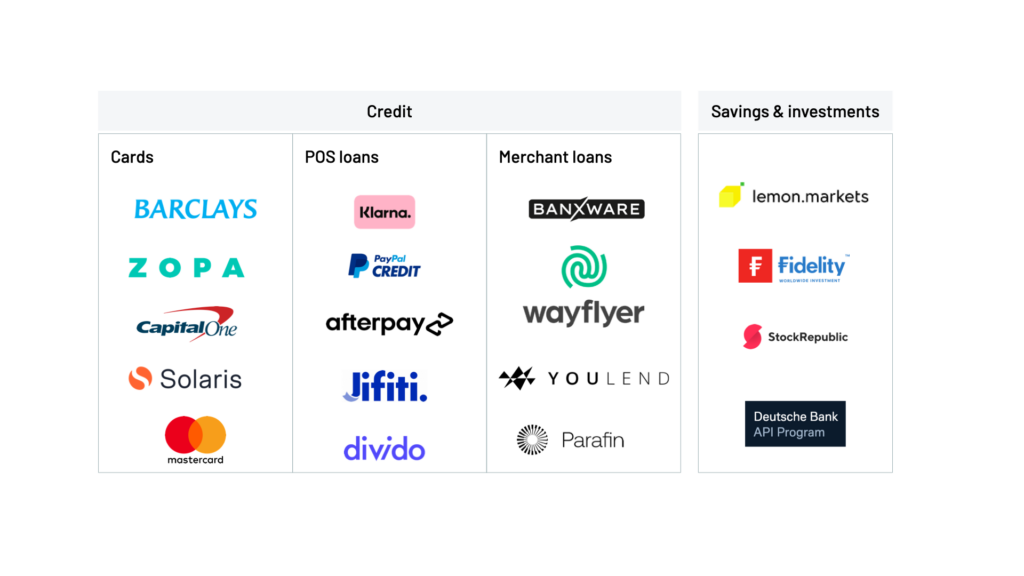

Segmentation of embedded finance providers (non-exhaustive)

Embedded finance platforms are designed to make it easier for companies to offer financial services to their customers without the need to develop and maintain their own infrastructure. By leveraging an embedded finance platform, companies can reduce their operational costs, speed up the time to market for new financial products, and provide a better customer experience.

Embedded finance vs. Banking-as-a-Service

Embedded finance is often mentioned in the context of Banking-as-a-Service (BaaS), which is a type of provider that specialised in the provision of banking services in a B2B2X mode. Thus, many embedded finance use cases are enabled by BaaS providers, as brands outside of the banking domain typically don’t have the internal resources, know-how or strategic appetite to bring financial services in-house.

At the moment, the BaaS segment is highly fragment, with various providers that offer specific banking products in unique ways. Hence, it is especially important for brands outside the financial services sector to first get an overview of embedded finance deployment strategies and the related vendor landscape. In our whitepaper with Tuum, we previously segmented the market according to licensed vs. not licensed providers and their functional scope:

Segmentation of embedded finance providers

Embedded finance is highly relevant for both brands that want to gain a new, sticky revenue stream as well as financial services providers that want to extend their reach beyond own channels. Get in touch with us today to explore how embedded finance provides an opportunity for growth and innovation.

About the author