Business lending is at an inflection point that separates leaders from laggards, driven by rapid advancements in lending infrastructure, data and distribution. In our latest report, we break down our key observations on the future of business lending and how lenders can tap into emerging business growth opportunities.

Recently, the venture capital firm Activant concluded that the ‘great white whale’ opportunity in fintech is in B2B due to larger sales transactions and mission-critical purchases “for which financing is not an option, but a fundamental requirement.” I fully agree with the view that the B2B segment is currently a frontier of innovation, especially for fintech lending. After having ideated and developed a new venture within the digital business lending segment for a major Dutch banking institution, we decided to distill our key observations and hypotheses in a new report titled “Leaders renovate in winter: Utilizing the current downturn to build next-generation business lending services”.

Our latest Lending whitepaper

The report is built around three main themes:

- Representing a substantial portion of the EU business landscape, SMEs are both resilient and increasingly underserved, signifying a massive untapped market for innovative lending solutions.

- New-era lenders now go all-in on automation, data utilization and product innovation. Underpinned by these trends, three distinct business models emerge as winners: digital lenders, orchestrators and Lending-as-a-Service models.

- Structural shifts towards embedded finance, sustainability and AI will further impact lender’s ability to remain competitive.

With the convergence of tech and finance, the report outlines a roadmap for lenders to seize these opportunities. It discusses the role of data-driven decision-making, agile credit policies, back office automation and the emergence of tailored financial products, as well as the strategic shifts necessary to thrive in this evolving market. It’s an essential read for banks, fintechs, and investors looking to navigate and capitalize on these changes.

Get in touch with us here to receive your copy.

Analyzing the evolving business lending market

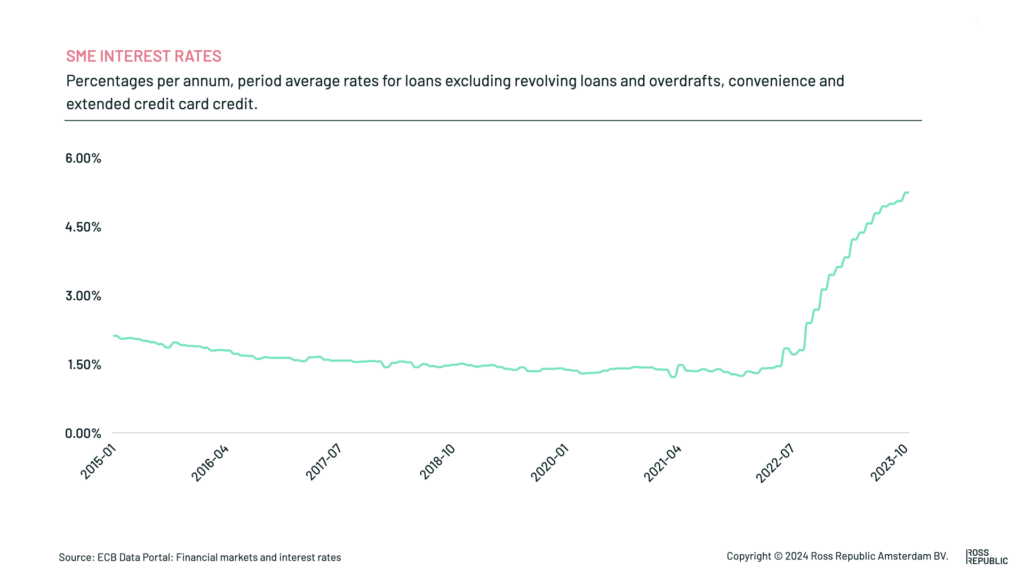

A paradigm shift is unfolding in European SME financing: both the supply and demand for loans are simultaneously contracting. It’s a unique occurrence that uncovers structural challenges in the European financial landscape: Out of all macro developments covered in our report, the increase in interest rates has been the most significant barrier in access to funding particularly for SMEs due to their smaller capital base and higher risk profiles. This leads to a widening SME funding gap, i.e. the situation in which the market is not able to supply a sufficient amount of external financing to SMEs. We found that this applies especially to asset-light businesses (think: e- software, marketplaces) or businesses with challenging cash conversion cycles (e-com). While these segments are growing fast and represent attractive target groups for lenders, they often cannot obtain the necessary financing from the regular system of financial intermediation.

SME interest rates

Simultaneously, business lending has become a distribution, data and automation play, which requires a revolution rather than evolution of established lending approaches. How can lenders evolve to profitably lend to SMEs in this new era?

Key trends shaping business lending in 2024

Over the past decade, SME digital lending has significantly evolved within lending business models, marked by three major phases of innovation. Initially, Fintech lenders created a vastly more efficient playbook for originating small business loans. Distribution was done cheaply via online platforms or marketplaces and applicants were serviced efficiently by utilising data-driven risk models and eligibility (pre-)decisioning . More recently, embedded lending by non-financial platforms has streamlined the underwriting process, making it more efficient by utilizing proprietary data for financial decisions. Currently, the industry sees a diversification into three business model innovations, reflecting a strategic shift towards efficiency and customer-centric solutions in small business financing:

- Fully digital lender: continuous optimization of the fintech lending model

- Orchestrator: utilizing composable banking to orchestrate a combination of own and 3rd party lending products

- Lending-as-a-Service: The “Stripe for SME lending”

While it’s easy to draw up new lending business models from scratch, in reality most lenders are already active in the market and are battling their own unique challenges. Most business model transformations start from very unique point of departures and their progression is often hampered by variables such as cost of capital, legacy technology or tech debt, which can decelerate business model shifts. Yet, all things being equal, we believe the three outlined core SME lending business models will outperform any other less differentiated competitor.

Digital transformation in lending

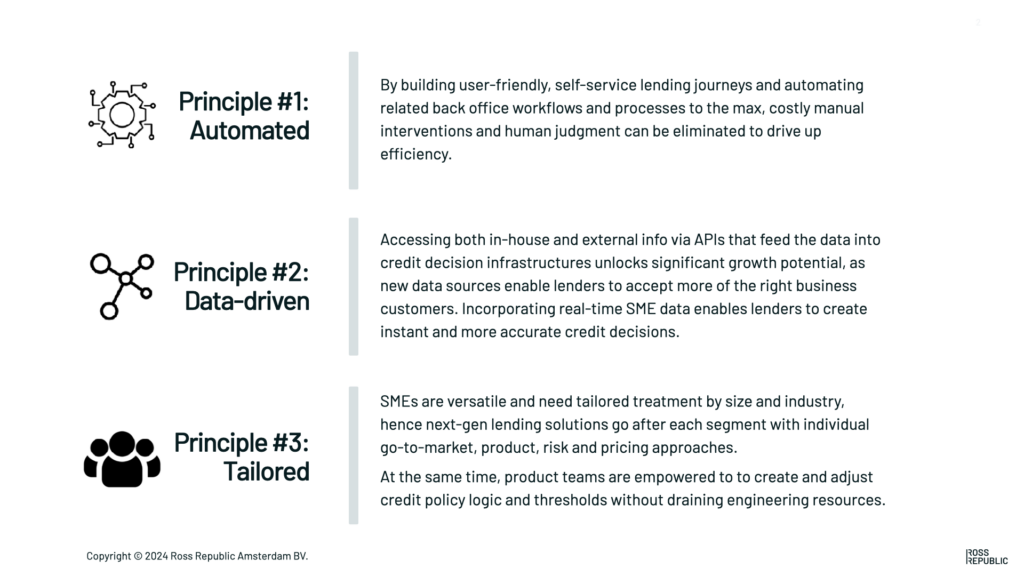

A recurring theme is the rise of data-driven lending solutions. In the report, we outline three key principles that have an outsized impact on lending practices: automation, data-driven decision-making and tailored solutions. Automating lending journeys and back-office workflows to eliminate manual processes and improve efficiency is a key success factor to lift unit economics. Data-driven strategies are just as pivotal, as APIs allow to integrate both in-house and external information into credit decision infrastructures, enabling real-time, accurate credit assessments. Lastly, next-generation lenders will go all-in on customized lending solutions that can fully address the specific needs of their target SME segments. A key part of offering tailored lending solutions is the agile adaption of credit policies by product or sector teams without overtaxing internal engineering resources.

Key lending principles

In the paper, we outline how the three principles can be leveraged to find new growth opportunities in business lending. Get in touch here to receive full access to our business lending report.

Identifying growth opportunities in business lending

Next to the three key SME lending business models and underlying tech developments, our report details out three overarching themes that any lender should have on top of mind: embedded lending, sustainable lending and the application of artificial intelligence and machine learning on lending use cases.

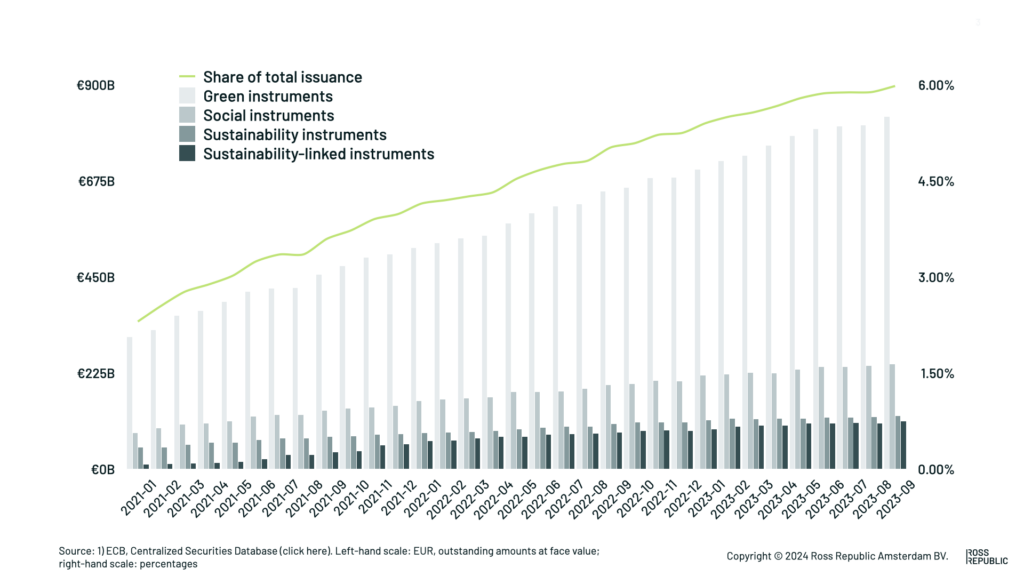

For instance, related to sustainable lending we recognize ESG-linked lending as a hypertrend that unlocks an opportunity to be positioned as ESG leader by increasing access of sustainable finance. From a regulatory point of view, the entire regulatory environment around ESG is shaping the way financial institutions approach lending, with an emphasis on sustainability and long-term resilience. The EU’s current and upcoming regulatory frameworks, such as the EU Taxonomy, Non-Financial Reporting Disclosure (NFRD), Corporate Sustainability Reporting Directive (CSRD), and the Sustainable Finance Disclosure Regulation (SFDR), indirectly influence business lending by setting standards for what is considered sustainable and by requiring disclosures related to sustainability.

Share of ESG-related instruments

From a demand point of view, lenders in the SME segment are positioned to lead in Environmental, Social, and Governance (ESG) by facilitating better access to sustainable finance. While SMEs face financial constraints, the growth of ESG-related financial instruments offers a new pathway. Although still a small portion of the EU debt market, sustainable debt securities have shown a significant rise, doubling in issuance over the last two years (see infographic). Approximately 60% of EU SMEs are investing in sustainability, with smaller companies increasingly utilizing external financing for these investments. Moreover, the impact of climate change on businesses has been acknowledged by over half of EU SMEs, leading to a greater emphasis on sustainable practices which can enhance their business performance and resilience.

Navigating the business lending landscape

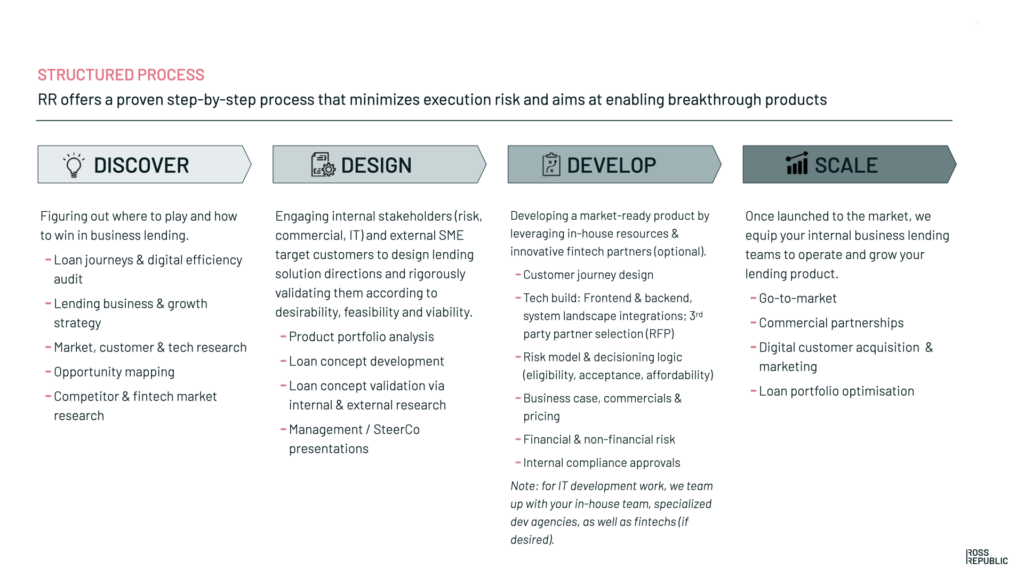

Instead of getting stuck in optimizing legacy approaches, let’s rethink SME lending from first principles. At Ross Republic, we’re consulting fintechs as well as large banking groups to find answers to the question: Using latest technical advancements, what does an optimal SME lending process look like? For instance, in one of our projects, we ideated a tailored SME lending product from scratch, leveraging the key trends of embedded finance, automation and data-driven decisioning. The product is now on track to deliver a significant new income stream by addressing previously untapped SME target groups.

Based on similar client projects, we’ve designed a structured process that helps to ideate, build and scale new lending products:

Loan development process

Get in touch here to receive your copy of the business lending report and to explore how we can work together.

About the author