This is the second blog post about our new financial services whitepaper. While the first one covers the importance of product portfolio innovation, this one explores how to deliver three-dimensional portfolios through omni-channel customer journeys. If you’re interested, grab your copy of the whitepaper at the end of this article.

Horizontal and vertical distribution

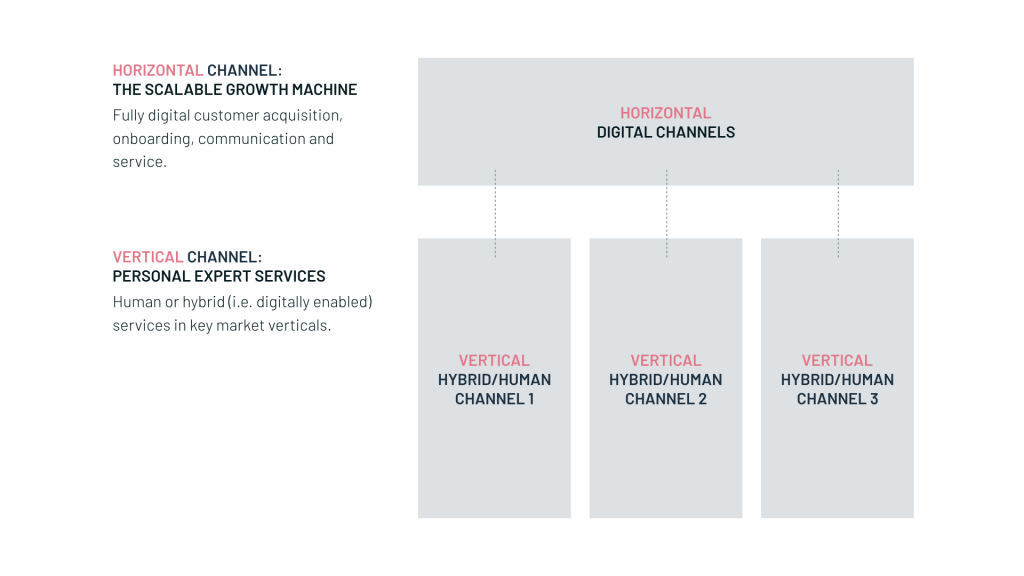

After re-designing the product portfolio (and products) according to the three dimensions (digital-first, human-first and hybrid), the next logical step is to think about how these products are actually delivered to different target groups. While digital channels win the top of the funnel, human interactions can address the steps underneath and are therefore still very important for closing sales and advising customers for more complex financial needs.

There are two distinct approaches: horizontal channels for (digital) scalability and vertical channels for differentiation on service level. Both need to be orchestrated to ensure frictionless customer journeys, and therefore increase sales. However, with new technology stacks and digital marketing possibilities, it’s already clear that the horizontal digital channels are table-stakes to survive in banking. A common benchmark is e.g. BBVA, who generates over half of its total group sales over digital channels, which saves costs and increases reachability of new target groups.

Horizontal – building efficient digital service and product channels

How to reach the right audiences and to offer frictionless banking experiences

The horizontal channel covers all fully scalable digital marketing and communication channels. After redesigning the product portfolio across the three dimensions, offerings should be delivered through efficient end-to-end digital channels that are optimised for conversion. Especially financial services providers can leverage their high volumes of customer data for better targeting, performance and conversion optimisation. Beyond that, horizontal channels can contribute much more than just being efficient conversion channels, such as refreshing the brand, removing barriers to buy or increasing the ROI of digital products. On the backend side, horizontal channels allow to scale digital modular platforms, as for example in the case of BBVA.

Platform-driven architecture utilising open interfaces/APIs and passporting allows to develop standardised, horizontally distributed product lines that are digitally native and tap into broad customer segments. Such low-barrier entry products (current accounts, account aggregations, integrations with 3rd parties from non-financial segments) are efficiently delivered online and increase the overall reach of the bank.

Vertical – differentiating hybrid and human channels

Complex and specialised financial products are best delivered through human or hybrid interactions. The use of big data and artificial intelligence (AI) will radically enhance, not replace, such interactions with customers. Beyond that, modern branch concepts or remote specialists utilising online conferencing tools will further increase the convenience of vertical channels.

Building contextual and adaptive services on top of digital product platforms

Still, more than 60% of primary bank customers claim proximity to bank branches are important. The low churn rates of legacy banks confirm that primary bank customers are not yet ready to switch fully to the fintechs. However, even though most clients still stick with their legacy banking providers, many also try out various banking products from other providers that offer better rates or features. While these customers can be retained by offering attractive digital products, specifically the services that depend on relationships and proprietary insights can become a key competitive advantage for banks that build out such vertical hybrid channels.

Enhancing advisory with AI and Big Data

Future hybrid and human advisory services will still largely depend on human experts. However, artificial intelligence (AI) and Big Data offers the opportunity to collect data across channels and automate routine activities so that financial advisors can concentrate on the actual advisory.

In order to succeed with vertical channels, financial services providers need to ensure:

- Data sharing: make customer insights internally available across channels (e.g. between banking app and branches), enabled by tracking and data lakes

- Modern technology setup: the tools and technology needed to deliver exceptional services

- Accessible human experts: personalised, expert services should not only be available at the branch, but also remotely accessible through modern conferencing tools (video chats, screen sharing)

Key questions to get started with creating smart omni- channel customer journeys

- How can digital offerings be scaled and efficiently distributed as entry-level products?

- How can offerings be differentiated in a digital environment? How to avoid commoditisation?

- How to create a cross-channel, modular journey that makes the best use of digital and human channels?

- How to increase cross-selling between categories?

About the author