New technologies and digitalisation are next to regulation and compliance a top priority for many financial institutions. However, digitalisation in banking is not about becoming digital. It’s about growth. In our new financial services whitepaper we have outlined how financial institutions can boost their top-line growth through product portfolio innovation and cross-channel customer journeys fit for the digital age.

This post covers the former topic of product portfolio innovation. If you’re interested, grab your copy of the whitepaper at the end of this article.

Financial services is under disruption

The financial services industry is undergoing tremendous change: new technologies and changing customer expectations, coupled with increasing regulatory burdens and compliance make it ever more difficult to compete on healthy margins. Much has been written about the technological shifts in banking, however most of the discussions miss the point: banks need to stop pondering about digital and begin leveraging their assets and know-how in different ways, enabled, not defined, by digital.

Focus on the revenue-generating digitalisation initiatives

While efficiency gains and IT modernisations are necessary to be able compete in the banking ecosystems of the future, the actual returns often take a long time to materialise. According to latest research, banks have spent $1 trillion globally between 2015 and 2018 on their digital transformation, with very limited effects on revenue growth. Thus, it’s ever more important to focus digitalisation initiatives on the commercial side: uncovering new markets and value propositions, products and services, intelligent monetisation models and engaging experiences that customers trust.

That’s why in our new whitepaper we explored how financial institutions can boost their top-line results by rethinking their approach to product portfolio management. These are the revenue-generating and customer-facing innovations that can really make an impact on how the bank develops and distributes financial products in the digital age.

“Financial services organisations can avoid disruption if they now start adapting their core capabilities to the new requirements of the market: agile, customer-first, digitally enabled.” – Tintti Sarola, Founder and CEO of Ross Republic

Three-dimensional product platforms

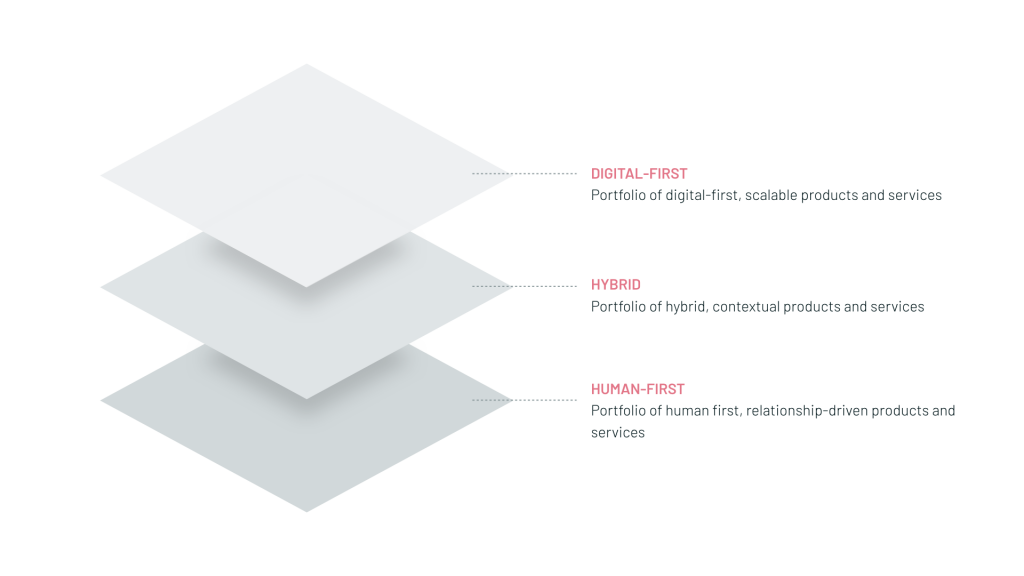

Boosting top-line growth by combining digital, hybrid and human interfaces.

Banks have accumulated legacy product portfolios that on the one hand generate a lot of tech debt and burdensome IT maintenance and on the other hand don’t contribute to revenue growth. A typical portfolio consists of 150+ products, however most of them are neither phased out on a lifecycle logic nor are they needed by most customers, who on average only use 2-3 products.

Based on our experience working on growth strategies with fintechs and digitalisation projects with more traditional banks, we created a new framework that helps to streamline and upgrade legacy product portfolios for the digital age. Digital product portfolio management is fundamentally about acquiring more customers and earning more with existing ones. This can only be done by rethinking which products can and should be fully digitalised and which ones will be delivered through human interaction.

Beyond that, the digital imperative is to turn the established product-centric view on its head and start with the customer: developing a streamlined and modular product portfolio that is centered around actual client needs and their willingness-to-pay will also make cross-and up-selling easier and help to avoid accumulating products that no one cares about.

The framework allows to build the portfolio around customer needs of individual target groups as well as new technological possibilities: digital-first, human-first and a smart combination of both (hybrid services).

- digital-first product platforms that can be scaled efficiently, enabled by cloud technologies, APIs and digital distribution channels

- hybrid products (human and digital) that are highly contextual, personalised and adaptive, enabled by advanced data analytics and AI

- human-first products and services that will be delivered in key market segments through experts, enabled by virtual remote services

Building such a modular product portfolio allows to redesign individual financial products around digital, hybrid and human layers. It also shows that there is a lot of potential in fully digitalising a large percentage of financial products, while relationship- and knowledge-intensive services benefit from hybrid or human-first interactions.

Developing financial services across three dimensions

By developing the product portfolio across the three dimensions, banks can generate substantial operational efficiencies due to scalable cloud platforms, fewer products, streamlined processes and reduced physical footprints. At the same time, customer journeys become more coherent and frictionless.

The crucial shift in this reconfiguration is the customer-centricity: products can be built, adapted and delivered according to general target customer needs (low-intent, best delivered through digital) as well as specific market demands (high-involvement, best delivered through hybrid models).

Key questions to get started with product portfolio innovation

- How might the product portfolio be designed around customer needs and willingness-to-pay?

- How to reconfigure products and revenue models to compensate declining net interest and fee income?

- What are quick-wins that can improve the current offering without long IT lead times?

- How to manage API risks and gain opportunities from open banking and PSD2?

About the author