Goldman Sachs makes a big bet on digital services, Visa fortifies its network of networks strategy and BBVA sells chocolate on Amazon.

Our monthly commentary and curation of market signals within the fintech and banking industry. We filter out the noise and present ideas that shape the next generation of financial services.

Goldman Sachs focuses on digital consumer banking and banking-as-a-service for future growth

Goldman Sachs: Investor Day 2020

On Wednesday, 29th of February, the bank held its first investor day to lay out its 263 page long vision for its digital future.

Most noteworthy is that the investment bank will double down on digital consumer banking, which is a direct competitive move against established retail banks.

The firm launched its greenfield digital proposition, Marcus by Goldman Sachs, in 2016. So far, the offering covered online savings accounts, loans and a credit card that was co-branded together with Apple.

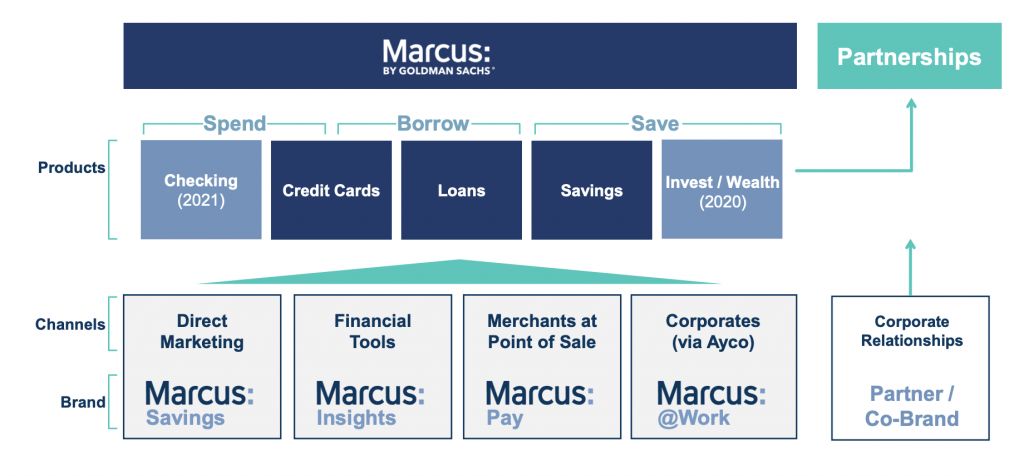

The investor day underpinned the firm’s big bet on Marcus, as it laid out its plans to offer offer additional financial products under the brand. Moreover, the Marcus brand will act as a platform for other companies’ products and services:

Product strategy for Marcus by Goldman Sachs. Source: Goldman Sachs

What started out with a very narrow beachhead, online savings accounts, is going to evolve into a one-stop shop for digital banking services that covers spending, borrowing and saving.

Leveraging one of the most well-respected brands in finance and starting out legacy-free, Goldman Sachs has strong potential to build up a competitive digital consumer division on global scale over the next years. Recent surveys confirm that in the US, Marcus already has the potential to become the 5th largest bank.

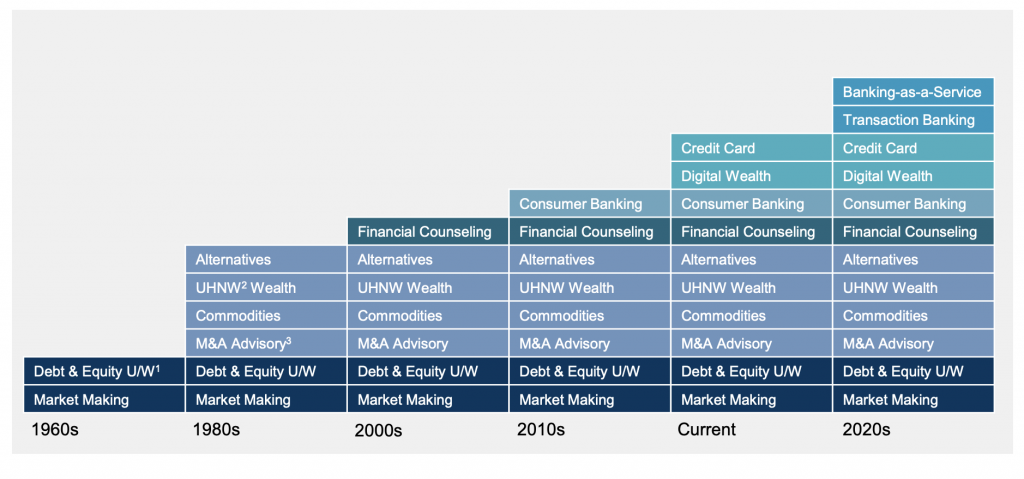

Apart from its strong push in consumer banking, Goldman indicated plans to add banking-as-a-Service (BaaS) to its services in 2020:

Evolution of Goldman Sachs’ business lines. Source: Goldman Sachs

Building on modern technological infrastructure is a necessity for digital innovation and becoming part of digital ecosystems, i.e. for the future of any financial services provider. That’s why BaaS is a very attractive future growth segment, however a specialised cloud service leader for financial institutions hasn’t emerged yet.

By spinning off its own core technologies and selling it as a service to other firms, Goldman Sachs could fill this niche and add another lucrative layer on top of its revenue stack. The company already has extensive experience in running complex trading platforms at scale, thus it has the competitive advantage to create the Amazon Web Services (AWS) of finance.

In a nutshell, Goldman Sachs is shedding the heavy reliance on its trading and investment banking legacy focus. It never managed to generate pre-crisis profits and its stock performs poorly compared to major rivals. Thus, continuing business as usual is not an option anymore, a fate that many traditional financial services firms face.

The success factors for Goldman Sachs are clear:

- Leveraging existing global brand equity to branch out into new consumer banking services

- Building these new services in a legacy-free, greenfield environment (new division, new technology, new incentives)

Building consumer trust remains a challenge for mobile-first banking services

The Telegraph: Revolut could face lawsuit from customers locked out of their accounts

The aggressive growth of Europe’s mobile-first banks, such as Revolut and Monzo, is a heavy stress-test for their customer success and compliance departments. Monzo adds around 200 000 active users every month, which is necessary to keep investors happy, however it also requires to scale operational processes and structures.

Most fintech companies are pushed to the edge of their capabilities, such as N26, which has been probed by the German regulators about fraudulent transactions and shortcomings in customer communications last year. This month, the Telegraph broke a story about several (ex-)customers that have teamed up to potentially sue Revolut over its account freezing practices. Apparently, some users have been waiting up to eight months to get their money back that was stuck in their Revolut accounts.

This incident shows how hard it is to scale a consumer-facing financial service when regulatory and risk requirements (anti money laundering, security checks), investor expectations (hyper-growth), and end-customer expectations (transparent service, fast response times) clash together.

Increasingly, neobanks need to prove that they can not only acquire a lot of customers, but also turn a profit. This can only work if they can give customers enough reasons to use their digital accounts as primary accounts and become highly active users. Building trust plays a crucial role here, as no one wants to deal with the false negatives described above. Not reaching a real person on the other end of the phone, when a timely solution is needed, definitely destroys any trust in new neobanks.

Visa acquires Plaid in a smart bet on banking-as-a-service

TechCrunch: Visa is acquiring Plaid for $5.3 billion, 2x its final private valuation

Visa is the world’s leader in digital payments, processing around 65 000 transaction messages per second around the world. By connecting issuing banks to acquiring banks it ensures that e.g. a Chase merchant gets paid when a customer pays for a coffee with a credit card.

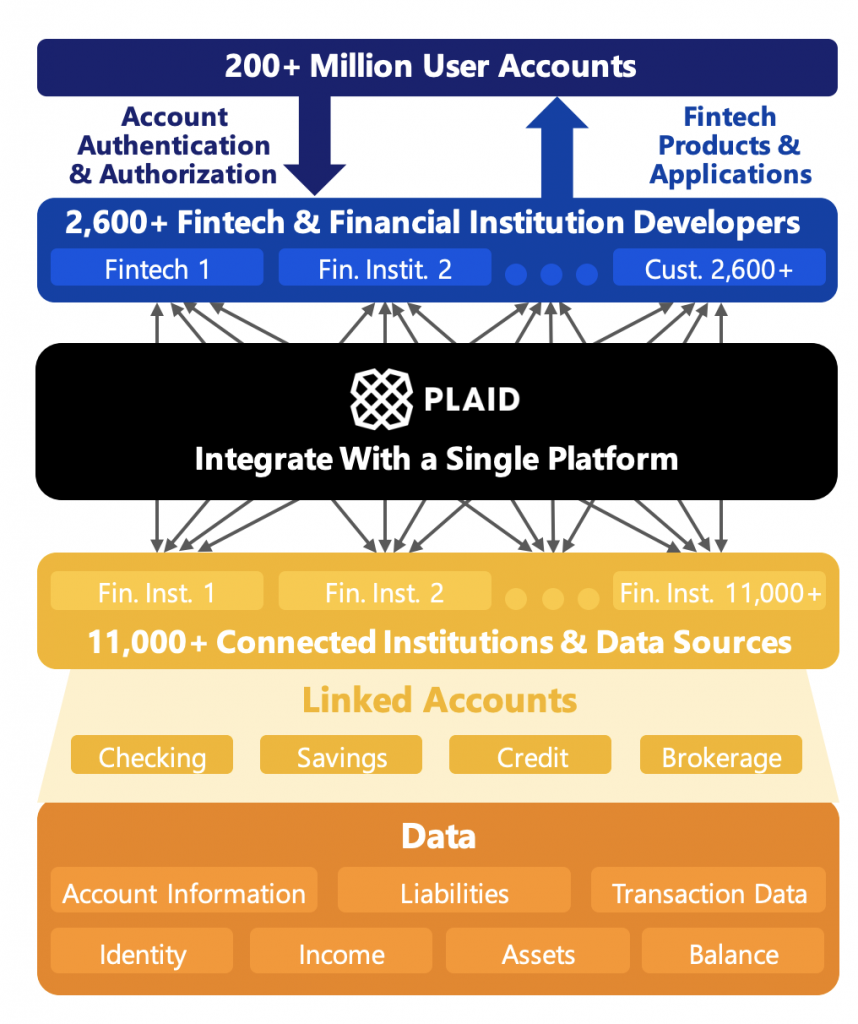

Plaid in contrast is one of the biggest networks enabling the open era of banking. The service lets third party developers and fintech companies connect to bank accounts. In the absence of a regulatory-driven open banking agenda as in Europe, the banking landscape in the US is highly fragmented. Any new service that builds on top of banking data needs to go through Plaid. Visa explained this model based on Plaid’s current numbers in the post-acquisition event presentation:

Plaid enables developers to access banking data easily. Source: Visa

For Visa the acquisition of Plaid is thus a smart bet on the open finance hypothesis, which claims that in the future any brand will become a banking-like entity by seamlessly embedding financial services.

BBVA now sells chocolate and tote bags on Amazon. Are financial products next in line?

BBVA: BBVA, together with El Celler de Can Roca, launches product sales on Amazon

In a recent press release, BBVA announced to join renowned Spanish restaurant El Celler de Can Roca in selling a selection of products on Amazon. For now, customers can purchase aprons, tote bags, and chocolate. The bank indicated that it uses the project as an e-commerce learning experience and explores offering banking products on the platform.

While Amazon is currently not selling financial services directly on its platform, BBVA mentioned that financial institutions have to adapt to this way of selling. According to BBVA, it’s a pilot project aimed at boosting digital sales:

“This approach also provides BBVA with a pilot project where it can trial the functionality of the world’s largest e-commerce portal, paving the way for the bank to offer other types of financial products in the future. Currently BBVA already sells close to 60 percent of its products over digital channels. Selling through Amazon would extend online sales opportunities, complementing the bank’s proprietary digital channels.”

Exploring and finding new distribution channels and platforms is crucial for retail banks to reach customers effectively. Using Amazon’s distribution power makes sense in theory, however without specifics it’s difficult to predict if this model will benefit Amazon or the participating banks. With Amazon’s history of copying the most successful product lines and offering them under their own brand, it might be a risky partnership.

About the author