Our monthly commentary and curation of market signals within the fintech and banking industry. We filter out the noise and present ideas that shape the next generation of financial services.

Move fast and break things? How to destroy trust in banking.

Quartz: Wall Street regulators will investigate whether Apple’s credit card is sexist

Last month the big tech’s foray into banking was covered widely. Now Apple is already under scrutiny from regulators for its credit scoring algorithm. Entrepreneur David Heinemeier Hansson discovered an allegedly inherent bias when comparing his personal credit score to the one of his wife, which was 20x below his own. After unveiling the scoop via Twitter, many other affected users revealed similar experiences. The whole incident caused Wall Street regulators to look into the matter.

The @AppleCard is such a fucking sexist program. My wife and I filed joint tax returns, live in a community-property state, and have been married for a long time. Yet Apple’s black box algorithm thinks I deserve 20x the credit limit she does. No appeals work.

— DHH (@dhh) November 7, 2019

Two interesting takeaways:

Diverse teams are key to ensure inclusive products and services

Neither credit cards nor algorithms are sexist, but their customer experience (CX) outcomes are. When such algorithms get constructed, it’s easy train them with biased data or to code in human bias. It’s a known issue that led big tech firms (Google, IBM, Microsoft, AirBnB) to increase the diversity of its engineering teams and to introduce AI principles.

In financial services, most providers usually serve the lowest common denominator of actually quite diverse target groups, which results in very homogenous product portfolios. In order to ensure that services and the CX are truly customer-centric and inclusive, diverse teams are key.

Read more about biased algorithms here.

Own your outcomes

Even though the new service is “created by Apple, not a bank”, Apple’s brand is now attached to one. After peak iPhone, Apple currently diversifies its revenue streams with a shift to services. Contrary to everything else the company does, it doesn’t operate the primary technologies that run its credit card, which leaves its brand vulnerable to any CX failures – even if they are originated from Goldman Sachs’ side.

As ecosystems and co-branded fintech services are on the rise, being able to orchestrate the whole customer journey without owning the full tech stack will gain in importance.

Fintech challengers are disrupting margins? A case study on how incubments can fight back.

a16z: Does Zero-Fee Trading Pay Off?

Sifted: Wealthtech wars — and why the UK is the next battleground

The entire financial industry is aging out, as traditional players have missed out on targeting younger customer segments with competitive digital offerings. This led to the success of new mobile-first, zero-fee fintechs, which are estimated to gain up to 85 million customers in Europe by 2023.

Robinhood is one of the new players that has been challenging the brokerage industry. It tackled the vulnerabilities of incumbent brokers by making trading easy, accessible, offering a neat user interface and most importantly, zero fee trading. The Robinhood app is listed on place #10 in Finance, whereas Charles Schwabs’ app (the incumbent broker) is listed #98. The average Robinhood customer is 32 years old and thus exactly the profile that the traditional players desperately need.

Robinhood would make up a great disruption story, until a few weeks ago Charles Schwab announced in a gangster move to drop its commission fees for US stocks, ETFs, and options trades. Several other incumbents followed shortly after, which fundamentally evaporated Robinhood’s top of the funnel.

While pressure on fee income through digital business models and new aggressive competition has been acknowledged by most incumbent players, only few have shown the guts to radically change business models. Schwab makes an interesting case here.

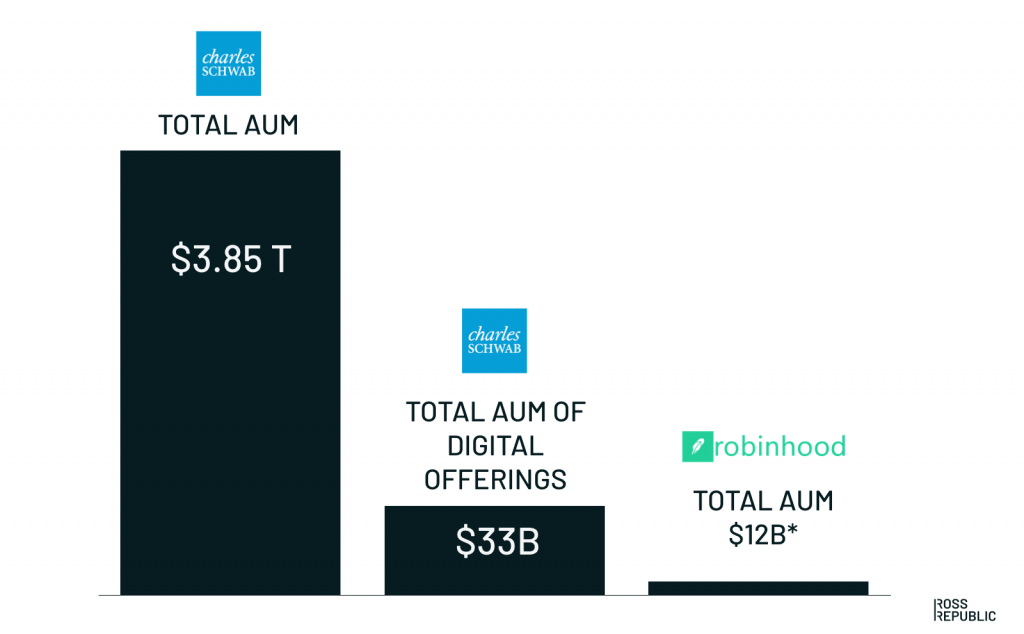

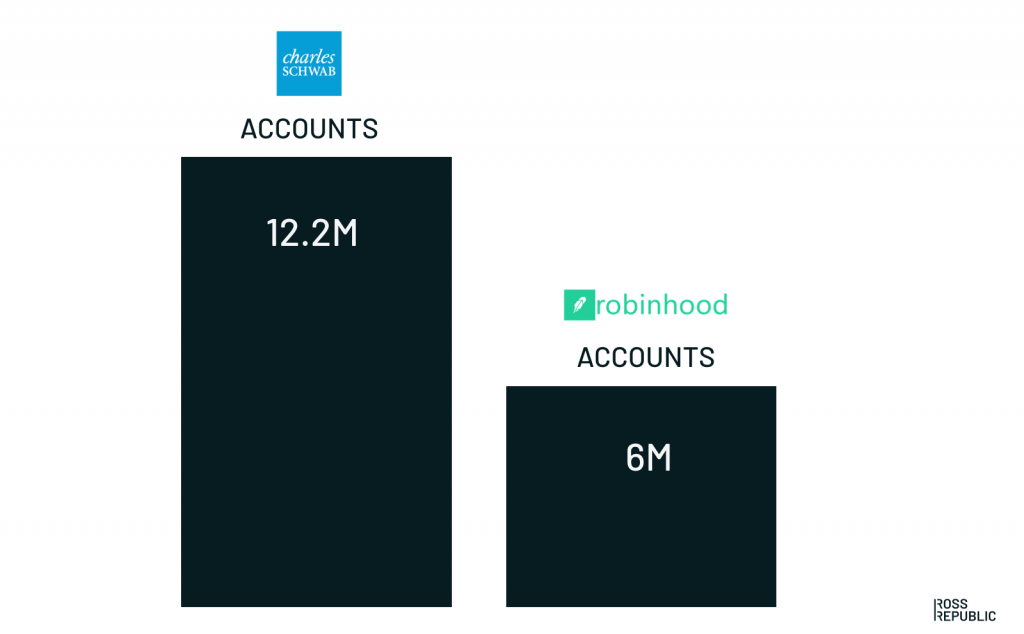

As covered by a16z, Schwab’s commission fees only contributed to ca. 6% of its revenue in Q3. By not charging commission, the company boosted new account openings by 31% compared to the month prior. While opening up its services to a broader/younger user base, Schwab now pushes into lending and income services and gains interest on new cash assets. Just dropping fees won’t do the trick, Schwab desperately needs to catch up on digital UX improvements. That shouldn’t be a challenge for a broker with over three trillion dollars under management and 12 million active customers:

Fintechs are great at creating superior digital offerings and piloting new user-centric monetisation models. In doing so, they definitely pressured the incumbents not to rest on their laurels, which ultimately benefits all end-customers.

Incumbents and fintechs don’t compete on fees or features. They compete against better ways of serving customers, enabled by the now available tech stacks and business models. Customer-centricity is the ultimate benchmark.

The fintechification of everything and how banks might become the most loved institutions

a16z: Banking on the Future: Why our most hated institutions will become our most beloved

Forbes: Fintech: The Fourth Platform

Financial Times: Cache crunch, Google-Citi deal could be future of banking (€)

Angela Strange of a16z explained how technology enables new fintechs to be founded and incumbent banks to better serve customer needs:

“(…) what if software could address these hard, structural problems, enabling even non-fintech companies to provide financial services for their customers? What if, as a result, people didn’t just put up with, but actually love, their banks?”

In the article, the key technological trends at play are:

- API-enabled, modularised services allowing for outsourcing and fast deployment

- New online distribution channels and acquisition loops bring down customer acquisition costs

- More and better data available

Very similar to Robert Armstrong’s view in the Financial Times article (€), exactly these trends power big (tech) brands to seize new revenue and data opportunities from banking plays:

“Fundamentally, a bank is a balance sheet, a data-processing system and a sales force. Silicon Valley companies may be content to leave the balance sheet, the most heavily regulated bit, to the banks. But they are coming for the other parts.”

These developments will ultimately lead to a change in distribution power, as any brand can become a bank. Banking-as-a-service lowers the barriers to entry by making adding banking-like services as easy as connecting to an API (quoting from a16z):

“(…) the next era of financial services will come from seemingly unexpected places. Just as Amazon Web Services dramatically lowered the cost and complexity of launching a software business, unleashing thousands of new companies, the “AWS for fintech” stage has arrived in banking.”

Matthew Harris of Bain Capital Ventures posted a similar hypothesis on fintech as the fourth major platform technology:

“(…)we’re turning our attention to investing in companies that use financial technology as an ingredient versus a primary business model.

We’ve already been trained to conduct financial transactions inside of software applications (think payments inside of Uber), so if you’re utilizing software to run your business, using that same software to get paid and make payments is logical and more natural than going to your financial institution to do so. These relationships are data-rich, which leads to smarter cross-sell, prequalification and massive risk reduction. The monetization opportunities are not only large, but actually meaningfully larger than the original software opportunity.”

This leaves a few strategic implications for incumbent players:

- Make a hard pivot to become a product factory

- Compete against the vast amount of consumer/B2B brands (that employ the best digital talent, have vast proprietary data, can offer frictionless and convenient CX) that will integrate financial services into their own offerings over the next decade

- Build a position as the trustworthy, neutral financial health provider. Incumbents can now take a stance against all brands that clearly only move into banking to push customers towards their core business and squeeze more revenue out of them (either by using their data or producing lock-in effects)

Want to peek into the future of fintech? Have a look at China

NYT Magazine: China’s Internet Is Flowering

Nothing new, but China is home of one the most successful fintech ecosystems. NYT Magazine wrote a nice overview of China’s internet economy. There are many adjacencies that might give some inspiration about how banking can evolve in the West, in adapted versions:

“Chan could have created a regular mobile app, but the integration with WeChat Pay, the platform’s mobile payment service, made billing easy, and most important, customers were already there.

All of them are drawn in by the gravitational pull of WeChat’s enormous number of users and its standardized software infrastructure. It resembles the European Union in the way it has evolved into a market ecosystem: Miniprogram developers benefit from a common currency (WeChat’s mobile payment system), an identification system (WeChat’s login and password) and greatly lowered barriers to trade and movement (easy integration with any number of other services on WeChat).”

After Libra is falling apart, EU regulators might launch their own version

Reuters: Work on ECB digital currency under way, progress possible next year

Financial Times: ECB explores development of a digital currency

The ECB is working on its on digital currency as an alternative to Facebook’s Libra and other private projects, aiming to reduce costs of international transactions. The announcement of Libra was a wake-up call to the ECB – if Libra will finally be launched and succeed, it might end up being successfully adopted as it meets customers needs for a digital currency as an alternative to cash.

“The ECB official said several options were being studied. Under the most ambitious plan, users of the new digital coin could open bank accounts directly at the ECB. That would cut transaction costs but would make existing banks and payment services largely redundant.”

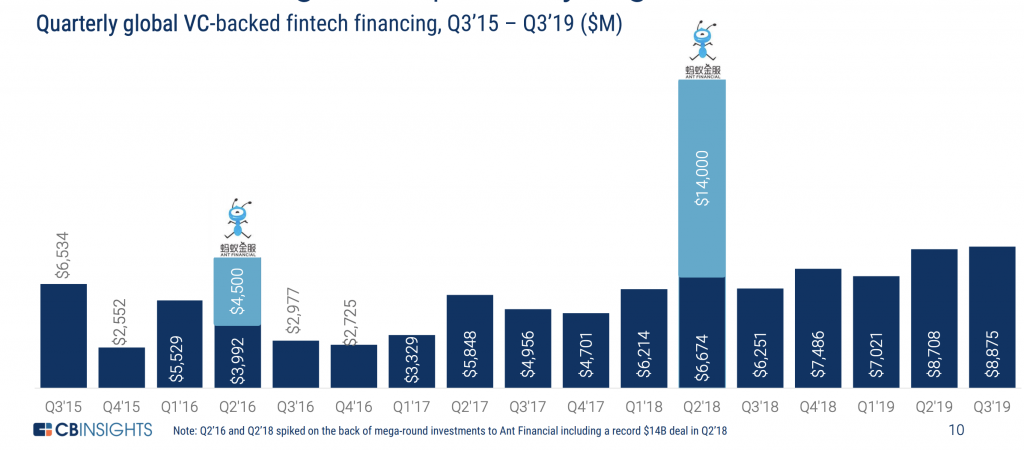

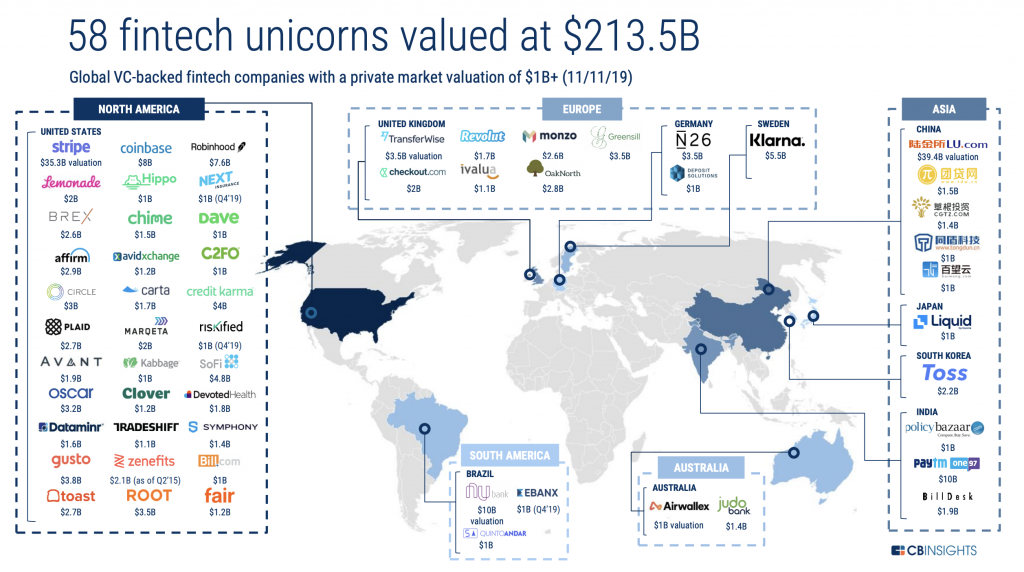

Has the market reached peak fintech? Funding in Q3’19 topped $8.9B

CB Insights: Global Fintech Report Q3 2019

CB Insights released their recurring report on the current state of fintech:

“2019 global fintech funding topped $24.6B through Q3’19, already surpassing 2017’s total.”

About the author