Since the PSD2 deadline hit two weeks ago on Sept 14th, we can finally leave the reductive threat vs. opportunity discussion behind us and start exploring meaningful, customer-centric applications. Are banks ready?

The global regulatory direction of the banking industry is clear: the long-held data troves of incumbent banks are opened up. The intention is to increase competition, foster innovation, make payments more secure and to strengthen consumer protection. For instance, the Open Banking initiatives by the Competition and Markets Authority (CMA) in the U.K. and the revised Directive on Payment Services (PSD2) in the EU fall into this category. Based on these developments, banks should be worried about their future competitiveness, which has been discussed to death within the industry. Many publications predicted the disruptive Open Banking tsunami that wipes out the large universal banks.

After the hype, however, reality usually kicks in. PSD2 is a perfect example of how the effects of new technologies are overestimated in the short-term and most probably underestimated in the long-term.

Banks have always been horizontal platform companies. Through Open Banking, their individual business lines become very attractive targets for standalone specialists.

For now, most banks have been, or still are, busy with meeting the vague technical compliance standards mandated by PSD2. Since the directive has been announced, many consultancies declared the complete disruption of the incumbent banks. Obviously, these predictions didn’t hold true.

So far.

Open Banking is still in its infancy. What’s important to understand is that banks have always been platform companies. They strongly control their offerings and the underlying value chain. The current regulatory directions and consumer expectations are starting to challenge that power structure. Eventually, the broad horizontal offerings that banks have built up over the past will eventually break. They suffer from their own success. End-customers become frustrated with the undifferentiated, low-touch services that cater mostly to the largest common denominator of the bank’s target group.

As more and more data is pulled via open APIs by third party providers (TPPs), the banks’ individual business lines are drawn into a million different directions. What was once a subcategory for the incumbent bank suddenly becomes a very attractive target market for a standalone specialist, such as payments or tailored SME lending. Thus, a new wave of innovation emerges, taking apart verticals that a broad horizontal bank in comparison simply can’t serve as well.

The un-bundling of platforms and vertically integrated businesses has been repeated over and over in other industries, for instance the most eminent being Craigslist, broken up into Airbnb, Zillow, Upwork, etc. With Open Banking, incumbent banks are next in line. In Germany, payment provider WireCard (€18B) already has a higher market cap than Deutsche Bank (€14B) at the time of writing. The banking value chain will inevitably transform from a linear one into value creation networks that look more like ecosystems. It’s not about if, but when; even though such disruptive shifts don’t happen in a vacuum and take some time to fully materialise in different markets and segments.

Does the unbundling of financial services just follow a natural evolutionary cycle, or is it avoidable by proactively promoting the unbundling by the incumbent player itself?

In order to remain competitive, banks continue to set aside large IT budgets to modernise their tech stacks and continue to digitalise front- and backend applications. By establishing more advanced technical capabilities they eventually operate like modern technology companies. However, these exercises are merely homework, incremental improvements. Such technological shifts, especially the ones triggered by Open Banking, can only be fully leveraged when they’re accompanied by a business model shift. Technological improvements alone are not an answer to how to operate in Open Banking ecosystems.

The real question, therefore, is the following: Does the unbundling of financial services just follow a natural evolutionary cycle, or is it avoidable by proactively controlling and promoting the unbundling by the incumbent player itself?

Banks have been confronted with the question if they can stay relevant if new fintech companies attack specific niche verticals with tailored offerings, such as payments, current accounts, or loans. How loyal are customers to their primary bank when they realise they can get more convenient services for a better price? For example, German comparison platforms such as Check24 (AISP/PISP) or Finanzguru (AISP) already secured their PSD2 licenses.

Should banks try fight for customer loyalty at all cost or use their remaining market power to re-focus their offerings and key target groups? In Germany, protectionism is still prevailing, as some larger banks now mainly offer the new PSD2 APIs as data gateways and don’t support the previous standards anymore (e.g. FinTS), with the effect that many 3rd party software providers used by their customers are temporarily not able to connect to the banking data anymore. That’s why the German regulator BAFIN just announced (€) that banks need to keep previous data gateways intact until the new PSD2 APIs work properly. Additionally, for most banking customers PSD2 is so far just a dubious regulation that has made their day-to-day banking experience worse due to the cumbersome Strong Customer Authentication (SCA) methods.

Instead of truly educating customers about the potential of an Open Banking ecosystems, partnering with TPPs and proactively working on new propositions, many players are unfortunately still protecting their current market position.

Banks basically have three strategic options when it comes to Open Banking:

- Continue to do business for as long as possible and wait until the last profitable business line is taken away by third parties (in this scenario, it would be wise to set funds aside for the launch of new core business lines)

- Become an infrastructure provider (the typical “dumb pipe” argument, however BBVA or Starling bank have shown that this can be a good business with the right scale)

- Proactively invest to enhance product or market share leadership (functional M&A will likely play a key role here)

Open banking shouldn’t be treated as a mere compliance exercise. As the market dynamics still evolve, now is the right time to figure out where to play and how to win in Open Banking:

Three playgrounds

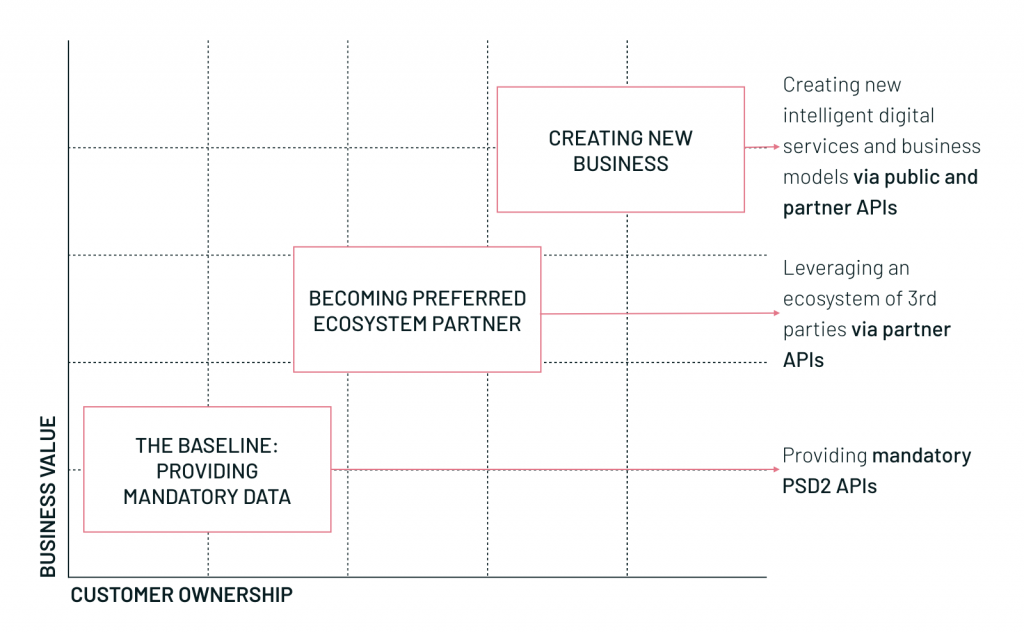

Ross Republic uses the Open Banking opportunity framework as the lenses through which to identify opportunities and implications.

- Business value: How actively does the bank participate in new value chains?

vs.

- Customer ownership: How strongly and where does the bank own the customers?

Tailored strategies

It is important to note that winning in different Open Banking positions requires different strategies, capabilities and resources. The Open Banking strategy must be both realistic and aspirational:

- Realistic to get started fast

- Aspirational to support the business transformation

The Open Banking playing field and example use cases

The most common application is account aggregation, which per se doesn’t sound too disruptive. However, what the aggregation allows you to do as second- or third-order effects, can be very disruptive: it provides the data baseline to get a client’s full financial overview, helps customers to develop financial literacy, enables faster access to other (financial and non-financial) products for cross-selling and speeds up cost and time to serve for more intricate services, such as applying for a mortgage or loan offering.

The most comprehensive platforms that currently provide access-to-account (XS2A) services are Swedish payments firm Klarna (connects to over 4300 banks across 14 European markets) and Dutch payments firm Volt (connects to over 4000 banks across 14 markets).

Use case 1: New bank offerings for B2C customers

Let’s be honest, most people have a hard time keeping an overview of their financial situation. Behavioural psychology has presented deep challenges to the rationality assumption favoured in standard economics, and now the long lists of biases of judgement and decision making are commonly accepted, especially when it comes to day-to-day money management.

What if banks are not only used as virtual money storage containers, but helped to keep a complete overview of all financial matters and proactively nudged users towards the best financial choices in their unique situation?

Offerings that fall into the personal finance management (PFM) category are:

- UK: Yolt (by ING); Lloyds bank app, Plum

- NL: Grip (by ABN Amro)

- GE: Yunar (by Deutsche Bank), check24 (price comparison platform with PSD2 and soon full banking license)

Image: Yolt by ING

By leveraging AISP and PISP use cases in personal finance management apps, banks can provide more personalised service and tailored products.

Use case 2: New bank offerings for SME customers

Small businesses have been the nightmare customers for incumbent banks, a segment with many diverse and complex needs that make it difficult to serve them very profitably. Now, with potential PISP (Payment Initiation Service Providers) or AISP (Account Integration Service Provider) licenses, or even own account provisioning, the champions of SME businesses can finally fully claim this target group for themselves: accountants and bookkeeping SaaS companies.

Offerings that fall into the SME category are:

- Europe: Holvi (acquired by BBVA); BBVA One View

- Germany: Penta, Buhl (accounting SaaS with AISP and PISP license)

- UK: Coconut, Tide, Mettle (by Natwest), XERO (accounting SaaS with AISP license)

Image: Holvi

To defend against future TPP competition, e.g. accounting companies with PISP licences, banks can simplify and streamline the financial management of SMEs by entering new financial product categories.

Use case 3: Better lending offerings

Digitalising lending is not a new idea. However, for both B2B and B2C clients, Open Banking offers an opportunity for banks to get required financial data faster and to merge it with other digital risk scoring sources. This brings banks closer to the vision of real-time risk assessments and loan decisions with the tap of a button.

Offerings that fall into the lending category are:

- Germany: N26 credit (in partnership with auxmoney, which uses the figo connect API)

- UK: OakNorth, Zopa , Growth Street

Image: N26

By gaining a better understanding, faster, on the customer’s creditworthiness and solvency, banks can increase their lending market share while reducing risks and boosting productivity.

What’s next?

Open Banking is a new opportunity for growth. When looking at the forefront of Open Banking, the UK, it’s clear that new ecosystems take time to emerge and that banks can benefit a lot from initiating their own use cases. By figuring out how to navigate Open Banking and APIs as well as how to partner up with 3rd parties, banks can enhance their products and improve monetisation. Beyond that, by proactively promoting the unbundling of the bank’s own horizontal offerings, they can let 3rd parties create new services with their data, which will ultimately benefit all customers.

Many customers still trust their banks as the main place of their financial home and are probably not yet ready to switch the primary relationship to a new TPP. Hence, banks needs to get the innovation (to the market), before the challengers get the distribution. The party who owns the day-to-day user interface will ultimately have the most influence to cross- and up-sell other products.

Ross Republic has extensive experience in forging partnerships between financial services providers and 3rd parties and in creating ground-breaking core and non-core offerings that leverage APIs and customer data. Get in touch with us if you want to know more!

About the author