In cooperation with Holland Fintech, Accenture and other fintech experts we examined the state of fintech and banking in the Netherlands.

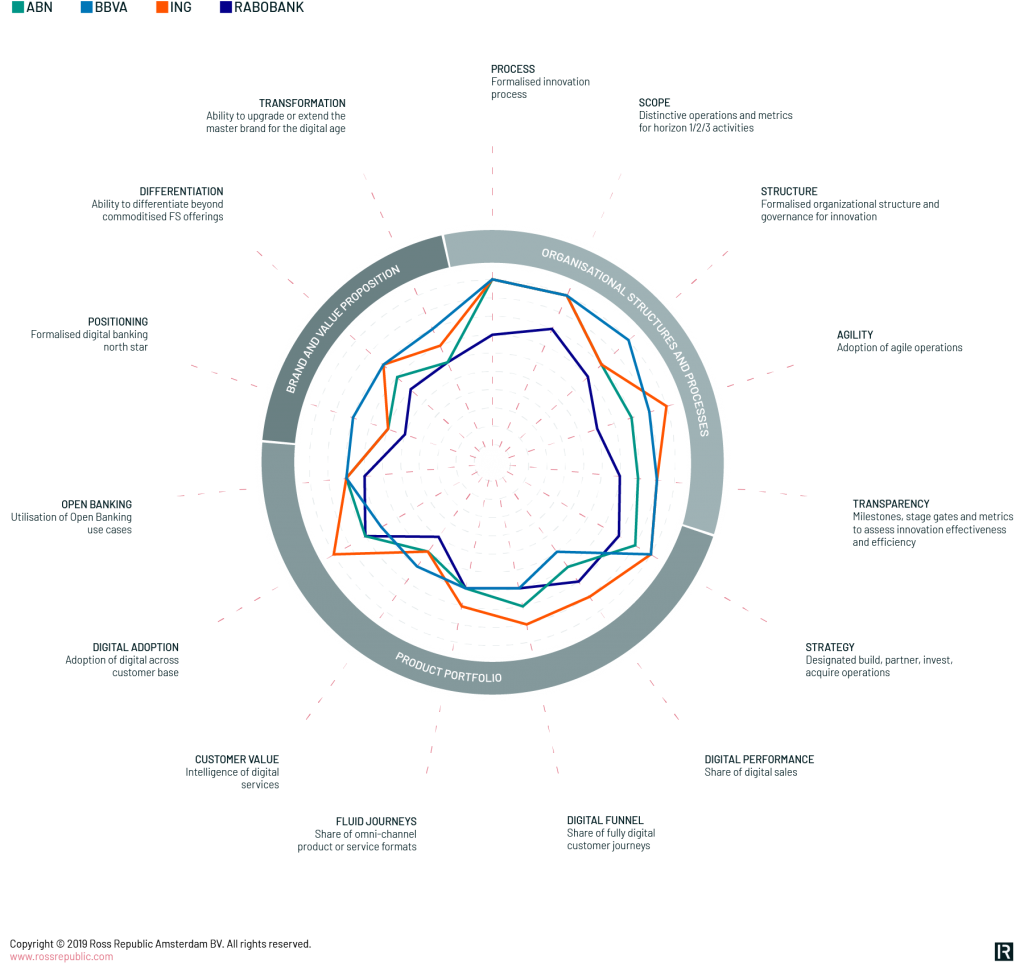

The Dutch banking market is one of the most digitally advanced and mature banking markets. The three incumbents, ING, ABN Amro and Rabobank, own most market share. Yet, they are still investing heavily in innovation and new business models. That’s why we analysed how Dutch banks are preparing their organisations for the future and benchmarked them against the current European innovation powerhouse BBVA:

Benchmarking Dutch banks’ innovation activities against BBVA

The analysis uncovered three action points for successful digital innovation:

- Leaving legacy structures behind by adopting more agile planning models and customer-centric organisational structures and processes

- Building scalable product platforms

- Establishing a brand architecture that leverages the incumbent’s trust with fintech challenger’s agility

About the author