Why wealth managers should go all-in on digital transformation by approaching technology transformation through the lens of business model innovation.

In order to cope with the structural market shifts ahead of the wealth management industry, new technologies can help to provide radically enhanced client experiences and to underpin new future-proof business models. However, to fully seize the real potential of digital transformation, legacy approaches to tech vendor assessments and the strategic rationale behind tech procurement needs to change radically.

True digital transformation takes the business model to the next level

By using a production function-based model to explore the role of investments and acquisitions, a recent study conducted at Boston University School of Law revealed that “investments by dominant firms in intangibles, especially software, are distinctly associated with greater persistence and reduced leapfrogging.” In addition, the study found higher mark-ups are associated with greater displacement hazards, linking rents positively with industry dynamism. While technology has often been labelled as a force disrupting industry incumbents, it now appears, according to the study, to actually help defeat disruption.

Technological evolution, such as new cloud computing or API use cases, has decreased barriers of entries and unlocked new levels of efficiencies in the financial services industry over the past decade. Most, if not all, financial services providers have been implementing new technologies with the main objective to boost operational efficiencies and automation. Yet, as increasingly proven by evidence, leveraging technology beyond cost-cutting measures can enable wealth managers to deal with increasingly competitive market dynamics, to improve the quality of their products and services and to launch entirely new business models.

Wealth management is the next frontier in fintech

The opportunity for wealth managers to leapfrog into digital-era business models is both significant and urgent. Many B2C industries, such as retail, travel, or entertainment, have been disrupted in the last 25 years due to digital transformation. Not only processes and products have become digital, but the underlying business models and value chains shifted as well. For example, the entertainment industry has evolved from a transaction-based model (e.g. owning physical CDs bought in a store) to a subscription-based model that allows to stream any content on demand, on every device for an affordable price. Furthermore, the streaming platforms’ algorithms analyse the continuous flow of user data to further optimise the offering and processes: by generating data-driven network effects, services are becoming highly personalised at scale. Beyond that, digital transformation processes result in a separation of manufacturing (e.g. artists, music labels) and distribution (e.g. Spotify, Apple Music) functions, enabling the archetypical digital business models of ecosystems, aggregators and platforms that intelligently match supply and demand.

Traditional banking and specifically the wealth management segment are just at the beginning of this shift, however it will sooner or later have a significant impact on the future power dynamics within the industry. The following sections of this article dive a bit deeper into the market shifts currently happening in wealth management and the role of technology in enabling new business models.

Changing market environments require adaptive business strategies

In his paper The Adaptive Markets Hypothesis, Andrew W Lo, Director of the MIT Lab for Financial Engineering, examines the workings of financial markets and its individual players through an evolutionary model of individual adaptation to changing environments via simple heuristics.

Currently, wealth managers are receiving all sorts of signalling that large-scale market shifts are underway.

Once the environment suddenly changes, established heuristics that have proven successful for business survival and growth, can quickly become ineffective and essentially wipe out entire species, as exemplified by the fast-moving hedge fund industry. Currently, wealth managers are receiving all sorts of signalling that large-scale market shifts are underway, which in turn makes re-evaluating established business heuristics (i.e. strategy) essential.

The short sections below outline top trends and developments that will significantly change the business environment wealth managers operate in. In short, eminent demographic changes will result in new client behaviours and expectations, which in combination with latest technological advancements call for new business models. As most new business models heavily depend on deploying new technologies, approaches to software and vendor assessments should take a holistic business model evolution into account.

Demographic shifts will result in a significant wealth management industry shake-up

The Covid-19 pandemic has undeniably accelerated the adoption of digital technologies across the banking sector. However, an even greater external force impacting wealth managers is the fact that the demographics of key client segments are about to change significantly. One key aspect to address is the retirement of the boomer generation, people born between 1946 and 1964. It opens up a large blue ocean market opportunity for wealth management services that focus on the de-cumulation of wealth, i.e. ensuring that clients can draw out accumulated retirement savings intelligently and sustainably. One example of such a service is Silvur, a retirement planning app that helps boomers reach their retirement goals and develops a smart pay-out plan.

A ticking pension time bomb

With rising income inequality, not everyone entering the retirement age will be able to build up enough savings in the first place.

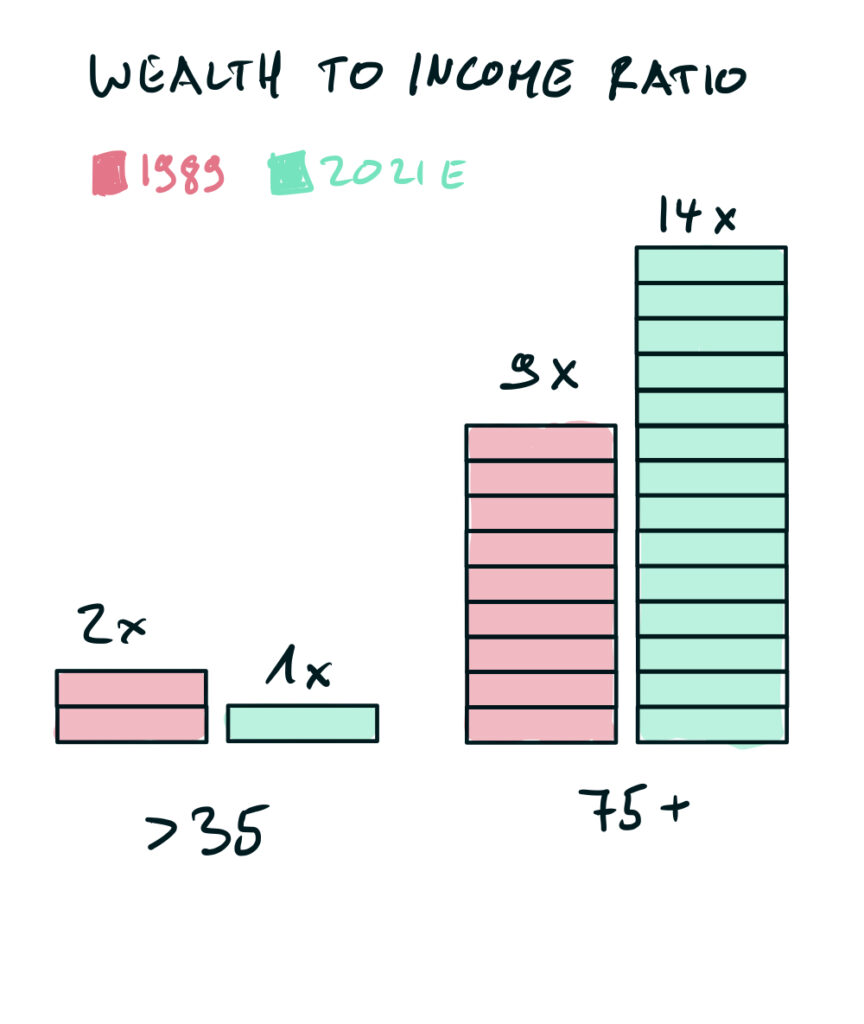

US wealth to income ratio. Source: JP Morgan

Adding up to intergenerational wealth inequalities, the past 30 years have seen a wealth transfer from the young to the old. The global pension time bomb is ticking: the World Economic Forum (WEF) predicts that by 2050, i.e. when the first millennials begin to hit retirement age, the pension savings gap will reach $427 trillion. According to the WEF, an ageing population and poor access to savings products are two key determining factors that have impacted the current saving rates. Thus, the democratisation of wealth management and wealth products tailored to a wide range of market participants and across investable assets is a further demographic-change-related opportunity for wealth managers.

Unprecedented wealth transfer

Beyond the retirement-related shifts, the boomer generation is about to create a historic wealth transfer. For example, it is estimated that over the next decade in the U.K. alone, £215 billion of investable assets will be passed on to the next generation. The unparalleled transfer of wealth is expected to be served by a declining pool of advisors, while the growth of digital-first fintechs, such as Germany’s Trade Republic that now manages over six billion Euros in assets, spur competition in the sector. Incumbent wealth managers will swiftly have to serve a much younger, more digital-savvy clientele. Will they want to be served the same way as their parents? Unlikely. New forms of client engagement will be needed to avoid the risk of customer churn, as younger high-net-worth-individuals (HNWI) expect a much more self-directed investing experience, enabled by real-time and intelligent digital services. Existing propositions and processes at incumbent wealth managers are not yet adapted to this new world, representing a looming opportunity to re-engineer them to cater to younger generations that soon will have access to a significant amount of investible assets.

Rise of female investors

Another client-led shift is the currently underserved, but emerging segment of female investors, who are increasingly gaining access to investable assets and are becoming much more active in the workforce. Needless to say, women have different expectations and needs, compared to traditional wealth management offerings or r/wallstreetbets aimed at Robinhood bros. According to a study by Columbia Threadneedle Investments, 37% of women in Germany and 23% in the U.K as well as Italy say they have neither financial reserves nor investments. The amount of new wealth services specifically tailored for women are therefore expected to increase. The recently launched fina, Jefa, Ellevest or the Madame Moneypenny Facebook group with over 100.000 members demonstrate early market traction. Incumbents like Fidelity Wealth Expert have similarly started to offer investing workshops exclusively for women.

Changing client expectations

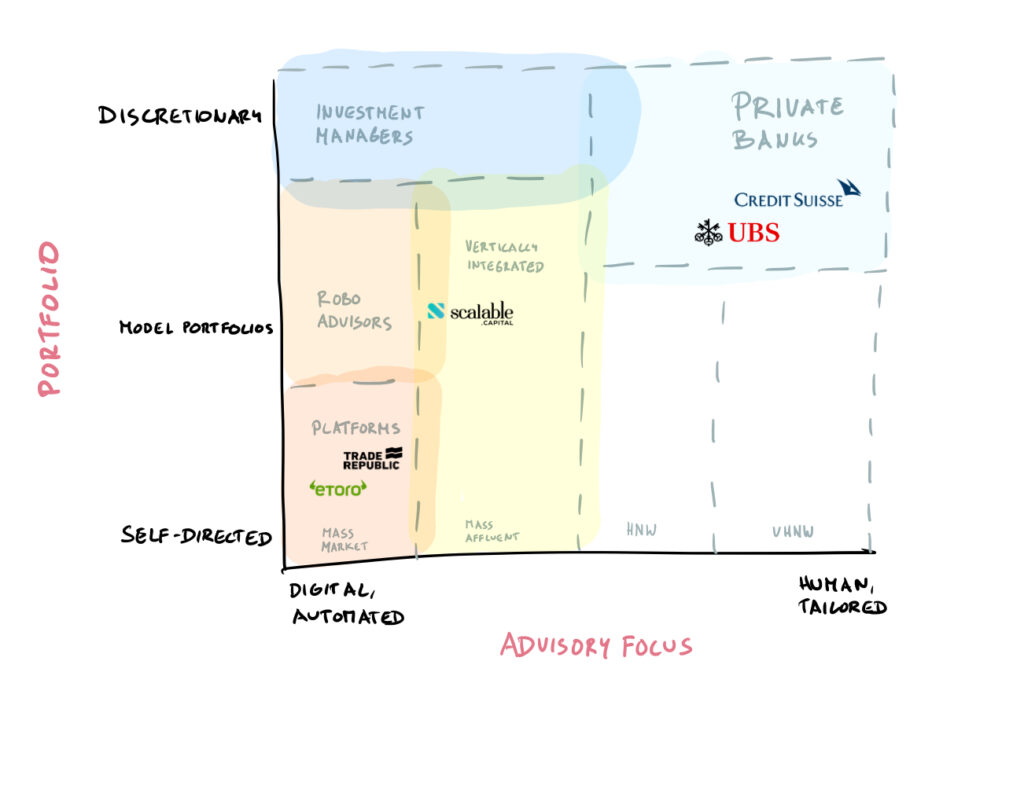

Across client segments, service expectations are increasingly driven by best-in-class digital experiences that clients know from established entertainment apps, online retailers, neobanks or big tech platforms. Additionally, preferences regarding sales and advisory channels have swiftly moved towards digital solutions during the Covid-19 pandemic, which makes transparent and seamless omni-channel offerings, highly personalised and data-driven services, as well as remote advisory assistance new table-stakes capabilities for every wealth manager. Once clients have tried new digital service models and propositions for the first time, the newly formed behaviours are expected to stick beyond the Covid-19 inflicted digital migration. Furthermore, new digital wealth management solutions are increasingly adapting to specific target groups, e.g. fintech brokers like Trade Republic or eToro that are targeting digital-first mass market users. Innovative wealth and advisory solutions are similarly becoming established in the mass affluent as well as (ultra-) high net worth (UHNW /HNW) segments, such as Scalable Capital’s selection of model portfolios or Credit Suisse’s digital private banking offering, CSX.

Wealth management market landscape with illustrative examples

Structural profitability erosion

Rising assets have resulted in increasing compliance and distribution costs, as well continuing pressure on fees due to a general market push towards transparency and comparability of services (MiFID II). Recent research has uncovered that many European wealth managers had to tolerate a decade of profitability erosion. Yet, only a few wealth managers took bold steps beyond cost cutting to build up new digital business with a measurable impact on net revenue growth. At Ross Republic we conducted a review of annual results of European wealth managers, confirming profit and revenue margin compressions, costs rising faster than revenues, and rising cost-to-income (C/I) ratios that go as high as 80% – although this depends on the market, e.g. in Germany, some private banks even have CI ratios beyond 90%. The introduction of MiFID II will have further significant implications on the operations, pricing, distribution, as well as product offerings of wealth managers, resulting in further rising costs and shrinking margins.

New competitive dynamics

Direct-to-consumer (D2C) robo-advisors are expected to reach $1.26 trillion in AUM by 2023. Similar model portfolio offerings as well as self-directed investing is currently getting a boost due to Covid-19: Digital brokers have made the markets more accessible and affordable for the average European investor to take advantage of the markets. For instance, only after a few months since BUX launched its investing app in Germany, it acquired 100.000 German users. Trade Republic, a fast-growing broker based in Germany, experienced similar customer inflows and recently launched zero-fee savings plans, including more than 280 ETFs and flexible investment amounts, starting at 25 euro. The plans can be initiated in just three simple taps in the Trade Republic app. BlackRock, the world’s largest asset management firm, is the strategic partner for Trade Republic’s ETF offering. Even though the assets under management of such new digital brokerage apps is small compared to the incumbents, the established players now have an opportunity to learn from the success of these new digital services and their go-to-market strategies.

Beyond direct competition from fintechs, wealth management services are further expected to become embedded in third party environments, such as personal finance management (PFM) apps or accounting services. Gusto is a prime example of such an embedded wealth management play. The software firm serves more than 100.000 businesses in the US, processing tens of billions of dollars of payroll. Lately, Gusto launched Gusto Wallet, a free app for employees to manage their savings, thus leveraging its large business customer base to win their employees as potential clients.

D2C digital wealth management services as well as the rising model of embedded wealth management shows that the go-to-market rules have shifted from linear distribution to seizing network effects that allow to acquire clients at low customer acquisition costs and aggregating services based on client needs.

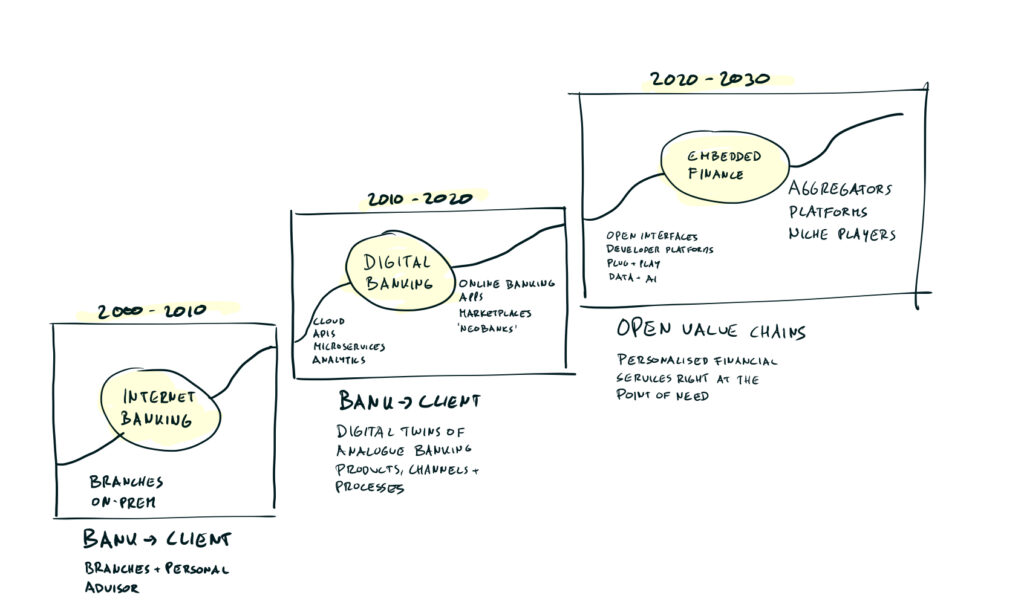

Technology change

As previously outlined in our article “How banks can unlock the potential of open finance” and discussed in our wealth management podcast, the adoption of cloud-native, composable architectures, independently deployable microservices and API-driven third-party integrations has replaced monoliths with platform-based stacks that smartly combine best-of-breed vendors. Such adaptive technology architectures can be highly tailored to fit the wealth manager’s propositions and business model. As cloud technology and interoperability lowers costs, wealth managers can manufacture their products at the lower marginal costs. At the same time, digital and embedded distribution channels unlock new sales interfaces at scale. The gathered data becomes a key resource to orchestrate highly personalised services, a key factor of differentiation in wealth management.

The winning financial services providers of tomorrow leverage technology as a key competitive advantage and enabler, rather than a cost centre. Digital transformation is about re-defining the end- customer experience, enabled, not defined, by technology. It is about pioneering new products and business models, as new technologies create new possibilities across the entire infrastructure stack. – Adrian Klee, Partner at Ross Republic

While modern technologies can improve operational efficiencies and enhance client relationships, the key is to leverage technology as enablers of new products and services, underpinned by new business models. While most wealth managers tend to evaluate new technologies mainly from an IT perspective, it is equally critical to look at it from a business model and strategic growth perspective. Thus, focusing on the latest tech trends, such as cloud or APIs per se is “almost the wrong focus and will likely not result in the desired ROI of such technology investments.”, as Ben Robinson, ex-Chief Strategy Officer at Temenos, highlighted in our recent podcast. “The key is to look at how to leverage the possibilities of new technologies to create business model innovation, new revenue streams or distribution models.”

New digital-era business models will emerge in wealth management

Legacy business models and operations of incumbent wealth managers are increasingly maladapted to some of the aforementioned shifts in the digital market environment. Mature industries impacted by digital transformation processes often result in

- a few winner takes it all players that aggregate demand,

- platforms that aggregate supply,

- as well as a long tail of direct-to-consumer niche players that focus on unique services or narrow target groups.

The transfer from a linear, industrial financial services value chain towards modular backends, open platforms and embedded financial services will gradually disintermediate the manufacturers and distributors of financial products.

From linear to embedded finance

While digital transformation is already on the agenda of the banking industry, many players are recognising now that they have to tackle their transformation efforts with high urgency to generate new net revenue growth.

Aggregators, platform providers, as well as specialised long-tail provider strategies are not mutually exclusive: An example of a financial institution that has launched a combination of such digital business models is Goldman Sachs. The firm built a portfolio of new business lines over the years:

- Marcus as an independent, digital-only challenger bank offering deposit accounts, savings accounts via managed portfolios, lending up to 40.000$ as well as personal finance management tools. Marcus is the aggregator that draws in deposits and new clients that Goldman Sachs otherwise wouldn’t reach.

- A cloud native, fully API-based Banking-as-a-Service (BaaS) platform, leveraging its banking license to conduct financial services across numerous jurisdictions. Goldman Sachs lets third-parties build on its banking infrastructure and APIs, a first use case is Stripe treasury.

Integrated & Self-Reinforcing Strategy. Source: Goldman Sachs

At the end of last year, Goldman Sachs had accumulated $96 billion of customer deposits via Marcus as well as $28 billion of customer deposits in its newly established transaction banking unit. Through its partnerships with brands that provide access to a large amount of potential end-clients, such as Stripe or Apple, Goldman Sachs is significantly growing its distribution interface. Such initiatives are a prime example of a digital-age holding company, which constantly deploys a portfolio of companies (i.e. experiments) that are synergistic within the holding group. Amazon has built the blueprint for it by decomposing the firm into smaller units, close to the customer, nimble and agile, yet all units contribute to the group via open data interfaces and shared services.

Aggregator vs. platform business models in wealth management

Aggregators of wealth management services will likely emerge from players outside of the traditional wealth management industry. All you need is an existing, engaged customer base, whose pull can be leveraged to embed wealth management services into the broader service offering. Possible scenarios include very tightly embedded options, such as the often-cited invisible Uber payment experience. As previously mentioned, an example of such an embedded wealth management solution is Gusto. Gusto offers a financial wellness platform by supporting clients to manage their payroll, access employee benefits like automatic savings, and recently it launched Gusto wallet, a free employee app for smart saving and spending. The phenomenon of super apps, a one-stop-shop for financial life, is another potential aggregator business model. For instance, Tinkoff has launched wealth management services into its ecosystem of services: an online brokerage portal, offering clients a low-cost and transparent platform for investing in a range of securities including Russian and international shares. Similarly, the Asian super app Gojek has integrated commodity trading functionalities.

Incumbent wealth managers that want to launch aggregation models will have the challenge of reaching a large scale of client engagement without loosing customers’ trust. While tech platforms reach plenty of engagement, they (yet) lack trust. Thus, wealth management-led aggregation plays by incumbent providers should leverage client trust, which e.g. could involve curated marketplaces: wrapping up adjacent services that clients might need based on their product or risk preferences. Ultimately, it’s the wealth manager’s job to match clients with exactly the right service at the right time. With the exception of open fund architectures, open sourcing products or services from best-in-class third parties based on client needs is still rare. Hence, aggregator business models represent a highly innovative market opportunity.

Early signs of platform-based business models are arising in the European wealth management industry as well. For instance, Elinvar offers a WealthTech Platform-as-a-Service, enabling asset and wealth managers to digitalize their business models from client acquisition, portfolio management to reporting and analytics. Furthermore, Nucoro offers a cloud-native savings and investment platform. Its tech platform enables any brand, or asset manager, to create new digital offerings such as goal-based savings apps, robo-investment propositions or a hybrid digital wealth management solution. Such platforms are expected to boost the rise of embedded wealth management, allowing non-financial brands to smartly integrate wealth management services for their clients – according to Swiss software firm additiv, a $100 billion market opportunity.

Winning in the embedded finance era requires wealth managers to adopt new strategic planning approaches

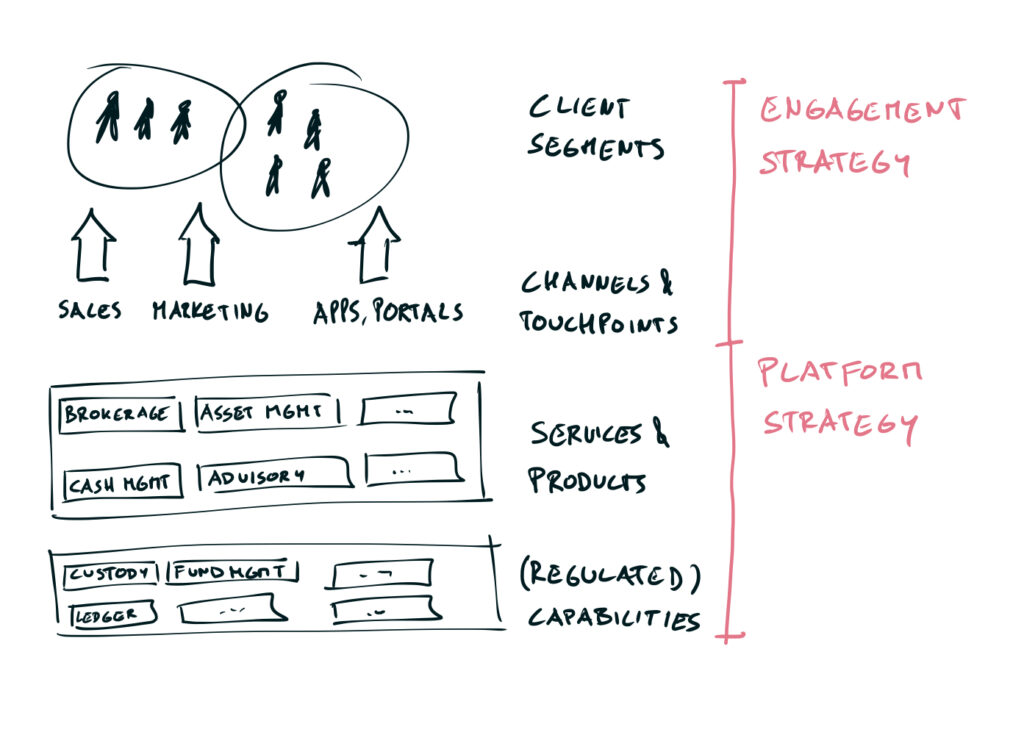

How to line up against emerging tech-enabled business models? Just sleepwalking into being a backend balance sheet provider for global tech platforms or being squeezed to become a long-tail supplier will be a painful transition for wealth management incumbents. Specifically, as many will lack a low-enough cost base in order to operate as a profitable niche provider or once customer churn becomes irreversible. Hence, new approaches to strategic planning will help to find a new competitive edge in the era of embedded finance. Fundamentally, decision makers at wealth managers should now consider two strategic areas:

- Engagement strategy – creating demand-side economies of scale: Getting clients’ attention continuously gets more expensive and challenging. Hence, successful wealth managers now consider the whole customer journey, from acquisition to activation and retention, and have a game-plan how to feed the core business by offering highly engaging services that truly solve customers’ various pain points.

- Platform strategy – creating supply-side economies of scale: Barriers to entry are increasingly lowered due to technological advancements and record levels of venture capital flowing into new wealth management propositions. Hence, enabling operational efficiencies by defining a modern IT strategy that enables intra-company efficiencies via APIs is the absolute baseline for successful wealth managers. Beyond that, there is a significant opportunity in distributing wealth management capabilities and products via third parties (i.e. opening up bank’s internal APIs to external consumers), either white labelled or under licensed partnerships.

Engagement and platform strategy

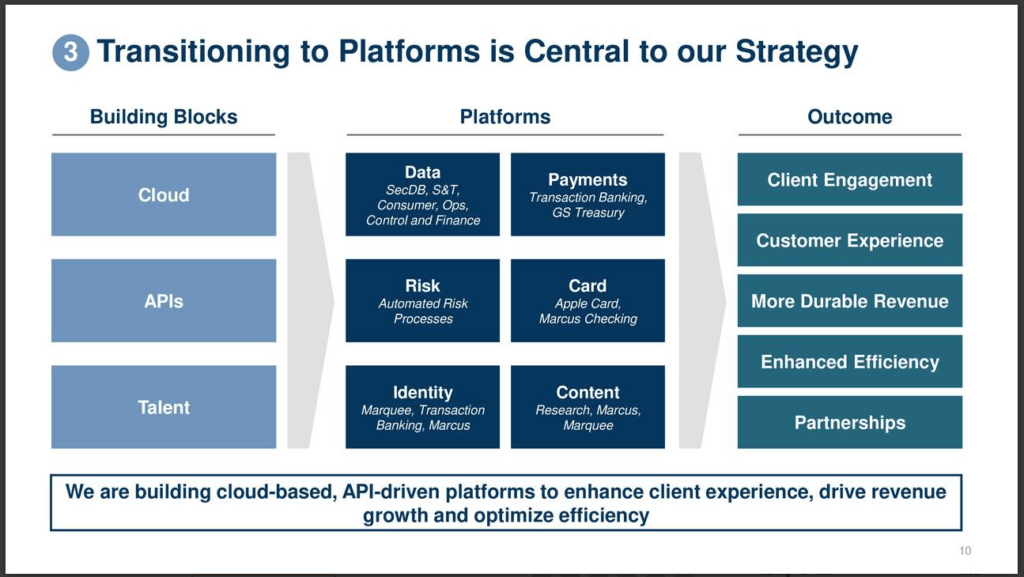

Again, Goldman Sachs spearheads such new strategic approaches and illustrated the benefits of having an engagement and platform strategy in its recent investor deck:

Platform strategy at Goldman Sachs. Source: Goldman Sachs

How tech helps to enable new business models in wealth management

Looking at new technologies and vendors not only from a pure technical perspective, but from a business model perspective is therefore critical in order to make the right vendor choices. For instance, most vendors can nowadays be deployed in the cloud and thus potentially contribute to cost savings. However, that shouldn’t be the only end-goal. Any new strategic technology vendor should be evaluated by both

- their ability to enhance technological scalability as well as

- their ability to enable business model evolution (engagement and platform strategy)

Evaluating vendor offerings based on their capability to improve client experiences in combination with the ability to innovate the underlying business model will generate a higher return on technology spend; instead of relying on traditional, arbitrary measurements, such as breadth of functionality, number of consultants or vendor maturity. Since the integration of new software has become much easier, choosing best-of-breed vendors that offer low cost of ownership, scalability, integrability, enablement of new business models, thus will become the logical choice for many wealth management firms.

To gain more insights into how to approach vendor assessments in the era of embedded finance, I recommend to listen to our recent “future of wealth management” episode on the Ross Republic podcast: Spotify / Apple Podcasts / Google Podcasts

Our research and strategy services have enabled traditional wealth managers to seize new business model innovation opportunities. If you’re ready to explore your own business model evolution in wealth management, please do get in touch with me here.

About the author