Thank you for joining the Ross Republic podcast. In our nineteenth episode, your host Adrian Klee is joined by Fabian Mohr, Co-Founder at UnitPlus, to discuss the convergence of payments and investing.

RR Podcast #19

Listen now on Spotify / Apple Podcast / Google Podcast

After studying economics and finance, Fabian worked for more than four years at Flossbach von Storch, one of the leading independent asset managers in Germany, covering the payment and software space by elaborating profound investment cases within those sectors. After recognising that there’s no real bridge connecting the world of payments and investing, he decided to co-launch a new fintech venture: UnitPlus. UnitPlus combines the benefits and simplicity of money as a means of payment with the return potential of the capital market. Unused money stored in a user’s current account is automatically invested from a reference account and can be used as a payment thanks to the unique “pay-with-portfolio” mechanism. In this episode, we explore the current state of the payments and investing market, what entrepreneurs can learn from Jack Dorsey (Twitter/Square) as well as what led Fabian to co-launch UnitPlus and how the concept works in detail.

The state of the market

The European Central Bank (ECB) expects higher inflation and more growth by the end of this year. The inflation rate will approximately reach 2.2 percent, the ECB recently announced. The combination of negative interest rates and high deposits means that many Europeans currently suffer a historic loss of purchasing power. For more than five years, savings accounts and other conservative forms of investment have yielded practically nothing. Yet, the prospects of change seem to be minimal. In addition to zero interest rates, many banks have introduced penalty interest for higher balances. Consequently, inflation destroys wealth day by day: Over 2.8 trillion Euros are stored more or less interest-free on German bank accounts. With the current inflation of 3.9%, the annualized wipe out of purchasing power would be approximately 110 billion Euro – the estimated net wealth of Microsoft founder Bill Gates.

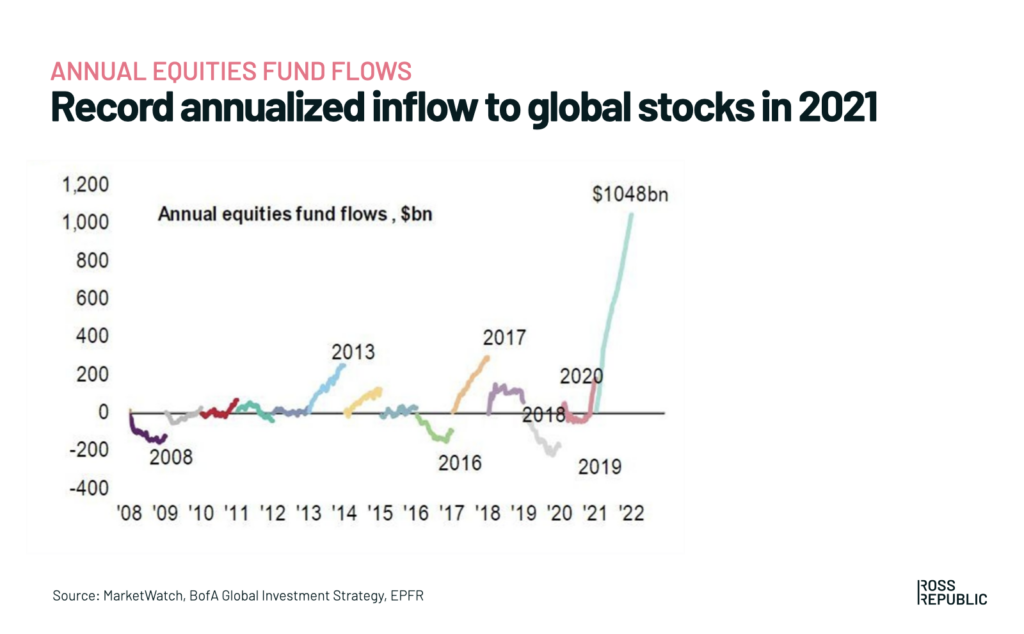

Increasing inflation is a problem occurring globally, driving investors to put money into riskier assets. E.g. the $1 trillion that has flowed to global stocks in 2021 is bigger than the last 20 years combined:

Investors are pouring money into global equity funds

How is the situation in Germany? Historically, Germans save more than their European neighbours, yet they don’t put their money to work via ETFs or stocks, but keep the majority in savings accounts – by far, the most popular product in Germany. Since last year, the situation is getting better: stock ownership increased to 17.5% in 2020, as new brokerage fintechs like TradeRepublic drove stock ownership upwards. Trade Republic has grown to more than 1 million users, 400 employees and 6 billion euros in assets under management. Likewise, most incumbent brokers reported record inflows of brokerage deposits and new customers. For example, investments into stocks have more than doubled at Dutch direct bank ING in 2020.

Most brokerage solutions, whether they are offered by a fintech start-up or incumbent, are mostly centered around offering investing solutions to target audiences that would have actively invested one way or another. Beyond that, their propositions are very focused on the brokerage and investment features. Hence, there’s still a largely untapped customer segment that on the one hand seeks easy entry points to ensure capital is used productively, without having to deal with brokerage functions. On the other hand, once capital is invested, sometimes users need to tap into their funds to finance a purchase – a painful customer journey when using one of the current brokerage-centric providers. In order to provide a convenient entry path towards productive capital and at the same time to offer unparalleled liquidity, UnitPlus has merged the concept of a payment card and an ETF fund.

How UnitPlus merges payments and investing

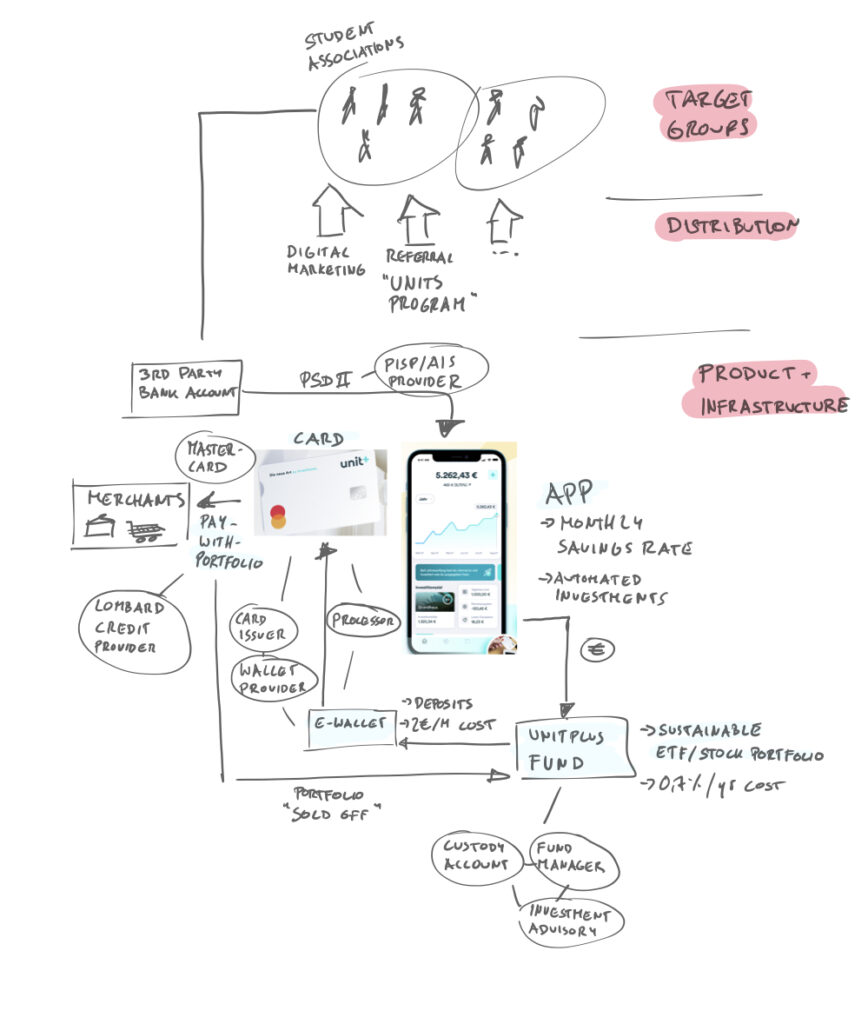

UnitPlus leverages open banking feeds to analyse a user’s monthly cashflow in order to make personalised recommendations around how much money is safe to invest. This way, capital that would otherwise stay unproductive on a current account, is automatically funneled into a sustainability-friendly ETF fund constructed by UnitPlus. The invested capital is available any time via the UnitPlus investment card, which allows to spend the invested capital on- and offline. Hence, the card is the trojan horse that brings a broad consumer base closer to the world of investing, without having to lock-up capital. In the future, there could even be a “pay-with-portfolio” checkout offered at online shops:

Schematic of the UnitPlus proposition. Source: Ross Republic

The strong growth of new fintech brokerage firms as well as new investment on-ramps by consumer fintechs like Revolut have shown that there’s strong momentum and market interest for new consumer-centric investment propositions. For more information around UnitPlus, head over to the UnitPlus website.

For a chat about digital investing, the future of wealth management and our related research and consulting services, you can get in touch with me here.