In cooperation with Holland Fintech, Accenture, Fincog and Infinium we created a new report on the Dutch banking innovation ecosystem. Based on Ross Republic’s project work with several international banks, we provided an outsiders’ view on how Dutch banks are preparing their organisations for the future.

Perspectives on the trends permeating the Dutch fintech ecosystem

The new report is a collection of insights from consultants within the Holland Fintech ecosystem that shed light on the trends and pressures active in the Dutch Fintech landscape, coupled with foresights into the market opportunities likely to prevail.

If you’re interested in our contribution, you can read the original full version here in this blog post. The report by Holland Fintech can be read here.

An outsider perspective on current innovation efforts of Dutch legacy banks

While the banking battlefield is currently getting re-configured, many European financial institutions are in search for a future-proof growth narrative. They have invested about $1 trillion over the last three years in digital transformation, which resulted in great PR, but often failed to deliver real revenue gains and merely resulted in catching-up with table-stakes capabilities.

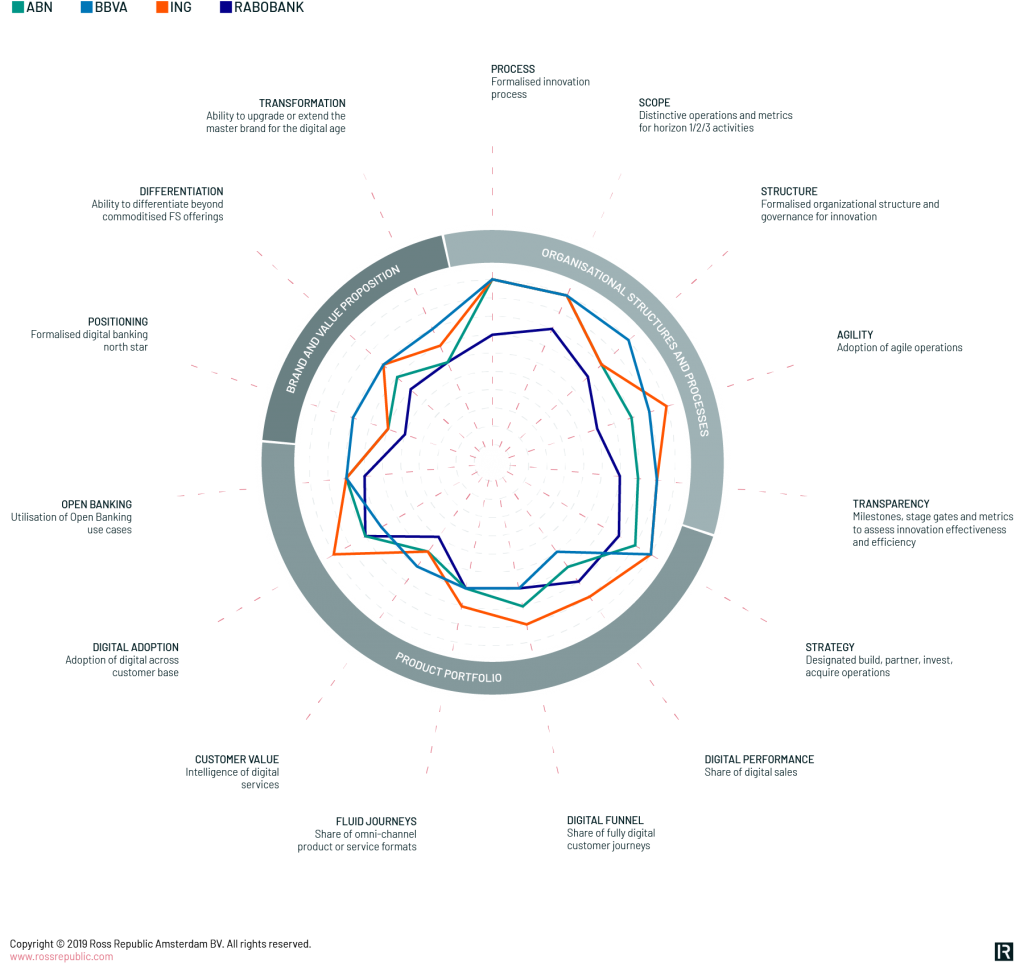

Much has been analysed about this issue, albeit the discussions often miss the point: innovation in banking is about redesigning the client experience, enabled, not defined, by digital. It’s about pioneering intelligent products and business models, as new technologies create new possibilities. In order to achieve exactly that, banks need to establish client-focused organisational structures and processes, a modern product portfolio and a brand that allows to position themselves as a credible player. We used these three dimensions to assess how Dutch banks are preparing for the future and benchmark them against the current innovation powerhouse BBVA.

The new wave of banking goes beyond banking and we believe that traditional financial institutions can own the next horizon of innovation. Dutch banks are already leading the revolution, as showcased in our study.

The data to assess each dimension originate from primary research (interviews) and secondary research, such as data available online and annual reports. We interviewed Duncan de Vries of NIBC Innovation Labs and Remco van der Veer of ING Labs, whom we’d like to thank for their valuable input.

Leaving legacy structures behind

Transformation is as much about new technologies as it is about culture. Banks have conditioned their employees for decades to be biased against change and risk-taking. However, these are exactly the skills now urgently needed to develop new competitive advantages for banks. From our project experiences with BBVA we know the bigger the bank, the more effort and budget is needed to even start such an undertaking. The Spanish banking group started organisational transformation efforts already in late 2013 with the so-called Digital Banking Area, which is a group of functional units with the mandate to boost digital transformation. Approximately 30.000 BBVA employees are trained in agile techniques and 1.500 employees function as design thinking ambassadors, just to name a few examples of the change initiation.

Faced with such initiatives, Dutch banks don’t need to hide, though. ING announced to implement agile processes, the so called one way of working (WOW) in squads and tribes, in June 2015 and has been executing the change process throughout the organisation rigorously: it’s among the first banks to roll-out agile across several countries and business divisions. Beyond that, all banks we analysed have to some degree formalised their innovation processes, e.g. “PACE” at ING, “DARE” at ABN Amro or “3-6-9” at BBVA. All of them incorporate the peak of the innovation hype-cycle: agile, lean and design thinking. Most of the banks analysed established clear activities across innovation horizon one to three. Re-skilling of employees is another integral part: all banks, except for Rabobank, have trained a large number of employees (outside of IT) in agile or design thinking. On this front, many European banking players can learn from the Dutch banks’ ability to redesign their established way of working.

Another important factor for fostering innovation is how banks embed innovation activities into their organisational structure. For instance, the turnaround at BBVA was only possible through top management commitment from day one. Similarly, innovation at ING is directly reporting to the CEO, with innovation centres of expertise integrated into business units and several independent labs around the world. ABN Amro also set up several independent labs and later pivoted to one centrally dedicated department. Smaller Dutch banks follow this trend, for example at NIBC innovation is directly supported by the CEO and integrated at the core organisation.

These transformational efforts are already paying off, for instance ING has launched several new propositions to market that have originated from internal employees.

Building scalable product platforms

Next to establishing customer-centric operating models, managing a digital product portfolio that maximises revenue potential and enables omni-channel user journeys is a pre-requisite for future growth.

Compared to European competitors, Dutch banks are among the leaders in harmonising IT platforms and leveraging digital banking features and sales channels. At ABN Amro, already more than 70% of retail sales are closed digitally. The way Dutch banks achieve this is by innovating the core business propositions through in-house build scenarios, stemming from agile operations and labs, and experimenting with partner or invest scenarios with external (fin)tech companies. For example, ING, ABN Amro, NIBC as well as Rabobank have several ongoing partnerships with fintechs, and are not afraid to exit once they prove unproductive. Beyond providing basic digital layers around the standard banking products, initial launches of actual intelligent banking services are for example Peaks (Rabobank) or Grip (ABN Amro).

Establishing a brand that customers trust

Most banks have built up their authoritative and top-down corporate persona for decades, however in the digital age it’s the end customer who enjoys the most leverage. Thus, we also had a look at how Dutch banks aim to get the brand permission that allows them to become a more credible and trusted partner in their client’s life beyond banking, which is the end-goal of building platforms and omni-channel journeys.

Most Dutch banks have industry leading NPS scores. The dual brand architecture strategy of modernising the core brand through coherent digital and hybrid customer journeys and simultaneously launching digital challengers (Yolt by ING, Tikkie or Kendu by ABN Amro) seems to work out well. However, with an increasing amount of stand-alone banking services, the challenge will ultimately be to integrate all new offerings again in order to prevent fragmented customer experiences and to build brand equity towards a single entity.

After all, no bank has yet placed a bold commitment or bet towards how the traditional bank will be positioned in the digital future.

Please find all innovation dimensions we analysed in the infographic below.

About the author