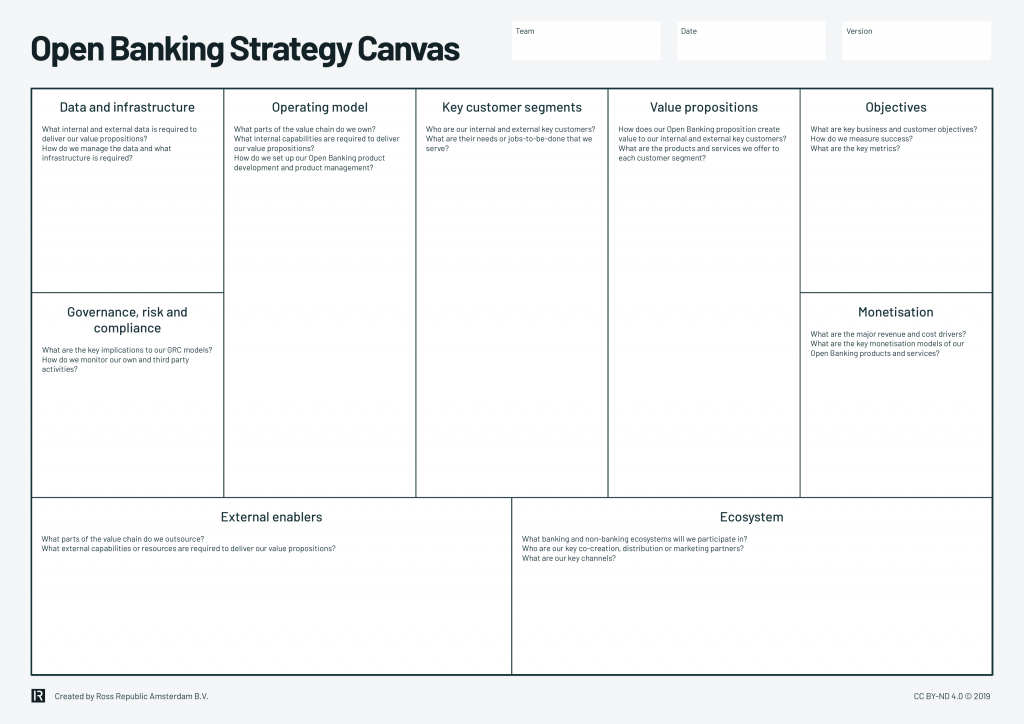

The Open Banking strategy canvas is an easy to use tool we created for any company or start-up striving to seize new opportunities from Open Banking. It helps to define the key cornerstones of an Open Banking strategy and to align assumptions of stakeholders from different backgrounds (tech, business, marketing). You can download the canvas at the end of this article.

Life after PSD2

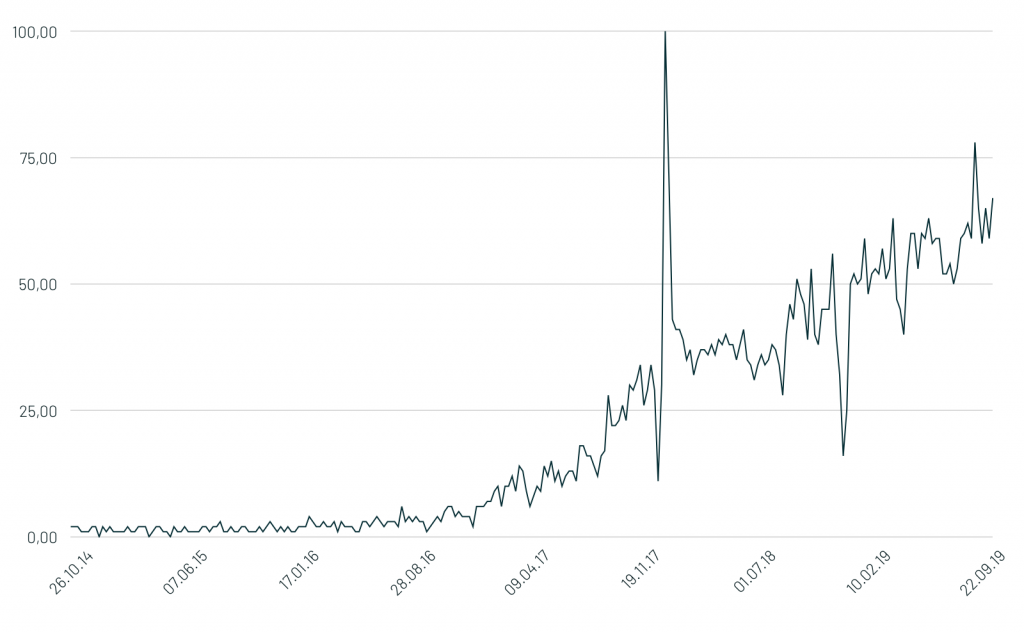

As previously illustrated, Open Banking gradually moves along the hype cycle. Google reveals that global interest in Open Banking has mainly peaked around the beginning of 2018, when the Payment Services Directive 2 (PSD2) arrived in Europe, and again last month, when the directive came officially into force.

Once the various Open Banking directives had been announced, there have been intensive discussions within the industry about possible implications and the intensified un-bundling of universal banks. While the data shows a steadily rising interest over the last years, apparently the intended beneficiaries of the Open Banking initiatives, the end-customers, have been excluded from most Open Banking conversations: more than 76% of European consumers haven’t even heard of it. Thus, now might be the a good timing to evaluate how to create customer impact through Open Banking?

A simple tool for developing an Open Banking strategy

It’s one thing to discuss about Open Banking from the sideline and another to actually develop new propositions. Based on our project experiences with banking clients we noticed that a simple canvas-approach, similar to the Business Model Canvas, would help to kickstart and streamline Open Banking initiatives tremendously. As each bank faces unique circumstances (product portfolio, tech stack, key target groups, development capabilities, etc.), the canvas provides a first overview of the key elements of an Open Banking strategy. Like similar tools, it helps to clarify the first-order assumptions of the strategy and provides an initial direction for the subsequent execution phase. While the elements of the canvas provide the first step in strategy development, it shouldn’t even be taken too seriously. Even though the input originates from market research, the overall business strategy and expert assessments, it’s worth nothing if not executed well. So keep it mind that also strategy development can be an iterative process that builds on market feedback loops.

How to use the Open Banking strategy canvas

While our last blog post introduced a simple framework for deciding whether to go beyond compliance, the Open Banking strategy canvas provides a coherent baseline for the Open Banking strategy development process. It can be applied regardless of the industry, hence large banks, fintechs, or any other company (e.g. retailers) alike should be able to utilise it.

Prerequisites

- Any Open Banking strategy needs to build on the existing growth and product strategy. These two need to be clear before planning any Open Banking activities

- There should be a common understanding of the general ambition level and risk appetite regarding Open Banking activities. These can be discussed using the RR Open Banking framework

- Open Banking is a cross-disciplinary activity spanning business, product development, marketing, partnerships, etc. Thus, creating an Open Banking strategy needs to be a team effort right from the beginning

The canvas can be divided into two major sections: all front-end, customer-facing activities are clarified on the right side of the canvas, while the back-end, operational activities are clarified on the left side. The connection and key focus between both sides are the end-customers and their needs (key customer segments):

Key customer segments

Open APIs alone do not add any value. There needs to be a clear end-goal around customer impact, which can only be created by knowing the customer’s needs and jobs-to-be-done (link). When it comes to Open Banking, there are three broad key customer groups: internal customers (internal departments who work with customer data), external partners (third parties that cooperate in e.g. marketing, product development or distribution) and external end-customers (third party developers, banking customers, your partner’s customers, etc.).

The goal of the key customer segment field is to get a common understanding of who you’ll create value for and what customer problems you’re actually solving with the help of Open Banking. Thus, the first step is to evaluate for which customer groups and which of their needs Open Banking might be the right solution.

Objectives

After outlining which segments will be targeted, it helps to define the basic objectives around business and customer impact. What are key business and customer objectives? How do we measure success? Each high-level objective should have at least one metric that will help to assess if the Open Banking activities actually contribute to reaching the objectives.

Value propositions

Next, as many high-level ideas for Open Banking value propositions as possible are ideated. What might help serving each target customer’s need better, cheaper, or faster? The ideas are clustered and new ones can be added during the whole process Keep in mind that Open Banking is all about product management: what’s the actual product that a PSD2 API provides, and for whom? What other products or services can be built around opening up or receiving additional data?

Ecosystem

You can’t talk about Open Banking without mentioning ecosystems. Open and partner APIs provide a whole new possibility space around creating value with or through external parties. Third party providers (TPPs) will utilise the PSD2 APIs anyway. How to make sure to become a trusted and preferred partner for TPPs, so that they are incentivised to create value-adding services? Who are the external partners that might become a new distribution channel? Beyond that, who might help you enhance or create new products, as account, transaction and additional data can be made available in real-time? This section aims to answer these questions, so that it’s clear which FS and non-FS ecosystems you will engage in.

Monetisation

One core aspect is to decide how Open Banking activities will be priced and monetised. Some offer open APIs free of charge, while others develop structured monetisation models per target group and use case. These decisions can be derived after clarifying the fields explained before. The most common monetisation models for APIs are:

- subscription fees

- pay per use

- tiered pay-as-you-go

- revenue-sharing

Internal usage of APIs of course contributes to enhanced product development, faster go-to-market and improved efficiencies, and cost savings.

Operating model

There are various ways to engage in Open Banking activities. Hence, defining which parts of the value chain will be owned and which parts will be executed by others helps to understand the internal requirements. What current capabilities can be utilised and what needs to be built up?

External enablers

External enablers are the partners that help to implement and to get Open Banking activities to the market, such as aggregators, plug-and-play solutions, or simply external development teams.

Data and infrastructure

Open Banking moves the competitive advantage from owning data to how data is utilised. Hence, this field clarifies what internal data will be opened up and what external data is needed to deliver the value propositions. Beyond that, how will the data be managed and how feasible are the initial ideas based on the currently deployed infrastructure? The point here is not go into technical discussions, but to provide a first assessment of what’s realistic. That’s why when developing the strategy, technical input is mandatory.

Governance, risk and compliance

Finally, as banks and any other TPP that uses PSD2 APIs is a regulated entity, there needs to be a first understanding of how Open Banking activities affect the current GRC models. Often cited examples for this field are e.g. data security, TPP risk assessments, and GDPR.

Kick-off your own Open Banking initiatives with the Open Banking strategy canvas

Before going into execution mode it helps to clarify the basic assumptions about how Open Banking will lead to increased customer impact or business value. Therefore, we developed the Open Banking strategy canvas to kick-start strategy sessions and to involve different stakeholders in the strategy process. Each field can be developed as thoroughly as it needs to be, however, the value lies in the execution.

That’s why we always try to combine the strategy development with subsequent Open Banking pilots. After defining the strategy, we prioritise the top Open Banking pilots, which are then tested directly with partners and end-customers. This way the strategy is informed by direct market feedback and ultimately the winning pilots can be confidently implemented and scaled further.

Download the Open Banking strategy canvas for free below:

We’re planning to further iterate the Open Banking strategy canvas. Make sure to contact me if you have any suggestions for improvements or if you like to get to know more about our agile strategy process.

About the author