As a part of our latest white paper release with Tuum, we have invited Andres Kitter, Head of LHV UK, as well as Tuomas Toivonen, Co-Founder & CEO at Holvi, to discuss how advancements in technology have radically changed tech vendor sourcing approaches.

We have recently teamed up with Tuum to create a new white paper called “It’s time to build! Making the right technology choices to enable true business transformation in banking”. In the paper, we invite you to discover the most important market shifts happening in banking and fintech, the key technologies driving the industry forward, emerging business models as well as what to look out for when choosing a core banking solution.

You can check out the white paper directly via Tuum here.

It’s time to build! Webcast episode three featuring LHV and Holvi

The “It’s Time to Build!’ webcast is a three-part series exploring some of the key findings in our white paper, featuring speakers from some of the most exciting and innovative players in the financial services industry. The third episode illustrates how a modern technology vendor evaluation process should be designed as well as the key factors to consider along with it. Moderator Adrian Klee of Ross Republic is joined by Andres Kitter, Head of LHV UK. LHV is an Estonian financial group offering a full suite of banking services and is the only provider capable of granting customers to both instant GBP and Euro payments directly. It’s the trusted partner for payment service providers for years, servicing a variety of companies, from fintech unicorns to established financial institutions. Previously, Andres was working for over 6 years at Skype as Payments and Billing Partner Manager. The second guest is Tuomas Toivonen, Co-founder & CEO at Holvi. Holvi offers freelancers and small businesses a home for their finances. With a business account and Mastercard, invoicing and bookkeeping tools all in one place, Holvi simplifies the time-consuming distractions of financial admin, helping business owners to manage their balance. From Tuum’s side they we’re joined by Rivo Uibo, Chief Business Office and Co-founder.

Rethinking technology procurement in banking

To generate new growth and transform a business, it takes a deliberate strategic decision about which digital business models to line up against and how to win in the chosen segments. As we have outlined in Episode one and two, winning in the current market environment demands that banks value technology as critical enabler of new business models, such as fully digital bank or platform plays. Yet, the predominant business models underpinning most banks have remained largely unchanged. In order to mitigate this issue, digital transformation in banking should not only focus on deploying new technology per se, but simultaneously take a strategic business model assessment into account. This consequently means that banks and fintechs should adapt strategic vendor assessments accordingly: New service models provide flexible access to infrastructure, software and processes (SaaS), which allow banks to follow best-of-breed approaches, i.e. combining specialised providers wherever required instead of going for the biggest and most established vendor.

In the past, when system integration was rather difficult and risky, the big traditional vendors had an advantage due to their extensive product offering. Today, thanks to new tech (cloud, APIs, microservices), why wouldn’t you choose the best of breed, e.g. for AML, underwriting, processing or customer servicing? With an ever increasing amount of specialised fintech vendors at growing maturity levels, the availability and reputation of suitable solutions is not a limiting factor any longer and presents an opportunity to move from a one-stop-shop to best of breed sourcing approach. In this episode, we discussed the aforementioned issues and how strategic vendor sourcing can take these considerations into account.

Navigating the current fintech vendor landscape

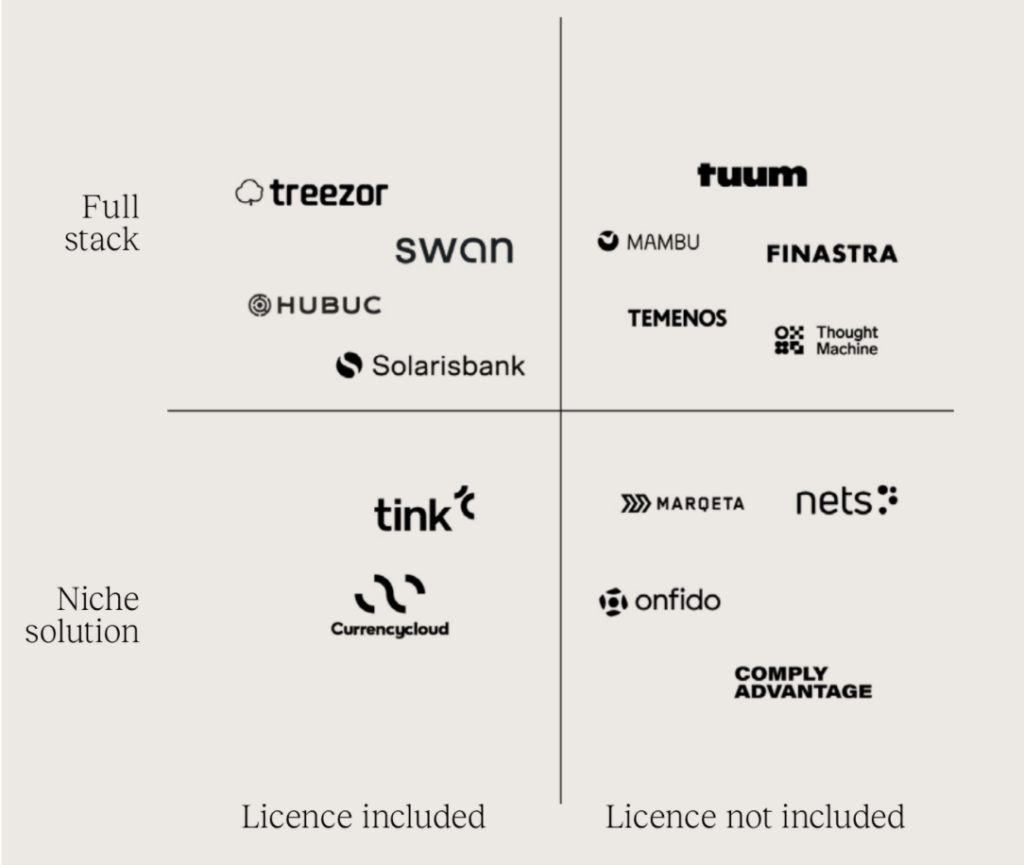

New breeds of banking service and software providers have emerged that enable banks, fintechs, and in fact any brand to launch digital banking business models. Many of the successful fintech infrastructure players actually emerged by empowering a handful of early-stage customers that achieved hyper-growth, thus resulting in high growth rates of the underlying infrastructure provider itself, a topic we discussed in our podcast “Rethinking B2B fintech concentration risk“. On the surface, most modern fintech infrastructure providers seem to offer similar services, such as the ability to offer integrated bank accounts or payment cards. However, the nuances and delivery models can vary significantly, which makes it challenging for the buyer to truly evaluate a vendor’s specific business model and tech execution fit. The framework proposed in our white paper provides a first segmentation of providers, dividing them into full stack vs. niche solutions as well as licensed vs. non-licensed providers:

Schematic of fintech infra providers. Source: RR & Tuum

In our third webcast, we addressed the current provider landscape by explaining some of the common misconceptions around core banking providers vs. Banking-as-a-Service providers vs. the large amount of smaller niche players (e.g. for risk analytics or digital KYC). Furthermore, Rivo outlined the key points to consider when choosing which provider will best equip your business to compete in the digitally enabled future of banking.

Have a look at the full episode below:

About the author