In the ever more global and digital marketplace, three things matter in growing business regardless of the industry. Customer-centricity, agility and size. Customer-centricity and agility for keeping the offering relevant to evolving customer needs. Size for know-how, sharing the cost of business transformation and increasing bargaining power.

Elusive high-performing deals

It is no wonder that the transaction volumes of the global M&A market reached $4.1 trillion in 2018. It is the third highest year ever for M&A volumes, and in 2019 the M&A activity is expected to remain strong.

The end-goal in every M&A transaction between established businesses is to achieve a long-term edge in the marketplace as well as increase shareholder value. After the deal, the two companies together should grow faster and be more profitable than they would be as stand-alone entities. After all, they now have greater industry know-how, stronger market presence, a more extensive and more diverse customer base as well as a more versatile product and services portfolio. They also can reach greater efficiencies by streamlining operations and having higher ROI as they share the burden of business transformation and digitalisation costs.

Despite all the pre-deal expectations, in less than 30% of the M&A deals the acquirers were able to consistently grow the combined businesses over industry growth rates. Why are so few deals high-performing deals?

The insights shared in this blog post stem from the learnings gained from working with a global B2B supplier. It had made a horizontal acquisition to strengthen its business footprint. Furthermore, the company aimed to accelerate its business growth in product categories in which it was underperforming as well as in geographic markets in which it had struggled to gain foothold.

Is your ambition to optimise, leverage or energise?

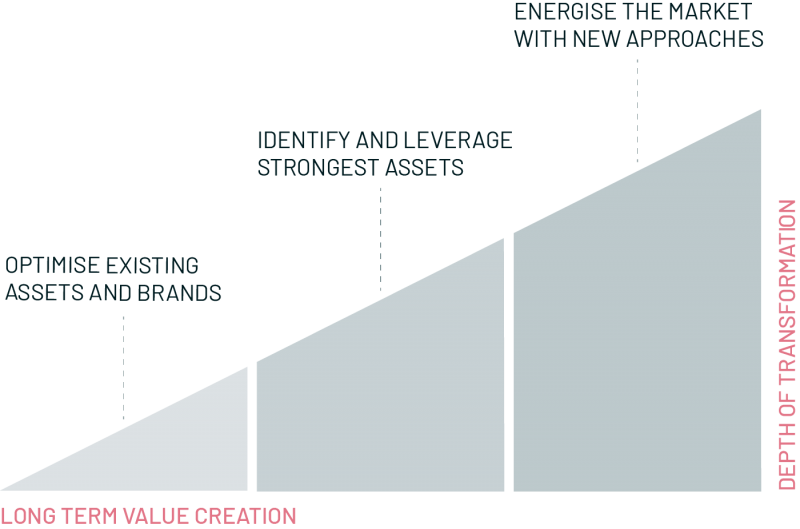

A sound starting point for detailed pre- and post-deal planning is to define an ambition level for business strategy and tactical planning, such as product and service portfolio planning, go-to-market, brand architecture and customer experience design.

First, based on the information available, does the management team believe that the businesses combined will achieve a long-term edge by merely optimising and leveraging existing assets? Second, does the anticipated post-deal high-performance require the management team to unlock new opportunities available as a result of the deal, and prioritise which of them have the highest growth potential? Third, is the end goal to energise the market by innovating new offerings?

Optimising and leveraging status quo is a dangerous path. Based on the post-deal performance analysis conducted by global consultancies, it is also a preferred but wrong route for many companies. Many of the well-established B2B businesses are not yet future-proofed. They are still on their journey towards greater customer-centricity. Also, the bulk of revenues in most industries come from traditional sources. To ensure that the two businesses have a solid joint strategy for long-term value creation, they should let go of the emotional legacies and embrace the new market opportunities opening up to them.

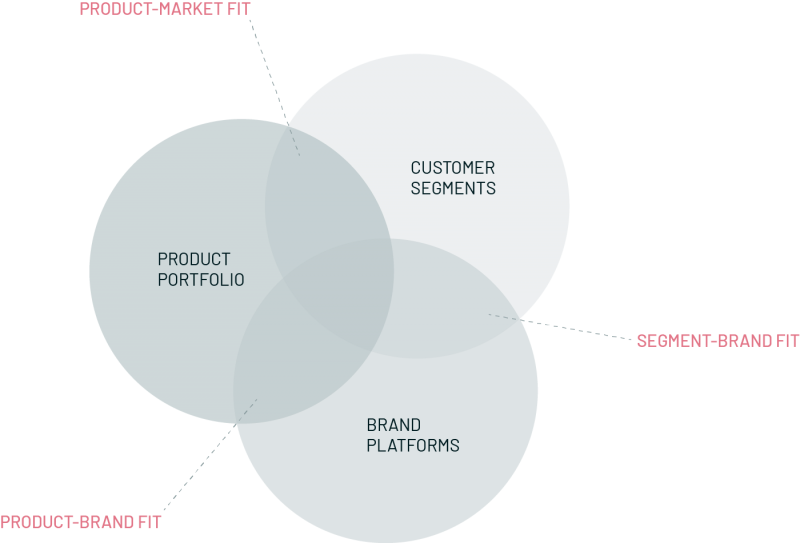

Introducing three growth fits

Once the management team has decided a suitable ambition level, it is time to move to three fits. Their function is to support growth, maximise efficiency, enable effectiveness, manage risk and change culture.

Product-market fit

What value propositions and price points meet the needs of attractive customer segments? Do the value propositions and price points vary in different geographic target markets, say in Europe and Asia?

The challenge for European companies with a globally known and strong brand is to be global and local in their value propositions and offerings. For emerging markets with lower spending power, they often need to create a considerably cheaper product line that still manifests the values and benefits of the global brand.

Segment-brand fit

What kind of brands are needed to connect with the target segments? If business growth in different geographic target markets requires different price points for the same product, how can strong European brands in Asian markets be leveraged without diluting the brand value in the home market?

Companies should protect and leverage all accumulated brand equity while having as few brands as possible. The sheer cost of maintaining brands is forcing to look for simplicity. The challenge is to acknowledge which of the brands in the combined brand portfolio truly have growth potential, either as-is or after their repositioning. Another challenge is to manage risk. Even if the brand did not have significant growth potential, it needs to be phased out without confusing existing high-value customers. The answer lies in creating a coherent ecosystem between all the brands needed for stability and growth.

Product-brand fit

What products and services are offered under each brand? How to ensure that every product and service meets the expectations arising from past experiences and new brand promises?

When defining optimal product and service portfolios for each brand, it is essential to remember that a brand is the face towards its target segments and should have not be tied to organisational structures or business models. In times of rapid change, a modern brand should be designed to embrace change and facilitate different business models.

Getting it right

The first criterion in a successful growth-oriented deal is whether the companies have solid data available and an ambitious yet realistic view of their market challenges and new opportunities by customer segment, product, region or brand. The second is whether the management succeeds in formulating an exciting joint vision, which is backed up by a realistic roadmap and supported by the board and shareholders. The third one is whether they succeed in transforming the business to capture that growth. The challenge is to get all three right.

____

This post is the first of three-piece series about business growth and brand architecture related issues. In the second post, I will look at the acquisitions of non-equals. In these cases, the main goal is to transform the acquiring company, not to grow revenues fast. In the third post, I will examine what kind of B2B branding architecture models and brands best support the growth of B2B brands.

Sources

Harvard Business Review, June 2016, Roger L. Martin: “M&A: The one thing you need to get right,”

https://hbr.org/2016/06/ma-the-one-thing-you-need-to-get-right

FT: Global M&A activity hits new high.

https://www.ft.com/content/b7e67ba4-c28f-11e8-95b1-d36dfef1b89a

JP Morgan: 2019 Global M&A Outlook.

https://www.jpmorgan.com/jpmpdf/1320746694177.pdf

Deloitte: Mergers and acquisitions for growth.

https://www2.deloitte.com/insights/us/en/industry/retail-distribution/global-ma-trends-consumer-products-growth.html

Deloitte: The state of the deal M&A trends 2019 .

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/mergers-acqisitions/us-mergers-acquisitions-trends-2019-report.pdf

Deloitte Review, Issue 11 | 2012: Growth through M&A. Promise and reality.

About the author