To kick off 2022, we asked some of our core team members to share their opinions on the trends and developments that business leaders should have on their map entering the new year. In this post, Partner Maso Arai explores the shift towards open ecosystems.

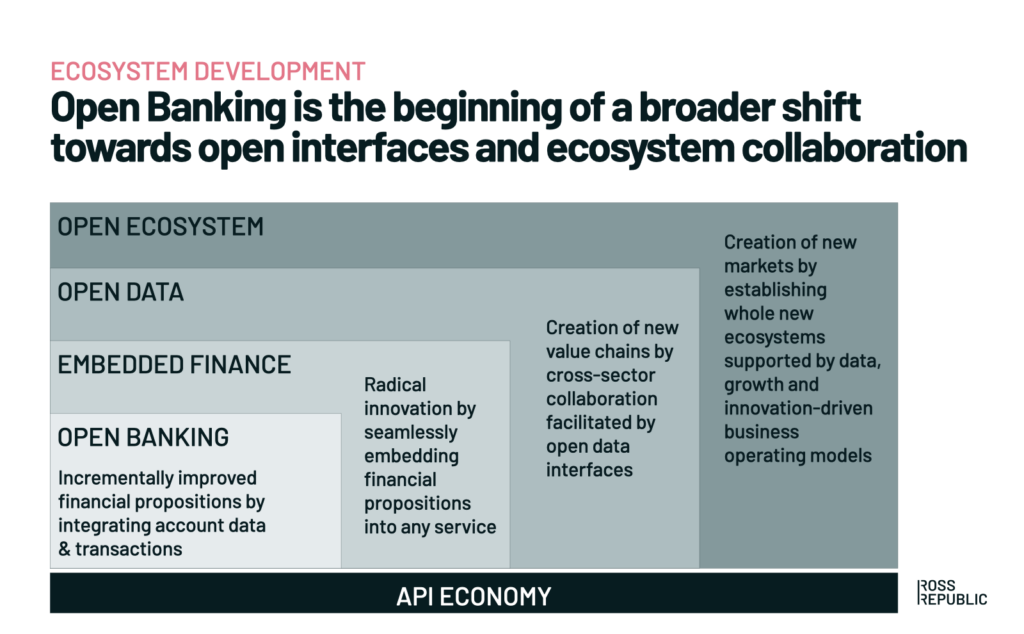

In my view, everything related to breaking down boundaries and making industries and the actors within more open has become a significant trend in financial services. Therefore, I would like to highlight four different angles, from open banking, embedded finance, open data to an open ecosystem.

The shift towards open ecosystems

When it comes to open banking, there are at least four types of players in market:

- Fintechs/startups that embrace open banking to do more business and gain their share of the market. There are plenty of examples here, ranging from personal finance management to instant consumer loans

- Banks that have heavily invested in building up open banking capabilities and now look into how to make it useful for customers and make it profitable

Banks that do only what is necessary from a regulatory perspective and lack the vision and strategy to see beyond regulation and cost - Non-financial players, like Huawei, who have seen the opportunity to tap into the financial space by using the open banking infrastructure

Embedded financial services is the next logical step, which allows any brand to seamlessly integrate a financial service into its own customer journeys. We have seen a certain level of boost in 2021 for both consumers and SMEs and we are yet to see plays for corporates. In most use cases, embedded finance has emerged as credit/lending services offered in collaboration between a financial and a non-financial service provider. It is more than that, isn’t it? Thinking of it as broad as embedded finance services means as a consumer, a freelancer and/or SME having access to and capability to use e.g. bank account, credit, lending, wealth management and more from the very everyday non-financial applications used to manage life and business. Will this make e.g. banking apps and digital banking irrelevant and/or make banks behind the scene players? Eventually, I believe most banks or banking services providers will become behind the scene players where the frontend layer is a non-bank/financial service provider – unless banks tune their purpose and strategy towards becoming a real ecosystem player.

Open Data is the new “oil” or “gold”, this saying hasn’t changed. What has changed and will keep developing during 2022 more rapidly is the number of financial, non-financial players, institutions, and governments that either alone or together lead the way towards utilisation of data from different sources for multiple purposes of common good for society, economy, businesses and individuals. MyData with its 100 organisation members and close to 400 individual members from over 40 countries, on six continents is an excellent example. Another brilliant development happens within corporate focused trade finance services. They are traditionally very heavily paper based with the need of multiple financial and non-financial players to engage and interact with each other. This space is going through an innovation cycle that it hasn’t seen for decades. Whether it is blockchain-driven, such as We.Trade, or API-driven, motivated by emerging open data and technologies (like SEB and Wärtsilä Corporation by Digital living international Oy) it is here to shift trade finance for good.

Lastly, there is the Open Ecosystem vision. It takes time, but it is on its way as banks, fintechs, and non-financial institutions are comprehending the fact that digitization has been mainly a mean, a cost-driven transformation, to a bigger play with winners being the ones understanding that the profit lays within eCommercialization of financial services. Getting there alone by doing/building more or less everything in-house is possible, but is it smart, deliverable within reasonable time, and will it ever generate the needed value to customers to become profitable? I doubt it. When it comes to the future of financial services and servicing customers directly or indirectly, establishing a strong ecosystem partnership supported by customer data, growth and innovation-driven business operating models will deliver real value and competitive advantage. Does your bank or financial service provider organisation have an ecosystem strategy and business operating model for it, do you know where and how to play in the new network of value chain, how to shift mentally and operationally from digitalization to eCommercialization? Top executives all the way up to the Board of Directors need to give these simple questions serious thoughts and actions.

We at Ross Republic have created and used our Elevator Boost model combined with ecosystem thinking to help organizations answer these questions. You can get in touch with us here.

About the author

PARTNER, ECOSYSTEM FINANCE

Maso Arai

Maso is a lifetime learner with predominant skill sets in outside-in ecosystem thinking and business development facilitating organizations and their top management to explore and exploit resilient commercial cultures. He has a background in Trade Finance, Fintech and Consulting, and specialises in ecosystem strategies and super apps.