Due to the rise of extensive digital ecosystems and financial super apps, Asia is a forerunner of open banking. This post provides and overview of the latest open banking developments in Asia, key players to look out for and implications for European banks.

Open banking developments in Asia

Open banking enables the connectivity between financial institutions, new fintech players and other firms from outside the banking industry. The increased interconnectedness and data sharing between these parties aims to increase competition within the financial industry and improve client access to financial services.

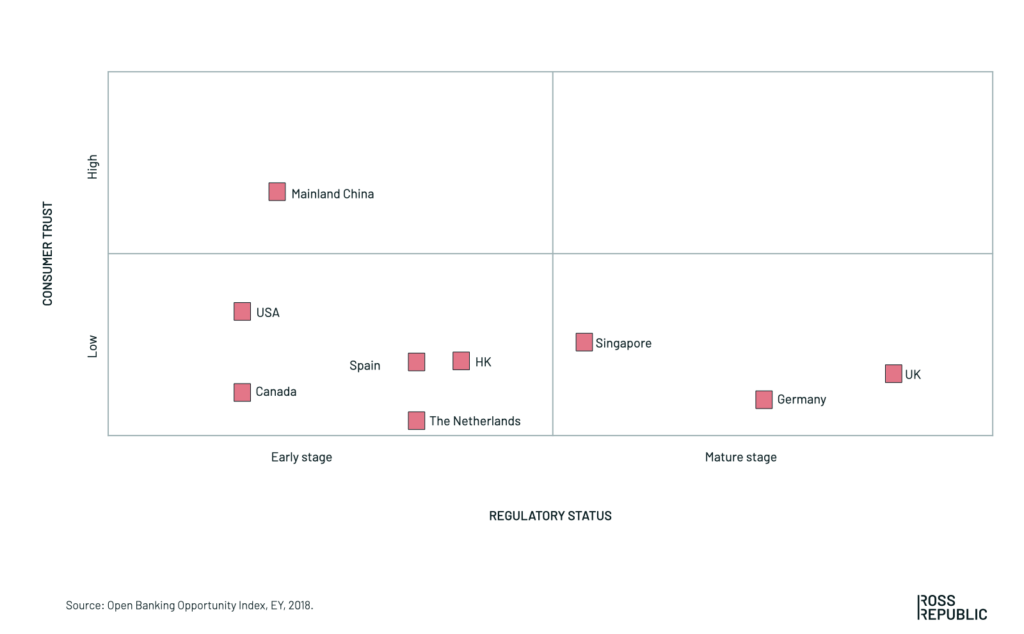

One of the biggest differentiators and aspects that influences the speed of API adaptability and innovation among parties in Asia vs. Europe is regulation, with its respective advantages and disadvantages. In Europe, open banking has largely been driven by the regulatory bodies, such as the Second Payment Services Directive (PSD2) in Europe and the Open Banking regulation by the UK Competition and Markets Authority’s (CMA). Such regulations forced banks by law to offer certain data types (account and payment data) via APIs to regulated third parties. In contrast to Europe, open banking in Asia is often driven organically by consumers’ willingness to share data, a high digital adoption rate and a culture of digital innovation:

China scores high on the consumer trust dimension

The key driver of open banking in Asia is mostly of commercial nature. Thus, financial institutions as well as technology firms swiftly implement open banking use cases by building on the key foundations of open banking: innovation, client-centricity and interconnectivity between financial institutions, fintechs and non-financial firms. Particularly in China, many banks are at the forefront of this trend and freely build out data infrastructures even without regulatory directives. Consequently, they are forming new client expectations and behaviours via digital financial customer journeys that build on open banking principles.

Large Chinese tech companies are leading the way

The Open Banking Opportunity Index from above shows the starting point of China’s open banking journey in 2018. In the last two years, API development has been growing exponentially with Alipay and WeChat Pay leading the way beyond China. For instance, Alipay’s 2020 11/11 Singles Day shopping festival generated 74$ billion in sales in just 24 hours.

“Most reporting focuses only on the surface, i.e. the shopping behaviours and financial metrics. However, below the shopping interface lays Alibaba’s platform that connects to multiple backend systems beyond payments: Alipay is not just using APIs to connect to other banks and fintechs, but to all merchants and corporates in order to enable one coherent, smooth B2B, B2C, C2B, P2P, etc. customer journey.” – Maso Arai, Advisor at Ross Republic

Similarly, China’s Ping An, Tencent and Ant Group are building their own API-driven fintech businesses. Ping An launched the platform Gamma O last year, which is part of its OneConnect technology offering. Gamma O is essentially an intelligent open platform for financial institutions, aiming to connect them with technology service providers. It aims to create an intelligent and open fintech ecosystem in order to enable the growth of open banks.

“Our merchant service platform connects millions of retail merchants to a network of financial institutions that offer payment services, account management, and merchant and consumer installment loans. We also use the platform to direct high-quality SME leads for loan products to our customers.” – OneConnect about its merchant service platform

Tencent operates the WeChat app, which has expanded from a messaging service to a platform that offers a variety of services, including mobile and online payments. Beyond that, Ant Group, the former payment unit of Alibaba Group, launched the popular mobile wallet Alipay that is used by over 1 billion people and captures over fifty percent of China’s 29$ trillion digital payments market. Ant Group has expanded beyond payments and is currently the largest provider of online consumer loans in China. Beyond loans, the platform successfully sells investment as well as insurance products.

Singapore, Australia and Hong Kong are pushing their own open banking agenda

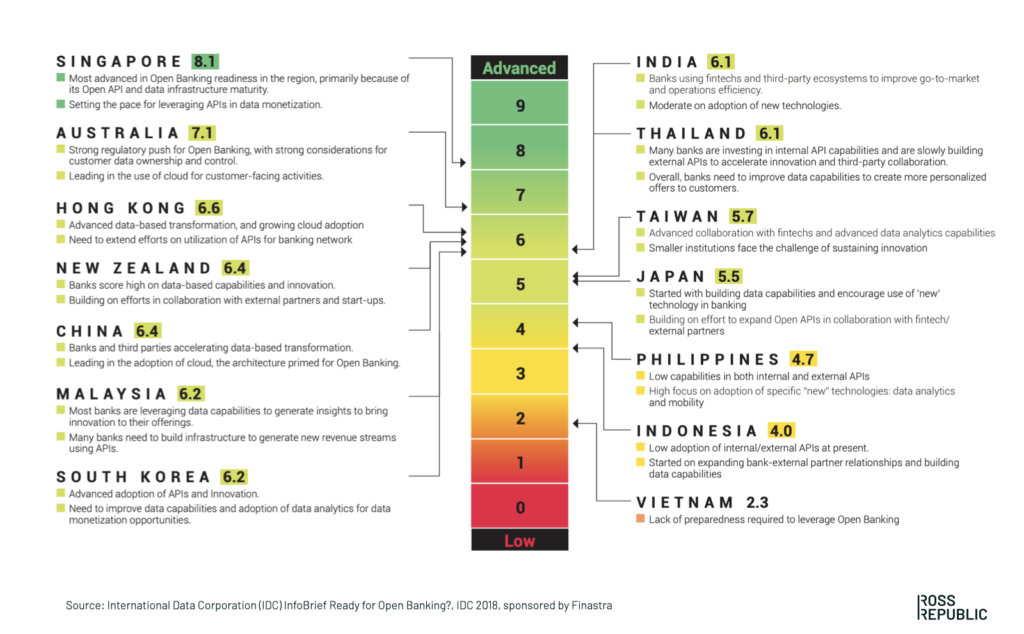

Next to China’s extensive digital ecosystems, according to International Data Corporation’s (IDC) Open Banking Readiness Index Scorecard, Singapore, Australia and Hong Kong stand out as progressive open banking markets.

A low score on the index means that the analysed banks showed a lower adoption of APIs and are in the early stage of data-based transformation and innovation. Advanced markets already had a higher adoption of APIs, more partnerships between banks and third-parties, and are in a more mature stage of data-based innovation.

Singapore, Australia and Hong Kong stand out as progressive open banking markets

The regulatory bodies in Singapore, Hong Kong and Australia have been recognising open banking frameworks and directives as an important mechanism to boost open banking ecosystems in their home markets. For instance, the Monetary Authority of Singapore (MAS) was the first regulatory body in Asia-Pacific to release an API Playbook. Singapore’s API Register has since logged 238 transactional and 279 informational APIs. In 2018, the Hong Kong Monetary Authority (HKMA) published an open banking API framework as well. Since 2019, around 20 banks in Hong Kong have launched more than 500 open APIs for product information, loans, credit cards, and other applications. Australia has launched the Consumer Data Right (CDR) legislation in July 2020, which obliges the four largest Australian banks to share their customers’ data upon request.

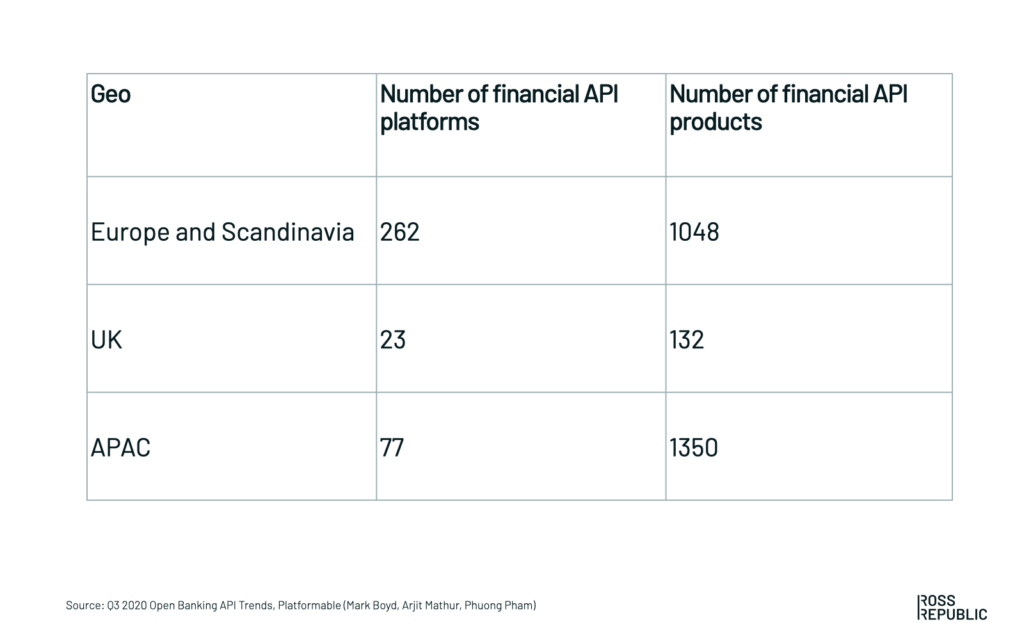

As a result of the aforementioned market forces and regulatory developments, the Asia Pacific region (APAC) now offers the largest number of financial APIs globally:

APAC offers the largest number of financial APIs globally

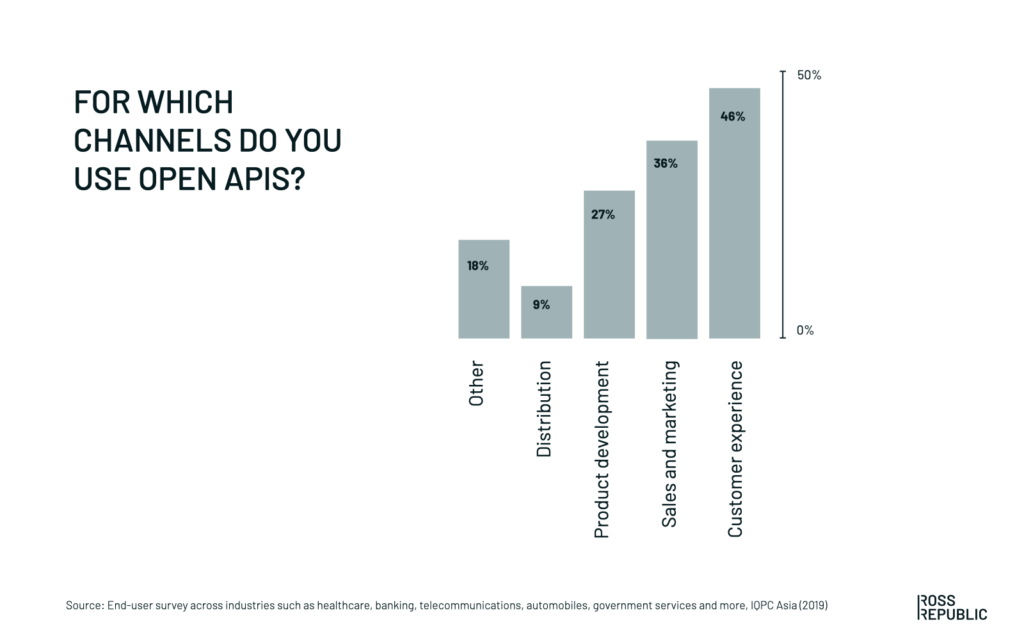

Priorities and challenges in Asia’s open API journey

Open API use cases gradually become more widespread, as a growing number of Asian companies across industries have established strategies that utilize open APIs, or having already entered the early stages of implementation. In a recent survey by International Quality and Productivity Center (IQPC) Asia, business respondents said their application of open APIs were primarily seen in the areas of customer service (46%), followed by sales and marketing (36%) . Nearly a third (31%) were in the process of open API expansion, and 8% had fully implemented open API systems. Asked to rank their concerns when it comes to implementing open APIs in their organisations, the majority of the respondents (40%) listed security and data protection as the most important.

Key priorities for Asian corporates when using open APIs

Open banking benchmarks to know

DBS, Standard Chartered as well as Citi stand out as early adopters of open banking in Asia.

DBS

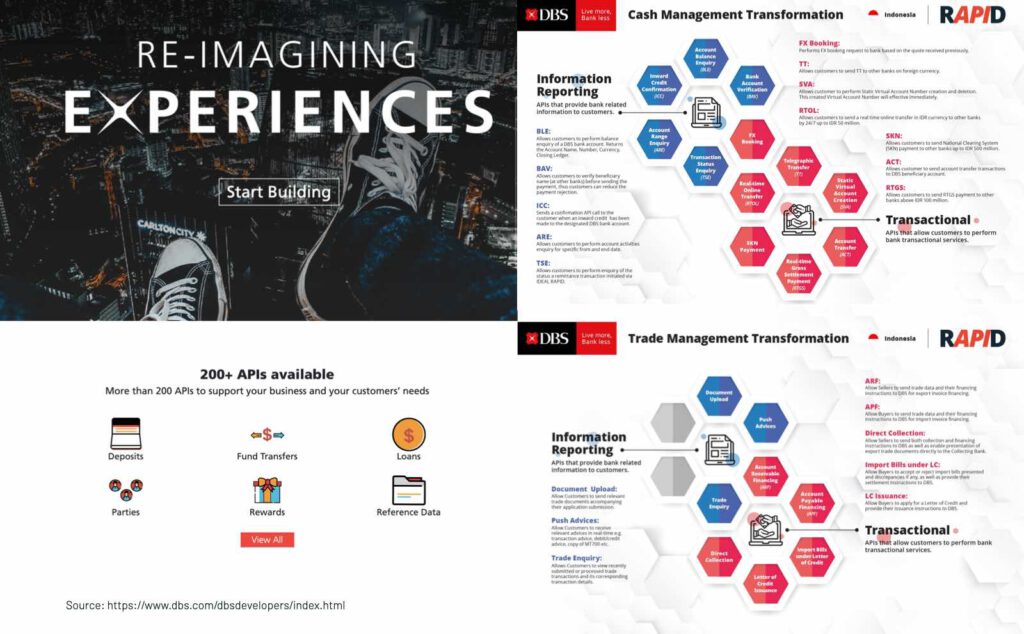

DBS started out, in a similar way as many other financial institutions, by connecting internal APIs. Afterwards, it launched its API developer hub in 2017, which is now one of the world’s most extensive API developer platforms with over 200 APIs that are used by already more than 50 companies.

DBS offers over 200 APIs

For Corporates, DBS offers a service called Rapid (Real-time API by DBS), which includes:

- Workflow APIs: interoperability payments, Cloud ERP integration, Direct Debit Authorisation, Bank Statements Provisioning

- Transactional APIs: Remittance Payments, Low Value ACH Payments, Real-time Payments, FX Booking, Real-time Collections, eACH

“We serve more than 1.2 million customers a week in Singapore. The DBS API partnership has helped us to speed up the process of payments so that our customers can focus on enjoying their meals. Speed is essential in this process, and we’re delighted that banks such as DBS are exploring the use of digital capabilities to smoothen such experiences.” – McDonald’s spokesperson

Currently, banking services that have integrated on DBS RAPID are:

- Account Information Services such as : Balance Enquiry, Account Status, Bank Account Verification and Inward Credit Confirmation (incoming fund)

- Payment / Transfer Services: Account Transfer within DBS Bank, SKN, RTGS,Telegraphic Transfer (SWIFT), Real Time Online Fund Transfer via ATM Bersama network and Virtual Account (VA) Online Creation

In the future, DBS stated to integrate existing banking services, such as Foreign Exchange (FX Booking), Trade and Tax Payments.

aXess by Standard Chartered

Standard Chartered, as one of the leading money-issuing banks, is part of in a taskforce that defines standards for open APIs under the Hong Kong Monetary Authority’s effort to make such APIs mandatory. Its open API platform aXess offers 82 corporate APIs.

“Our corporate clients use API services to initiate real-time payments and also to get real-time debit/credit notifications. This helps our clients with improved liquidity and working capital management.” – Martijn De Jong, Managing Director at Standard Chartered

Citi

Launched its global API developer hub in November 2016. Use cases include account management, person-to-person (P2P) payments, money transfer to institutions, Citi rewards, investment purchases, and account authorization. Citi’s institutional APIs include 147 APIs, which are so far used by around 580 clients.

“An online payment gateway service provider was able to integrate multiple banking products and payment types in a single API instruction. This has helped the client achieve a more efficient and faster payment processing.” – Citi

Bank’s in Asia are leading the way

Even without strong regulatory mandates, Asia‘s tech companies and banks are fully embracing the benefits that an open data economy can generate. They have already built massive cross-industry ecosystems serving billions of users that are willing to share data in exchange for better services. The orchestration of ecosystems is often cited as a new moat with the greatest business impact potential, however financial institutions should not underestimate the time and effort needed to get there.

Implications for European banks

So far, European banks heavily focused on taking existing products and making them available in digital channels. Next evolutionary steps are new digital banking solutions that have been digitally re-designed from first principles. Next, developer platforms allow to share newly built data and capabilities with the outside world, while marketplace models allow banks to integrate third-party solutions.

Even though direct analogies cannot be drawn for European financial institutions, they can learn a lot from the willingness to invest in new ecosystems and platform business models as well as the innovation savviness by their Asian counterparts.

A few key questions for leaders at European financial institutions to kickstart their open banking journey:

Client needs: How could banking and beyond banking data unlock new value for your clients? Could you integrate additional solutions to streamline your client’s customer journey?

Key partners: Which parties would need to work together to make it happen?

Closed vs. open product portfolio: Do you prefer delivering proprietary products via proprietary distribution channels? Or are you willing to either open up your own banking data and capabilities via third-party channels, as well as integrate third party products?

About the author