A deep-dive analysis of European fintech players offering new digital business banking services for SMEs.

Several well-funded fintech companies that exclusively focus on serving the freelance or SME market segment have been founded in Europe over the last years. For instance, Paris-based Qonto raised €136 million million, London-based Tide raised €156 million and Amsterdam-based Finom recently raised €17 million in venture capital. Given the remarkable market opportunities in SME banking, which we explored in the last post, this one dives deeper into fintech companies that shape the European business banking market.

Rather want to listen to our thinking on the future of SME banking? Check out our latest podcast episode: The future of banking services for SMEs

A deep dive analysis of Europe’s SME fintech players

Creating winning future strategies requires an in-depth understanding of how the next generation of business banks approaches the market. How do they position themselves? Who are their target customers? What features differentiate them?

In order to answer these questions, we analysed the market and put together a comprehensive list in airtable containing 30 key players that are actively operating in Europe and are mainly targeting sole traders or SMEs. The research was intentionally focused on fintechs offering daily business banking, such as payments, business current accounts and cards. Niche solutions, such as expense management tools like Moss or Pleo, and Banking-as-a-Service providers have been excluded. The research sample intentionally provides a snapshot of a broad variety of emerging banking business models. Going forward, more SME focused fintechs will be included, so please contact us if you have any suggestions.

The airtable offers key data of each fintech company, such as a snapshot analysis of their business and offering, their strategic way to play, a link to the company homepage, founding date, active markets, licensing, total funding, number of business clients and number of employees, clients per employee, account tiers and pricing, main revenue streams, UX snapshots, recent advertisements, target customer segments, as well as a full feature set comparison and notes on differentiating features.

You can access the airtable directly or have a quick look below:

Overview of Europe’s key SME fintech companies

Key highlights of the market analysis

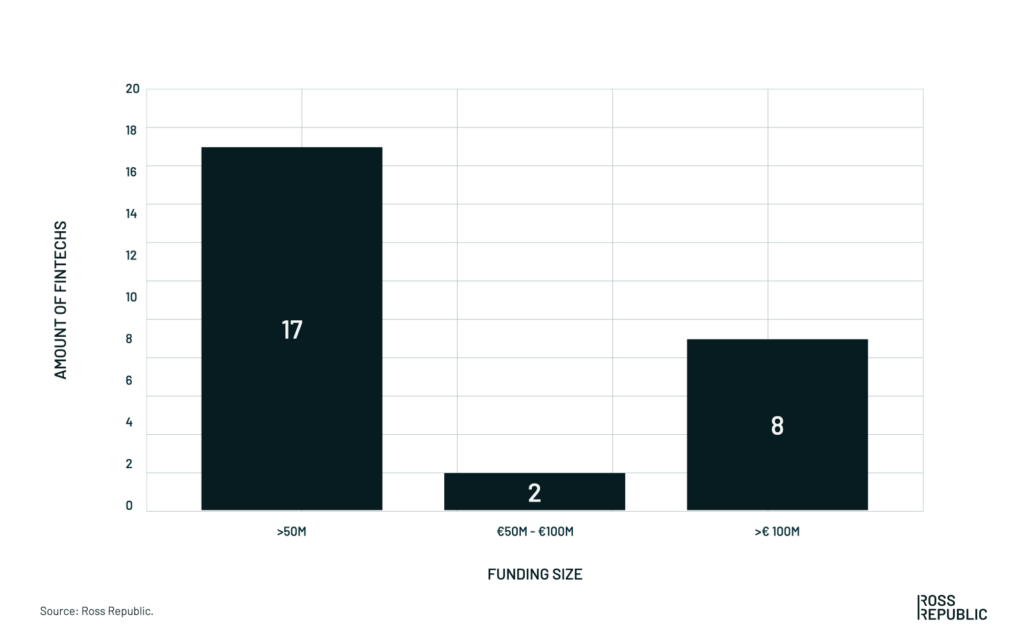

SME fintech has become a major force in the industry. The segment is now a key focus for VCs that bet on fintechs as the winners of the large SME segment opportunity in Europe:

Total funding sizes of the analysed fintech comanies

Beyond attracting major funding rounds, here are a few of the key highlights that we uncovered in our market research:

- The median founding date of all analysed fintech companies is 2015

- The fintech companies are active in over 48 countries, mostly driven by expansion efforts of N26 Business and Revolut Business

- Licensing strategies differ greatly: accounting- and admin- focused apps are running on whitelabel Banking-as-a-Service (BaaS) partners, while fintech companies with strong financial services value propositions are usually acquiring a full banking license

- Total funding tops over four trillion euros, however not all companies disclosed their external financing rounds

- In total, the fintech companies included in our analysis serve almost 2.5 million business clients and employ over 35.000 people

- Most pricing strategies follow land-and-expand strategies, i.e. offering an anchor product with limited features for free or at low cost and premium account tiers on top. Most providers rely on subscription fees and interchange fees, and a few select ones on net interest income

- The feature comparison shows how crowded and competitive the business banking space has become. Just to reach feature parity with a standard business banking fintech company requires a lot of development resources up front

Ways to play – how SME fintechs create value

After analysing the value propositions of each fintech company, we deconstructed their ways to play, i.e. common strategic archetypes that explain how the company provides value to its customers:

- Orchestrator: Leverages mostly proprietary solutions to offer highly integrated and tailored services to become the one-stop-shop and own the primary client relationship.

- Aggregators: Similar to the orchestrator, provides the convenience of a one-stop solution by aggregating several third-party data and solutions that fully address customer needs to become the primary client interface.

- Value player: Offers basic products that meet all hygiene expectations, often at low prices or at great value compared to competitor offerings. Not a first-mover, rather slowly adopts proven winning ideas.

- Innovator: Often a first-mover that continuously ships new and creative business models, products and features that shape the market.

- Product manufacturer: Offers banking products out-of-the-box and operates the underlying financial services infrastructure that is embedded in third-party environments. Does not actively own the end-client relationship.

The nuances and underlying objectives of the identified ways to play demonstrate that there is no standard approach to building a business bank. The first generation of SME fintechs have become successful by making the traditional incumbent banks’ offerings digitally available. Further, they create operational efficiencies by using new technologies for scalability and automation, as shown in the chart below. However, the next generation of business banks now need to make very deliberate decisions regarding their role in the financial services value chain, as well as their business models and products.

What features are SME fintechs offering?

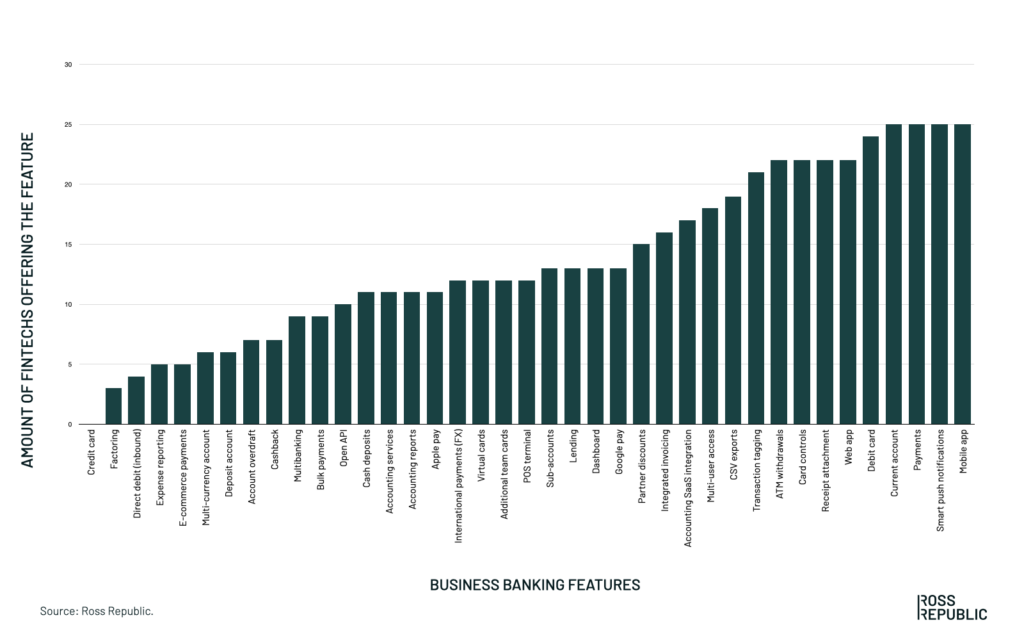

We compared all fintechs across 39 features, such as accounts and sub-accounts, debit and credit cards, virtual cards, integrated invoicing, lending, software integrations, FX, cashback, expense management, etc. The chart below shows common business banking features and how many of the 30 fintech companies included in our analysis offer them. For a full feature overview please have a look at the airtable, which will frequently get updated.

New strategies are needed to win in SME banking

Digital business banking has become a red ocean. First, there are several digital business banking fintechs actively operating in most European markets, so the first-mover advantage is gone. Second, once unique features, such as fast digital onboarding, modern web and mobile apps as well as accounting integrations have since become the norm. Just offering another business bank account with a few digital features is therefore not a differentiating factor any longer. As a result, most fintechs are actively upgrading their client services with tailored financial products or diversifying with beyond-banking services.

Following a distinct value creation strategy is an important success factor to stand out from the crowd. Learn more in our next upcoming article about future strategies that allow to create a competitive advantage in SME banking.

About the author