Thank you for joining the Ross Republic podcast. In our twenty-second episode, host Adrian Klee is joined by Chia Jeng Yang, Principal at Saison Capital, and Akash Bajwa, Investor at Augmentum Fintech, to re-evaluate how investors can take customer concentration risk at B2B fintech infrastructure players into account.

RR Podcast #22

Listen now on Spotify / Apple Podcasts / Google Podcast

Several high-growth B2B fintech infrastructure players, such as Marqeta (card issuing) or Affirm (installment loans), are characterised by high customer concentration risk: a significant share of their revenues are generated by a handful of clients. For example, Marqeta noted in their 2021 Q3 Form 10-Q filing: “We generated 68% and 72% of our net revenue from our largest Customer, Square, during the three months ended September 30, 2021 and 2020, respectively.” According to the FASB Accounting Standards Codification (ASC), firms are required to provide transparency around concentration risk, outlined in ASC 275. Vulnerabilities from concentrations can be caused by the volume of business with a particular customer, supplier, or lender; revenue from particular products or services; available sources of supply of materials, labour, or other inputs; as well as specific market or geographic areas. As a general rule of thumb, customer concentration risk occurs once a single customer accounts for more than 10% of net revenue, which needs to be reported in the firm’s SEC filings.

Economic research suggests that a highly concentrated customer-base allows a handful of customers to extract profits away from the supplier firm: major customer concentration is therefore negatively associated with the supplier firm’s profitability. If common knowledge suggests that concentration risk is something to avoid, why should the case be different in B2B fintech infrastructure? This question was the starting point for our episode, based on Chia’s and Akash’s latest blog post: Rethinking Concentration Risk in B2B Fintech Infrastructure. If you want to dive deeper into the topic, I highly recommend to check it out.

In the episode, we talk about why some fintech infrastructure providers, such as Marqeta, have proven that customer concentration risk can actually work in favour for their ability to achieve hyper-growth. In these cases, negative sentiments of revenue concentration risk are wrong, especially when the fintech firm:

- shows that clients who make up sizable chunks of its revenue are either growing (much) faster than the industry average or are already large blue chips (“whales”)

- translates the growth of these clients onto its own platform and operational scalability – monetisation via usage-based pricing plays a key role here!

- sustainably defends its offering, e.g. due to high degree of product specialisation or regulatory expertise

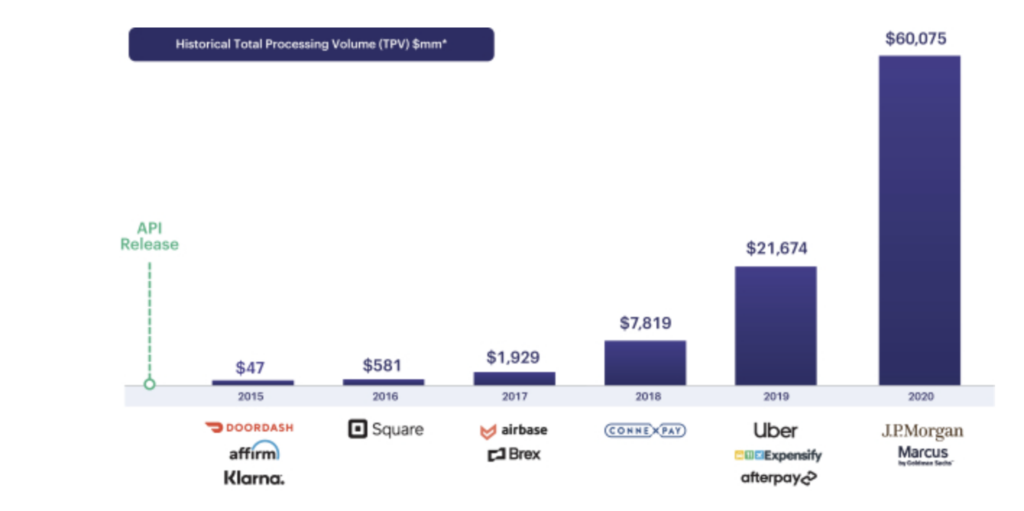

Marqeta is a great case study of how this can play out:

In 2020, the Marqeta Platform processed $60.1 billion of TPV. Source: Marqeta S-1

Our research and strategy support has enabled both incumbents as well as fintech companies to seize business model innovation opportunities and to scale across markets. If you’re ready to explore your own business model evolution in B2B fintech, please do get in touch with me here.