Thank you for joining the Ross Republic podcast. In our forty-first episode, your host Adrian Klee is joined by Piotr Pisarz from Uncapped to explore the current state of debt financing for digital companies and how Uncapped is becoming the leading provider of next-generation debt products.

RR Podcast #41

Listen now on Spotify / Apple Podcasts /Google Podcasts

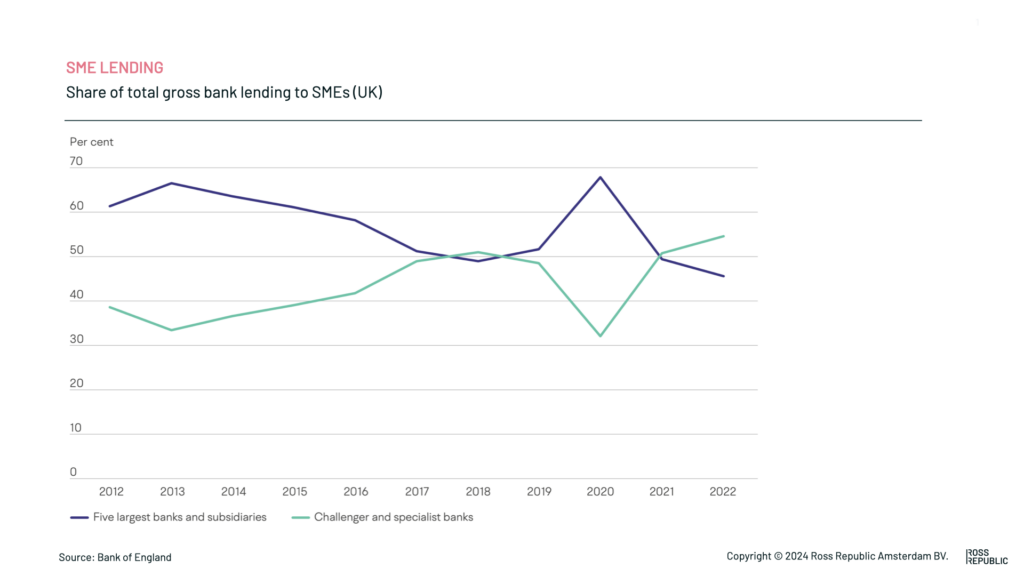

As outlined in our latest digital lending whitepaper, business lending is an area that is ripe for disruption. In particular, the fast-growing segment of digital businesses – think e-commerce, software, gaming or marketplaces – have been underserved by the traditional banking industry due to their lack of collateral and lower/negative EBITDA levels, which negatively impact their creditworthiness at traditional banks. Due to recent regulatory developments, tech debt and unfit underwriting/lending policy approaches, traditional banks have therefore left the field wide open for alternative lenders to serve small and medium-sized businesses (SMEs). In order to see where the market is headed, take a look at the UK: Challenger and specialist banks’ share of total gross lending reached a record high in 2022. Nominal gross lending excluding overdrafts to SMEs by challenger and specialist banks in 2022 was at £35.5bn, according to BoE data. This is the highest level since records began in 2012:

Gross bank lending (UK)

Although these stats are impressive, alternative lenders are more exposed to the recently strongly increased cost of funding compared to large established banks. Since February, there has been a notable rise in interest rates, especially in SONIA swap rates that incorporate expectations for the Bank of England’s Bank Rate. This has led to a roughly 50% increase in the cost of wholesale funding for marketplace lenders, asset finance providers, and Community Development Financial Institutions (CDFIs). This uptick in costs, coupled with more limited access to funding, higher expenses for wholesale funding, and possibly decreased equity valuations, may lead to fewer new lenders and business models entering the EU/UK market.

Alternative lenders now need to show resilience and proof the efficiency of their business models. With a recently closed funding round of about €230mn, this was a perfect time to speak to Piotr Pisarz, the co-founder and CEO of Uncapped.

Building innovative lending products to unlock SME growth

Founded in 2019 and now at around 90 FTE, the vision behind Uncapped is that founders shouldn’t have to give away ownership of their company to fund growth. Uncapped provides no-security and no-equity investments from €100k – €10 million to digital companies, such as e-commerce, direct-to-consumer (DTC), fashion, SaaS, gaming, and app development. In our podcast episode, we cover why these segments fall between the cracks of the lending industry, as they often neither fit the venture capital model nor the traditional bank lending model. John Luttig from Founders Fund recently summarised how new lending approaches will emerge to fill the gap:

As the ROI of SG&A spend becomes more predictable, a non-VC financial layer will emerge(…), similarly helping to fuel its growth.This suite of services will benefit from a tech-specific approach: real-time debt offerings based on operating KPIs, securitization of software ARR, and retail investor-facing SaaS bonds.

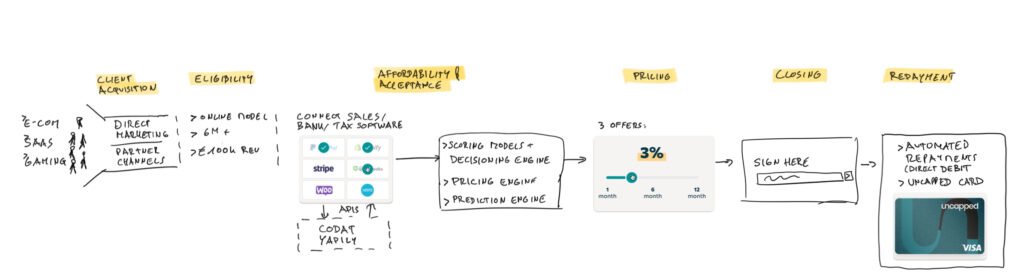

This is exactly where Uncapped comes in. With a deep understanding of digital businesses and their underlying KPIs, Piotr and his team built the lending product to incorporate real-time data through APIs and automated large parts of the underwriting and servicing process:

Uncapped Customer journey schematic (Source: RR)

Lending has become an automation and data game, where the player with the best dataset and decisioning model as well as operational velocity wins. At Ross Republic, we’ve helped both large European banks and leading fintech-scale-ups in developing their business lending products. Get in touch with me here to learn more.