Thank you for joining the Ross Republic podcast. In our thirty-sixth episode, your host Adrian Klee is joined by Michael Zyber from Metro Financial Services to discuss how established corporates can successfully execute an embedded finance play.

RR Podcast #36

Listen now on Spotify / Apple Podcasts

One strong signal that embedded finance is moving from the early adoption to mainstream phase is that large, traditional corporates are beginning to embrace the concept and allocating resources to embedded finance projects. One outstanding example is the creation of Metro Financial Services, a separate embedded finance innovation unit that was started by Metro Group. Metro Group it’s a leading international food wholesaler that is headquartered in Düsseldorf (Germany), operates across 30 countries, has relationships with around 17 million customers and generates a yearly turnover of 29 billion Euros per year.

The group has previously launched new digital innovation projects, such as DISH, a hospitality POS solution that already serves over 260.000 users in 16 countries. In 2021, the group decided to enter embedded finance by creating the separate METRO Financial Services unit, which was set up to combine innovative financial solutions with the industry-specific needs of the hospitality sector. Already in 2018, while I was working at SME neobank Holvi, Metro was already engaging in finding suitable banking partners to serve their SME clients, as they recognised that small businesses operating in the hospitality sector are underserved in regards to their banking needs. By setting up its own inhouse financial services unit it seems the best route to market was indeed to build instead of buy or partner, hence we invited the CEO of Metro Financial Services, Michael Zyber, to talk about their embedded finance journey from idea to execution:

- What makes embedded finance attractive for large corporates

- What key enabling factors should be in place to ensure success of embedded finance projects

- How to find the right embedded finance suppliers

- Why talking to customers is key when developing embedded finance propositions

- How large corporates can leverage their existing assets to maximise the impact of their embedded finance solutions

By following an iterative approach early on and testing ideas with customers, Metro quickly realised that creating an entirely new financial services offering and enforcing clients to switch to the new offering would hurt the adoption of the product. The main reason for this is that most of Metro’s small businesses clients already have their banking product set up, including underlying accounting workflows. In the episode, Michael and I agreed that trying to change entrenched user habits is often very challenging or near impossible, especially for established clients. That’s why Metro decided to lower the barriers of adoption by launching a Metro FS debit card that initiates a direct debit on the client’s existing bank account.

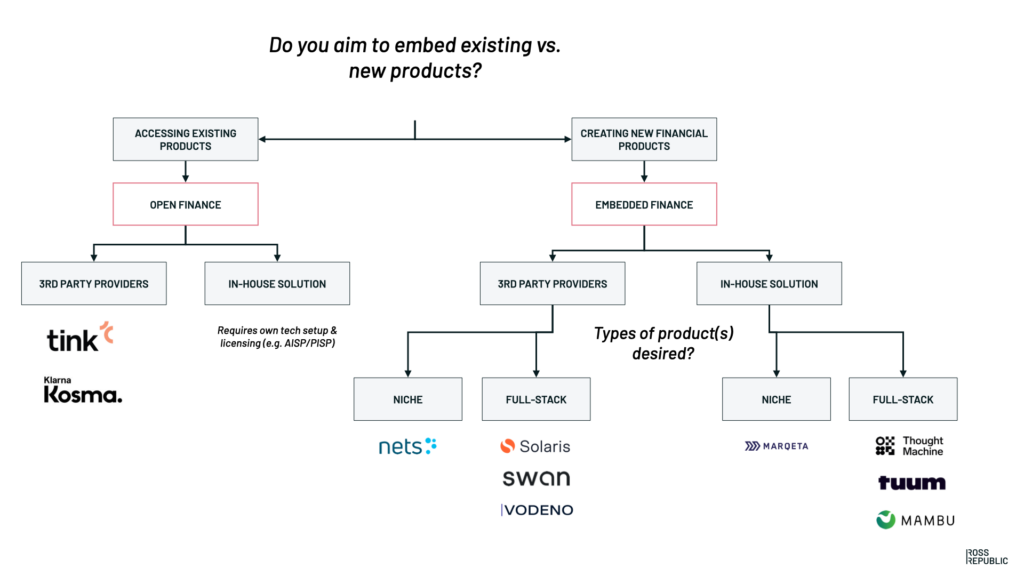

This is an interesting approach that other embedded finance players should analyse closely, as it exemplifies an evolution of the simple decision tree that I introduced in one of my last blogs:

Open vs. embedded finance. Source: RR

Embedded finance adopters usually decide early on whether they want to leverage previously existing banking products and data (open finance) or to launch an integrated, new product (embedded finance). The former is useful for e.g. instant credit underwriting use cases, as most clients usually have an existing bank account with historical bank transaction data. The latter is the key rationale for embedded finance, which allows brands to get creative around launching own financial services offerings as a value-added service augmenting their core value prop.

In the Metro use case above, it’s a smart hybrid between both worlds as the Metro FS debit card allows to create a new touchpoint for Metro, while ensuring the usage of the product easily weaves into existing workflows. In addition, Metro checks many of the criteria in our embedded finance definition:

Embedded finance is a (typically) non-financial brand seamlessly integrating a financial product as part of its broader customer proposition, leveraging proprietary assets, such as data, processes or channels, to create a radically improved end-customer experience.

An obvious asset is the existing access and brand trust towards a huge SME vertical – instant access to 17 million hospitality businesses. Its warehouses are a strong client touchpoint that is visited frequently and the previously mentioned digital SaaS touchpoints create additional sales interfaces. Again, highlighting the importance of an iterative venture building process, Metro found out that its physical warehouses proved to be a key asset for conducting regulatory onboarding, incl. the know-your-customer (KYC) checks that usually involved an ID card check. Just think about the average hospitality business, how old would you guess the age of the owner? Exactly. In many cases, they’re going to be non-digital natives that might have trouble finishing a regulatory onboarding process fully digitally and rather prefer to do that directly on the spot during one of their weekly Metro wholesale store visits. That’s why Metro has offered in-person KYC checks soon after the launch of the product.

Listen to the episode for many more insights on how to seize the embedded finance opportunity as an established corporate and do get in touch with me to discuss how you can apply embedded finance to grow your business.