A short synopsis of our recent conversation with weavr and TransactionLink about the definition and interplay of Banking-as-a-Service, embedded finance and API-driven banking.

API technology is revolutionising the fintech and the financial sector in general. It has allowed more companies than ever before to spring up and outstrip well-established banks where new financial companies struggled to find a foothold in the past. It is an exciting time to be in the financial industry, but it can be difficult to stay ahead of all of the financial API technology and understand what it all means. Hence, this article explains some of the most popular API-driven technologies and business models, such as Banking-as-a-Service and embedded finance, currently being used in the financial sector.

What Is API technology?

API stands for Application Program Interface. API technology acts as an intermediary between two applications, essentially being a gateway that enables software to talk to other software. An e-commerce provider, for example, offers a website or app where customers can purchase products. In order to receive the money from customers checking out into the merchant bank account, API technology is used to facilitate the checkout process. Specifically in payments, APIs have significantly improved the customer experience, enabling faster, more secure and cheaper transaction processing.

As requested by the Revised Payment Services Directive (PSD2), European banks offer API products that allow business owners, developers, and even consumers to access their accounts and initiate payments via third party providers without having to deal directly with their bank. This articles will discuss this further in the open banking section, however by using API technology, clients are able to pick and choose which services and products they want to access in a secure and automated manner.

Why APIs are popular in the fintech sector

Financial services is a popular sector because it is one of the biggest contributors to GDP. In the past, it was a difficult sector to break into as incumbent banks were well established, with plenty of resources and regulatory moats that new entrants could not easily match.

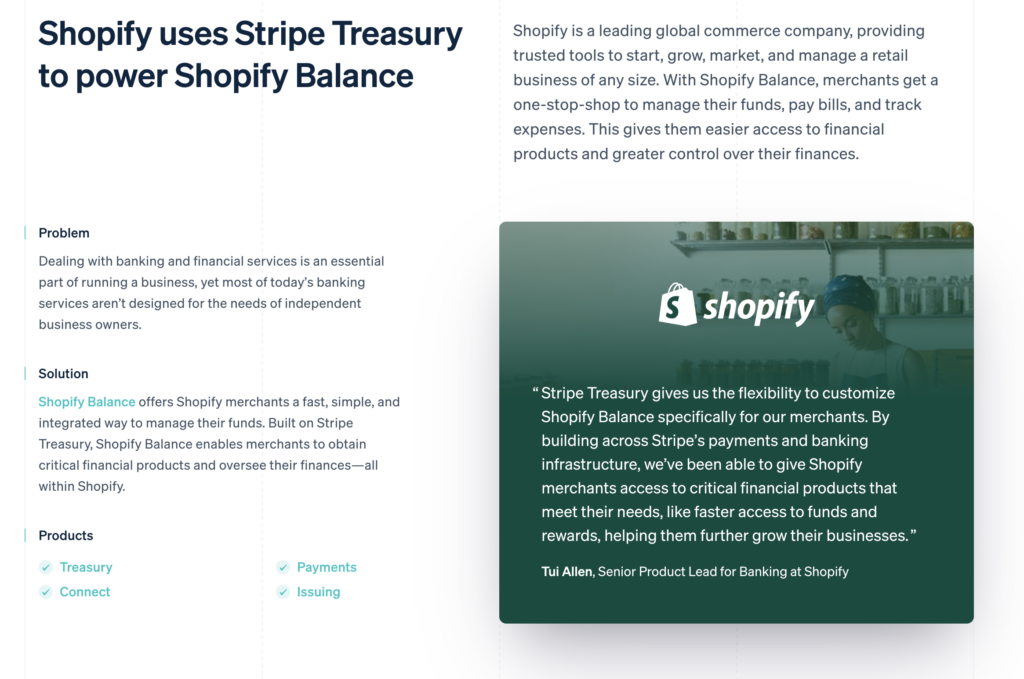

New regulations and technologies, in particular API technology, both (fin)tech companies and non-financial brands have been able to break into the market by unbundling banking product portfolios and offering increased convenience by concentrating on building financial services around customer pain points. Consumer and business clients place a high premium on convenience and on-demand availability when it comes to their finances, preferring to manage their finances digitally, and use non-banking apps, such as e-commerce providers or third party software to store payment information or handle transactions. For instance, an increasing amount of non-financial companies are now grabbing a piece of the market, and have been using API technology to expand their business into financial services. A prime example of this is Shopify Balance, which offers merchants a one-stop-shop to manage their funds, pay bills, and track expenses, built using the Stripe Treasury API.

Stripe treasury API. Source: Stripe

Shopify already has a huge merchant base who are likely to take up the financial product, especially as it integrates into the Shopify system with ease. It adds an additional layer of convenience to Shopify merchants and therefore is easily adopted. In addition, Shopify Capital has partnered with WebBank to offer working capital loans. Shopify Capital has grown to approximately $1.7 billion in cumulative capital advanced since its launch in April 2016, approximately $244.7 million of which was outstanding on December 31, 2020.

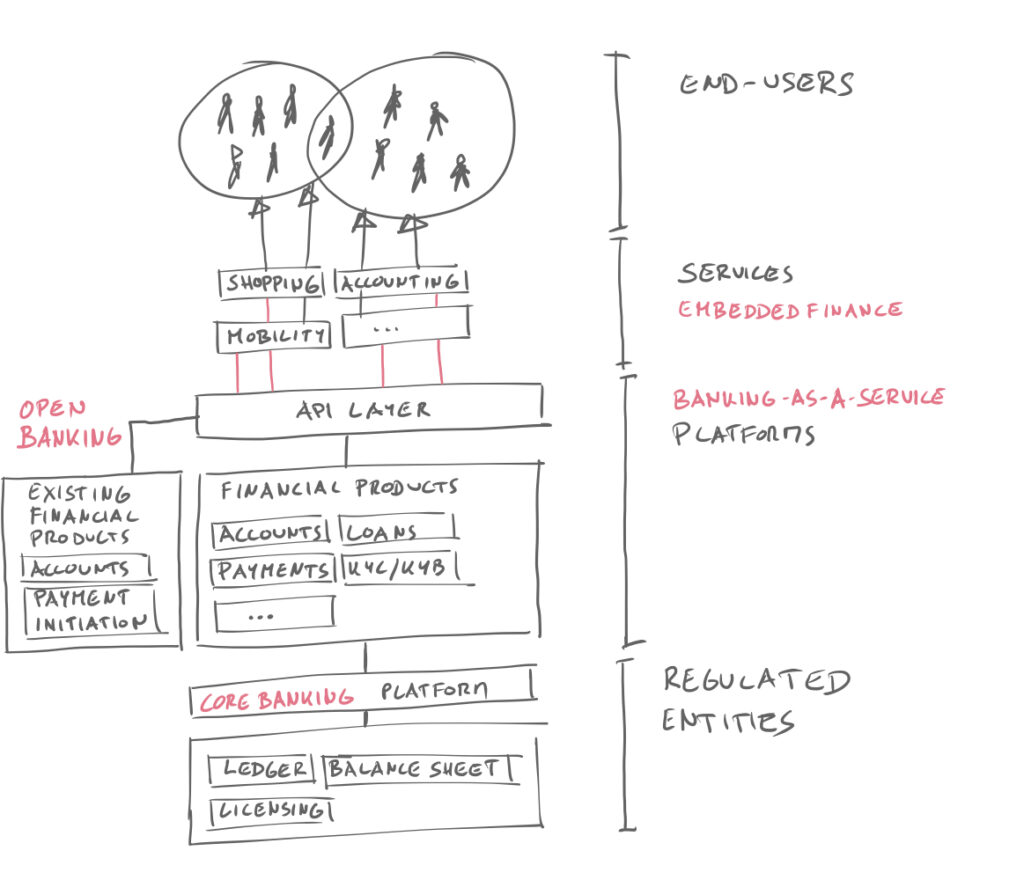

APIs have therefore unleashed a new wave of innovation in financial services. Four key API-driven banking segments are open banking, banking-as-a-service, core banking, as well as embedded banking, which are sometimes mistakenly called out interchangeably. What follows is a short explanation of how these four segments overlap with each other and what value they deliver:

Schematic of new banking delivery models

Open banking offers APIs to tap into existing financial products

Open banking is a concept that started in the UK. While most new financial providers struggled to break into the market around the world, the UK, in particular, was almost impossible to break into. There, the incumbent banks had been established for decades, and the number of assets and services they provided were impossible for a new company to match. Open banking became a way to bring new financial service providers onto the scene and therefore ushered in new technology and innovation into the banking space.

In our podcast with weavr and TransactionLink, we defined the principle of open banking as taking existing financial functions or existing financial products (via APIS, e.g. as requested by PSD2) and using them in new ways. It allows budgeting apps to import a person’s financial history, for example, and use it to create a personalised budget. It may allow a loan provider to analyse a person or company’s financial data in order to investigate their financial position. Open banking drove a lot of advances in the financial sector because it allowed fintech companies to build upon existing financial products to improve or create new services and functionalities.

Banking-as-a-Service platforms allow any brand to integrate financial products

Banking-as-a-Service platforms basically break down financial services, such as accounts, cards, loans or payments, into consumable APIs that any company can use to build solutions, e.g. by merging e-commerce and banking in the case of Shopify Balance x Stripe Treasury. However, this is where the Banking-as-a-Service market becomes a bit challenging to differentiate, as some providers only offer the capabilities to build new financial products, yet require the user to find a (bank) partner that provides the required licensing, e.g. for issuing credit cards. If a company wants to expand their business and offer a new service that would require them to have a banking license, it may not be worth their while to obtain a license, to begin with. Instead, they can partner with an existing bank to “borrow” their business license. Other providers, such as Solarisbank, already include the necessary licensing in their offer.

Core banking platforms provide the backend systems for regulated entities

A core banking system is a backend system that handles all of the day-to-day financial transactions. It processes payments and updates financial accounts and records. As the name suggests, a core banking system is the foundation of any bank, i.e. regulated entities, as well as the providers of Banking-as-a-Service platforms that offer their balance sheet and banking licensing as a part of their service.

Embedded finance is the development of seamless user experiences that include a financial product or service

Embedded finance describes the process of seamlessly integrating a financial product right at the point of interaction, tailored to the needs of the individual user and often improved due to the use of contextual data. An example of embedded finance is the aforementioned Shopify Capital loan or the QuickBooks Financing Line of Credit to provide faster access to lower-rate small business loans. In the latter case, the financing solution enables small businesses to use their QuickBooks Online data to apply for loan offers with the click of a button.

Embedded finance is a really interesting concept that will allow a lot of unique products and processes to emerge. You can listen to our recent podcast here to dive deeper into the topic or contact me directly for an evaluation of how your own business can successfully leverage banking APIs.

About the author