Our monthly commentary and curation of market signals within the fintech and banking industry. We filter out the noise and present ideas that shape the next generation of financial services.

Techcrunch: Uber Money is Uber’s new team focused on financial products and services

Building and managing a reliable financial infrastructure is crucial for Uber to foster growth in its various business lines. Thus, it’s not surprising that Uber makes a move into fintech. Just four months ago the ride-hailing unicorn teamed up with BBVA and Mastercard to launch debit cards for drivers in Mexico:

„Uber drivers must have a bank account to receive their earnings, and about 35% of the company’s workforce in Mexico opened an account expressly for that purpose (…). As a result of the partnership with BBVA, drivers will be able to open their accounts in the Uber app, without setting foot in a bank.“

Banking-as-a-Service (BaaS) makes it possible: embedding financial services into 3rd party branded offerings removes friction for end-customers and thus provides a more seamless experience. How many of those drivers would have opened their account directly at BBVA? Hence, for BBVA it’s a definitely a win:

„It is a significant milestone because for the first time we are offering a BBVA product that will ‘live’ in a third party’s platform“

The “live in a 3rd party’s platform” is important to note. This is not a simple product partner integration. The real success factor here is that BBVA’s banking infrastructure is natively embedded in the Uber app. While I have been involved with the fintech Holvi, we had executed a very similar cooperation. The difference in our case was that the account services have been simply integrated into Uber’s online onboarding, which still provided some level of friction for the end-user. Even seemingly small additional steps in the customer journey can create real adoption barriers.

Now, Uber announced the creation of a dedicated financial services (FS) team, Uber Money. The unit manages Uber’s credit card, debit card, wallet for drivers, Uber Pay, Uber Cash and it seems like they’re definitely ambitious to launch more FS-related offerings in the future. Launching a separate unit shows how strategically important the FS layer has become within the Uber universe, even though investors didn’t mind.

It’s not only Uber that doubles down on financial services. Alex Wilhelm of Crunchbase News recently noted that an increasing amount of start-ups start to integrate financial services. If you’re interested in learning more about the key players (US-centric, though), have a look here: Why Is Every Startup A Bank These Days?

Is every brand becoming a bank these days?

A more extreme hypothesis: Why is every brand becoming a bank these days? It’s not only big tech, like Apple Card/Pay or Amazon gearing up the SME lending business (€), it’s also (accounting) SaaS companies, retailers, telcos or comparison platforms that move into banking. Companies with strong brand loyalty (i.e. customer ownership) and high-frequency services now have a strategic window of opportunity to own the financial services side of the customer journey. Accessing transactional, account and risk data, distributing complementary financial products and simply having more control over the customer experience are good reasons for such moves. Open Banking, PSD2 and APIs make it possible, as long as customers are confident to provide consent. I’m sure we’ll see more use cases in 2020, as the list of PSD2 applicants continues to fill up.

Bloomberg: Digital Financial Services to Generate $38 Billion in Southeast Asia

Bain, Google and Temasek Holdings took a closer look at the digital financial services industry in Southeast Asia (SEA). With increasing internet connectivity and access to mobile, SEA is a hotbed for innovation, which specifically boosts digital financial services. Find the full report here.

According to the study, three in four adults in SEA have insufficient access to financial services. Now, these underbanked segments gain access to the internet via the mobile revolution. The game-plan to win them over is to use payments as first beachhead for expanding into adjacent financial services offerings. Specifically online lending and insurance products are expected to gain massive traction. The Asian ride-hailing unicorn and Super-App Gojek successfully developed its own in-app payments offering, which gives it a head start for introducing higher margin offerings, such as credit.

Bloomberg noted that incumbents still remain crucial in driving digital innovation in the SEA area by providing balance sheet access. DBS Group and United Overseas Bank have partnered with Gojek and Grab, respectively. However, do the Super-Apps really depend on the incumbents, or is it the other way around? Bert-Jan Van Essen of technology provider additiv makes the case for the Super Apps. So far, incumbents are still struggling with tech debt and are missing development, marketing and data capabilities. As banking is being un- and re-bundled by various digital players in SEA (via digital payments, e-commerce integrations, etc.), the legacy linear distribution model of financial services providers seems ripe for disruption:

“These brands [Grab, Gojek, Alipay, PayTM, WeChat], coupled with the products and services they offer, are already embedded in the daily lives of their target audience. When these consumers think about ordering a taxi, buying movie tickets, getting a meal delivered, booking a holiday, or doing countless other tasks, they turn immediately to their mobile device.”

“Against this backdrop, proprietary banking channels seem flawed in today’s environment.”

“As a result, the way forward for the incumbents is to identify ways to embed banking products and services across multiple channels, and to understand where they can be combined with data, as well as services, from multiple other parties and systems.”

“This is a key goal since the option of a separate brand that deploys a single-app channel strategy seems outdated in comparison with an ecosystem that blends a number of best-in-class apps, is lightly integrated and can be upgraded as a newer or better version appears.”

Read more about winning the re-bundling race in South-east Asia here.

McKinsey: Global banking annual review 2019: The last pit stop? Time for bold late-cycle moves

„This is likely the last pit stop in this cycle for banks to rapidly reinvent business models and scale up inorganically. Imaginative institutions are likely to come out leaders in the next cycle. Others risk becoming footnotes to history.“

The global banking annual review 2019 recently dissected global financial institutions and revealed statistics about the health of their business. It mainly results in a harsh final diagnosis to the legacy banks out there: they won’t face a bright future if they don’t go beyond doing their homework, i.e. resolving technology and organisational debt. Only hardcore measures (cut sunk costs, radical organic/inorganic moves, upgrading the tech stack from the ground up) can now prevent the worst, after a prolonged period of surface treatments (digitalisation, re-organisation, fintech partnerships).

As market and client demands, fuelled by new technologies, are changing, banks must naturally follow-up.

The report definitely exposes the multitude of factors currently at play within the banking sector. There’s radical change on both the supply side (new tech vendors and product providers) and demand side (customer expectations towards banking services). On top of that, banks need to figure out how to transform their organisation both from a technological and organisational perspective. It’s not that they are ill-prepared to master the challenges of the digital banking era, most banks are just still milking the legacy that made them big and powerful in the first place. As market and client demands, fuelled by new technologies, are changing, banks must naturally follow-up. Thus, it’s more a cultural and top-management mind-set challenge than a technological one, which is acknowledged in the report.

Snapshots of the report

Digitalisation challenges the very fundamentals of how banks operate:

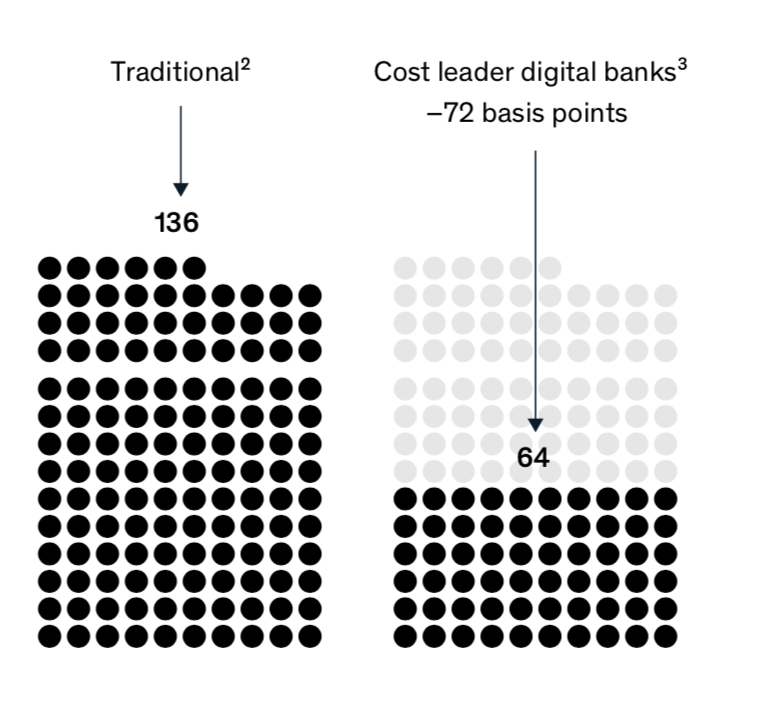

Operating–expense comparison across banks with different digitization levels, 2018, basis points, operating costs to assets

Source: Based on sample of top 1,000 banks’ data. Cost leader direct bank peer group includes ING Bank Australia, UmweltBank, Granit Bank, Rakuten Bank, Sumishin SBI Netbank, Sbanken ASA, Gjensidige Bank. Data: CB Insights, KPMG Pulse of Fintech, McKinsey Panorama Digital Attacker Database & Insights, SNL, Reuters

Technology lowers the barrier of entry and it allows to run with much lower OPEX. Traditional banks that just mimic the front-end side of fintech challengers will therefore still have massive cost bases to cope with.

Global adoption of online channels for buying financial products is clearly trending upwards, which forces banks to double down on digital distribution channels:

Gap between ‘willingness to purchase via digital channels’ and ‘actual sales behavior’ in 2018, %

Source: Consumer survey, responses to question asking: “For the products acquired in the last 2 years, please indicate the main channel you used to buy the product”; % of respondents having bought the product in last 2 years that have done it via a digital channel (selected “Internet Banking”, “Tablet Banking” or “Mobile Banking”). Data: 2018 Retail Banking Consumer Survey (n = 45,000).

These stats are aligned with numbers released by major global banks, who reach around 50% of blended sales via digital channels.

Another passage that that stood out was “Revenue growth: Improve customer experience to deepen relationships“, with conflicting advice about how to seize new digital opportunities:

“Improving CX for growth is not necessarily about being best-in-class, but rather closing the gap from ‘very unhappy’ (the point where customers tend to switch banks) to ‘good enough‘”

“Simply trying to move customers as a block from ‘unhappy’ to ‘okay’ to ‘great’ usually fails to lift revenues, due to diminishing returns.”

Improving CX to boost revenue is interesting advice, as if there’s a simple causation. Great CX is the outcome of understanding a client’s job-to-be-done, deeply caring about their needs, and solving it through technology and design. Nail that and you never even need to worry about churn.

Finally, the key indicator used in the report, return on tangible equity (ROTE), currently languishes around 10% globally. Many European banks are even below that mark. On top of that, 60% percent of banks globally generate returns below the cost of equity.

Additional diagnosed symptoms are:

- Top-line revenue is decelerating with loan growth of just four percent in 2018 (the lowest in the past five years)

- In 2018, bank lending globally grew by 4.4%, the slowest rate over the past

five years. At the same time, nominal GDP growth was at 5.9%. - Average margins before risk in developed markets declined from 234 basis points (2013 ) to 225 basis points (2018).

- Globally, margin contraction has accelerated, whereas the rate of gains from productivity improvements has diminished

According to the report, it is expected that these symptoms will impair ROTE of global banks even further.

About the author