Thank you for joining the Ross Republic podcast. In our twenty-first episode, host Adrian Klee is joined by Christer Holloman, founder of the finance platform Divido and author of the book Transactional to Transformational: How Banks Innovate.

RR Podcast #21

Listen now on Spotify / Apple Podcasts / Google Podcast

Christer Holloman is the founder of the finance platform Divido, the world’s largest white label platform for retail finance, more commonly known as Buy Now Pay Later. Prior to starting Divido, Christer was hired by Glassdoor.com, which later got acquired for $1.2bn USD, to support the launch in Europe. Before this, Christer helped traditional media companies like The Times and the Daily Mail in the UK and Gannett, the largest newspaper publisher in the US, to transition old business models to monetise new digital channels.

Christer is also the author of the Amazon Bestseller “The Social Media MBA” and just recently published a new book with Wiley called “Transactional to Transformational: How Banks Innovate”, which offers untold stories about how leading global banks delivered new solutions to consumers and businesses. In this episode of the Ross Republic podcast, we discuss:

- the parallels of digital transformation at traditional media companies and banks

- why digital challenger banks still need to work on their buy now pay later propositions to make them a success

- why traditional banks are more than just balance sheet providers

- how Christer started Divido

- what insights Christer’s new book holds for bankers that want to move their business from a transactional to a transformational one

Why banks should get started innovating along the spectrum of buy, build or partner

Christer has been involved in the digital transformation of traditional media companies early on. New digital distribution channels, online advertising and platforms have radically changed media business models. Hence, there are a lot of similarities when comparing the business transformation needs and challenges of media companies and banks. Christer referred in the podcast to the concept of the spiral of success, meaning that businesses are incentivised to keep doing what made them successful in the first place. Whole industries, such as the newspaper industry, can become trapped in their spiral of success if they are not able to spot structural market shifts and pivot accordingly, which can be a big mental hurdle for senior executives that are commonly incentivised for playing it safe and avoid excessive risk taking. If that sounds familiar to how most incumbent banks are still set up, you’re right. Christer has therefore released a new book titled “Transactional to Transformational: How Banks Innovate” that exemplifies via a series of case studies how financial institutions from all over the world have launched various innovations in order to overcome challenges such as:

- working around legacy systems

- creating a culture that embraces innovation

- increasing speed to market whilst satisfying risk and compliance successfully

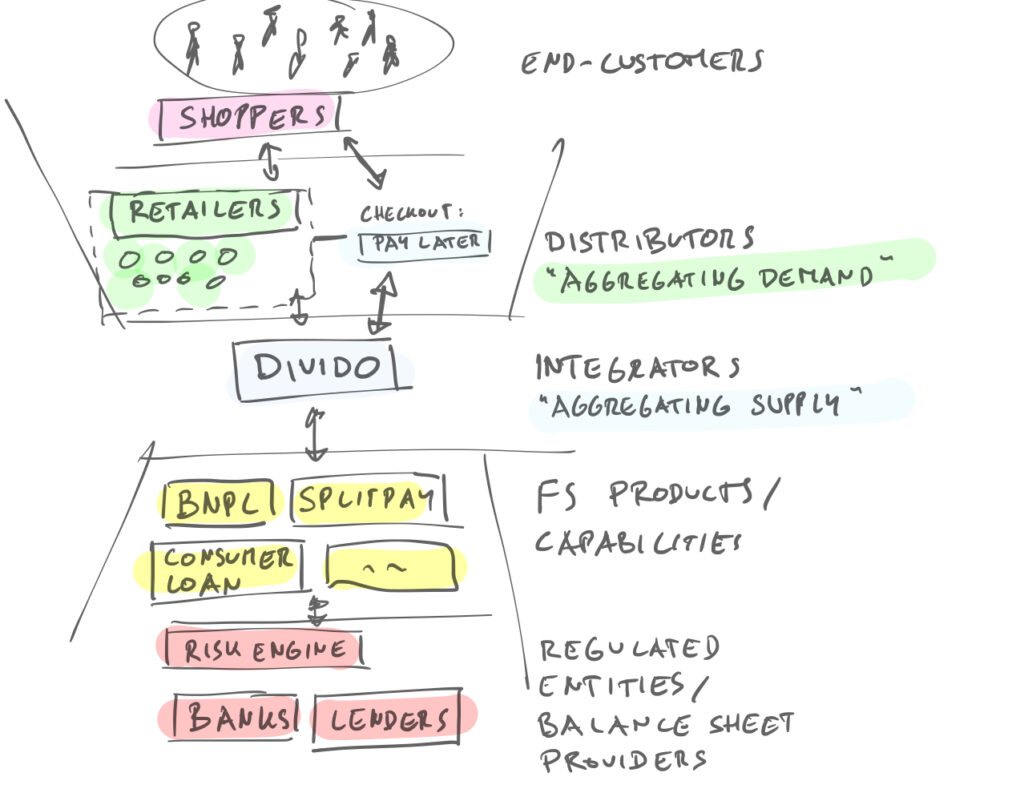

Christer‘s book offers amazing insights into how leading banks, such as BBVA, have solved strategic challenges through innovation. In today’s volatile world, any large corporation needs to balance the exploitation of the current business vs. the exploration of tomorrow’s business. A common way to structure the exploration of new business opportunities is to distinguish between buy, build and partner activities, which the book categorises accordingly. For example, in the buy section it lays out why BBVA set up its corporate venture fund, Propel Ventures, as a separate entity, enabling BBVA to gain access to fintech companies that offer strategic value as well as financial returns. The build section contains a case on National Australia Bank, which launched QuickBiz, an automated SME lending solution, leveraging cloud accounting data and API connections. The Deutsche Bank x Deposit Solutions (which now merged with Raisin) partnership is illustrated in the partner section. Deutsche Bank operates its Zinsmarkt deposit offering using technology supplied by Deposit Solutions since 2017. To date, around two billion euros of deposits have been transmitted via Zinsmark. Divido, the leading white label platform for retail finance, which Christer founded, is a perfect example of how incumbent banks can leverage partnerships to build up new distribution models. Divido’s whitelabel platform connects lenders, retailers and channel partners at the point of sale; i.e. opening up a new distribution channel for lenders that would otherwise not reach end-customers directly at the point of interaction (e.g. right at the check-out). It operates a marketplace model where lenders compete to offer the most suitable credit line to consumers:

Schematic of Divido’s proposition. Source: Ross Republic

Whether it’s buying, building or partnering with fintech companies, incumbent banks are well advised to take a closer look at eminent market shifts and start innovating in order to lift their mostly transactional customer propositions to a transformational one.

About the author

ADVISOR, PROCESSES AND CULTURE

Adrian Klee

Adrian Klee bridges the worlds of high-growth startups and complex global enterprises, with particular depth in financial services and industrial sectors.

A human-centric tech strategist, Adrian approaches culture through the lens of business operations. He brings a systems mindset to the table – using technology and AI to detect and remove friction, simplify complexity, and create leaner, smarter, more human workflows.

Adrian’s work focuses on performance through flow: aligning processes with purpose, enabling teams to work with clarity and speed, and helping organisations build the operational backbone for continuous change.